Northern Rock web collapse exposes frailty in all online banking

Analysis: The online run on the bank experienced by Northern Rock has provoked concern over how reliable other online banking services are, as well as raising questions guarantees of service.

One week and almost 3 billion later, the run on Northern Rock, the crisis-hit UK bank and mortgage lender has exposed many problems with the UK banking system in particular online banking.

The crisis at the lender took a frightening turn for the worse for many customers when they discovered they could not get at their money over the internet after Northern Rock's online banking website allegedly buckled under the weight of demand multiple times, with it slowing the stream of money pouring out of the business.

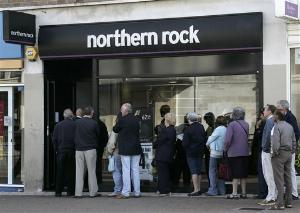

At the height of the run Northern Rock's website stopped working under pressure from customers trying to access their accounts, many of whom then joined queues outside the lenders branches. The bank has said its website is now working normally, but it hasn't stopped speculation that at least some of the failures were down to human intervention to stem the flow of withdrawals, rather than just weight of demand knocking the site over.

Now with the run apparently over, European banks are nervously checking whether their online banking web sites have enough raw computing power to weather a crisis if tens of thousands of customers pile in at the same time.

"I would be willing to bet that at the very least, all of the IT (information technology) delivery managers at big banks will be reviewing their systems and saying: 'there but for the grace of God'" said Ken Allan, an IT specialist at Ernst & Young.

And the Northern Rock crisis is not only a wake-up call for banks but for many other businesses, such as budget airlines, that have come increasingly to rely on the web as the first and sometimes the only way to offer services to customers.

As word spread last week that Northern Rock had been thrown a financial lifeline by the Bank of England to help it stay afloat, an old-fashioned bank run started to gather pace - the first of its kind to be seen in Britain since the 1860s.

Get the ITPro daily newsletter

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

The anguish felt by customers who were unable to reach their accounts over the internet and switch money to other banks may have been even more acute than anything experienced by people queuing up outside Northern Rock branches to withdraw cash.

"I think it's that dislocated feeling that internet organisations have," said Daniel Singer, a director in IT advisory services at KPMG in London.

"You are not quite touching an organisation when you are going through the website and when the system blows you have a real sense of loneliness and remoteness."

Banks can take stock but they are unlikely ever to devise a system of internet banking which is guaranteed never to fail.

"If everyone went on line and tried to take their money out from any online banking operation I am sure their systems would crash as well," said a senior analyst at a credit rating agency in London.

"All the real money is going into making internet channels more effective and secure. Banks need you to use the internet because it's cheaper for them," said Ernst & Young's Allan.

Allan said banks and other organisations which rely on internet systems could prepare for surges in demand by customers by laying on additional bandwidth and by making careful preparations for emergencies.

"The pragmatic approach is to have contingency plans - a layered approach. What is your on-tap capacity, and near-line crisis capacity and what can be brought in at short notice?" said Allan.

When systems fail, having a second line of defence, such as a reliable phone-in service that is quickly scaled up in a crisis can help quickly to reassure many clients that things are not spinning out of control.

But anyone boasting their internet systems will never let their customers down could be setting themselves up for a fall.

"It's a very dangerous attribution to use as a marketing vehicle because of the unpredictability. And you never really know whether you will be able to meet customer claims or fail, in an embarrassing and disastrous way," said a financial consultant.

-

Bigger salaries, more burnout: Is the CISO role in crisis?

Bigger salaries, more burnout: Is the CISO role in crisis?In-depth CISOs are more stressed than ever before – but why is this and what can be done?

By Kate O'Flaherty Published

-

Cheap cyber crime kits can be bought on the dark web for less than $25

Cheap cyber crime kits can be bought on the dark web for less than $25News Research from NordVPN shows phishing kits are now widely available on the dark web and via messaging apps like Telegram, and are often selling for less than $25.

By Emma Woollacott Published