Google’s AOL investment takes a dive

Moves by Time Warner to separate AOL into a standalone business set a far lower valuation for the firm than the one set by Google’s original investment.

Google's five per cent stake in fellow internet property AOL is likely worth far less than the $1 billion (500 million) the company paid for it.

The search engine market leader warned in a regulatory filing late last night that its stake in AOL, bought in 2006, will likely be hit by several factors, including AOL's demerger from parent Time Warner.

"We believe our investment in AOL may be impaired," Google said in its latest quarterly financial filing with the US Securities and Exchange Commission.

Google said it would continue to review its investment for impairment, and financial write-downs could be required in the future.

In a deal announced in December 2005 and which closed the following year, Google paid $1 billion in cash for a five percent indirect equity stake in AOL, thus valuing AOL at $20 billion (10 billion) at the time.

In return, Google secured renewal of its search advertising deal with AOL, its largest ad partner until Google's recent partnership with Yahoo.

Time Warner, which has been considering how it might dispose of AOL in order to focus on its core media properties, plans to split AOL's internet access unit from its advertising business by early 2009.

Get the ITPro daily newsletter

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

The move is a major step toward the eventual sale of one or both of the businesses, and would allow Time Warner to move beyond the troubled legacy of its 2001 mega-merger with America Online, which was then hailed as the "Deal of the Century" at the time, but was subsequently viewed as one of the biggest dot-com disasters.

At current market valuations, Google stands to lose an estimated $500 million (250 million) if AOL is spun off, analysts estimate.

Working in AOL's favour has been the growing value of its advertising assets. According to a February report by brokerage Sanford C Bernstein, less than 35 percent of AOL visitors are members, suggesting it is less reliant on dial-up and broadband subscribers. The report estimated at the time that AOL's advertising and media business alone could be worth as little as $10.1 billion (5.05 billion) and its dial-up access business worth about $3.7 billion (1.85 billion). AOL also bought British-based social networking service Bebo for $850 million (425 million) in March.

To put the $1 billion investment in perspective, Google generated $1.77 billion (885 million) in cash from operations in the second quarter from sales of advertising sold alongside search results on Google.com and affiliated web sites such as AOL, MySpace and Ask.com.

Google also gets an estimated $70 million (35 million) to $80 million (40 million) annually from AOL by providing search ad services, and is unlikely to want to risk AOL taking its business to rivals, analysts say.

ITPro is a global business technology website providing the latest news, analysis, and business insight for IT decision-makers. Whether it's cyber security, cloud computing, IT infrastructure, or business strategy, we aim to equip leaders with the data they need to make informed IT investments.

For regular updates delivered to your inbox and social feeds, be sure to sign up to our daily newsletter and follow on us LinkedIn and Twitter.

-

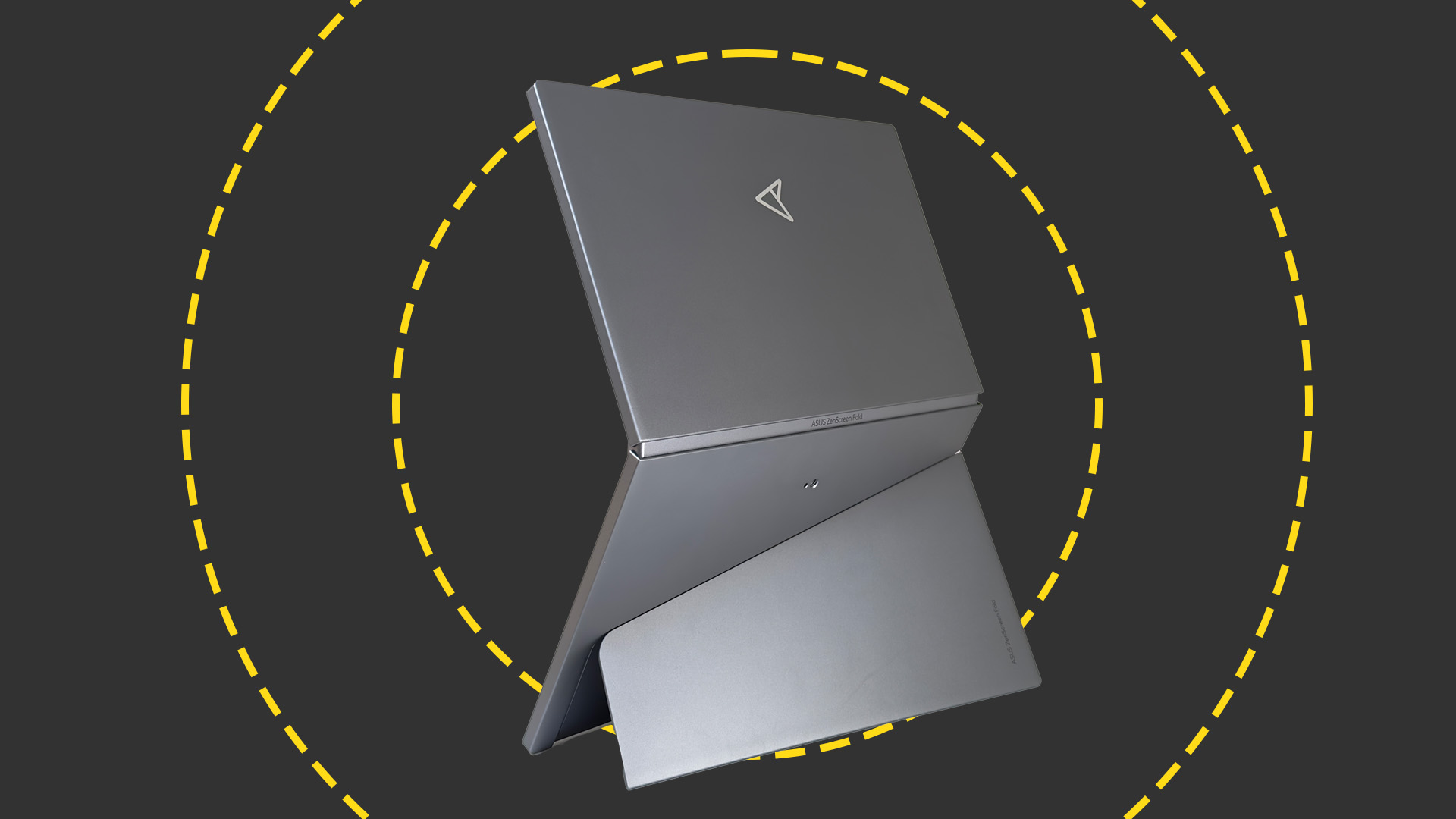

Asus ZenScreen Fold OLED MQ17QH review

Asus ZenScreen Fold OLED MQ17QH reviewReviews A stunning foldable 17.3in OLED display – but it's too expensive to be anything more than a thrilling tech demo

By Sasha Muller

-

How the UK MoJ achieved secure networks for prisons and offices with Palo Alto Networks

How the UK MoJ achieved secure networks for prisons and offices with Palo Alto NetworksCase study Adopting zero trust is a necessity when your own users are trying to launch cyber attacks

By Rory Bathgate