Emergency Budget analysis: Tougher times ahead for IT

Osborne confirms end to broadband tax, but picture for the wider information economy is more mixed.

The coalition Government's Emergency Budget confirmed that the"broadband tax" on landlines will be scrapped before it has even come into force. But the Budget, aimed at plugging a 150 billion gap in the public finances, will have wider repercussions for the information economy.

The most obvious measures, such as the new, higher VAT rate of 20 per cent, due to start from January, and a 1,000 increase in personal allowances, might well lead to increased consumer spending.

For individuals and non-VAT registered businesses, it can make financial sense to bring forward spending on "big ticket" items, such as computers and consumer electronics, before the rate increase comes in. At the margins, some lower-paid workers might also feel they have more money in their pockets.

Optimism about a short-term boost to consumer spending will be tempered, though, by the knowledge that tax rises are to come. Businesses also face several changes to taxation, which could affect their investment in technology.

Under the Chancellor's proposals, corporation tax will fall by one per cent a year, until it reaches 24 per cent, and the rate for smaller companies will be cut to 20 per cent. From next April, the threshold where employers start to pay National Insurance contributions will rise by 21 a week.

But the changes have to be set against a less generous regime for investment, in the form of capital allowances.

Capital allowances which determine how quickly a business can write off the cost of an asset, such as plant or machinery are being cut from 20 per cent to 18 per cent a year.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

The Annual Investment Allowance, which allows most companies to write off the full cost of their plant and machinery, up to a threshold, is being cut in half, to 25,000, although the measure will not come into force until April 2012.

A proposed tax break for the video games industry will not go ahead. There will, though, be further measures to encourage investment in "green" technology, though Mr Osborne did not provide further details.

Cuts now, cuts to come

Business groups broadly welcomed the Budget, with the Federation of Small Businesses describing the decision to increase VAT on 4 January , not 1 January, as "common sense".

Richard Lambert, the director-general of the Confederation of British Industry, said that the changes to company taxes provided "much-needed consistency".

"Taken together with proposals on foreign profits and intellectual property, these will help prevent and could even reverse the flow of companies overseas," he said.

The Budget outlined that most of the work to cut the deficit would be done through spending cuts, rather than higher taxes.

However, aside from announcing plans to cut welfare bills, and stating that capital spending would be protected, the Chancellor did little to expand on the spending reductions already announced.

These include 6.25 billion of cuts announced in May, which included a freeze on any IT spending over 1m, and reduced spending on outside consultants. A further 2 billion of cuts to projects was announced last week.

The full scale of spending cuts, and their potential impact on the information economy, might not be known until the main spending round in the Autumn.

The Government has already said that it will abolish the National Identity Card and biometric passports, and more cuts to IT-heavy projects could well be on the cards.

This could put a strain on a number of IT businesses that rely heavily on public sector contracts for work.

According to Neil Hutt, transactions partner with Ernst & Young, the professional services firm, the IT industry as a whole could well face tougher times ahead.

"For IT services businesses that provide consulting services and support to the Government things are going to be difficult - it will be a while before Government departments have the funds for one-off consultancy projects even if they do promise to improve efficiency in the longer term," he warned.

Short-term spending cuts could, though, affect the ability of public sector bodies to become more efficient.

In some cases, government departments might need to increase spending on IT, in order to support other objectives, or to bring in more efficient business processes.

It is hard to see how some of the proposed measures, such as cutting welfare benefit payments, can be done without at least some increase in IT spending.

In other areas, experts are concerned that the 1 million cap on IT spending might stop some parts of Government from taking steps now that will bring real cost savings further down the line.

At Ernst & Young, Mr Hutt suggests that this might force government departments to look again at moving services to offshore locations. Outsourcing, and other pay as you go services could also help departments to deliver efficiencies and stay below the spending caps.

"Whilst these spending cuts may at first seem concerning for public sector IT chiefs and IT suppliers, the advance of cloud computing is one way to ensure that IT solutions can still be implemented, but without the significant capital costs associated with the more traditional supply models," said Andy Burton, chair of the Cloud Industry Forum and chief executive of technology provider Rise.

"There's been a trend for a while now in the public sector for IT departments to be the catalyst for change and innovation, using technology to find more cost-effective ways of doing things," said Michiel van der Voort, director of international and professional development at the BCS. "Now more than ever, they need to show they have a strategic understanding of the organisation's goals and business objectives, to be able to help it move ahead."

With the Chancellor set on bringing public spending and revenues back into balance, the business case for any new spending is going to be scrutinised more closely than at any time in recent memory.

-

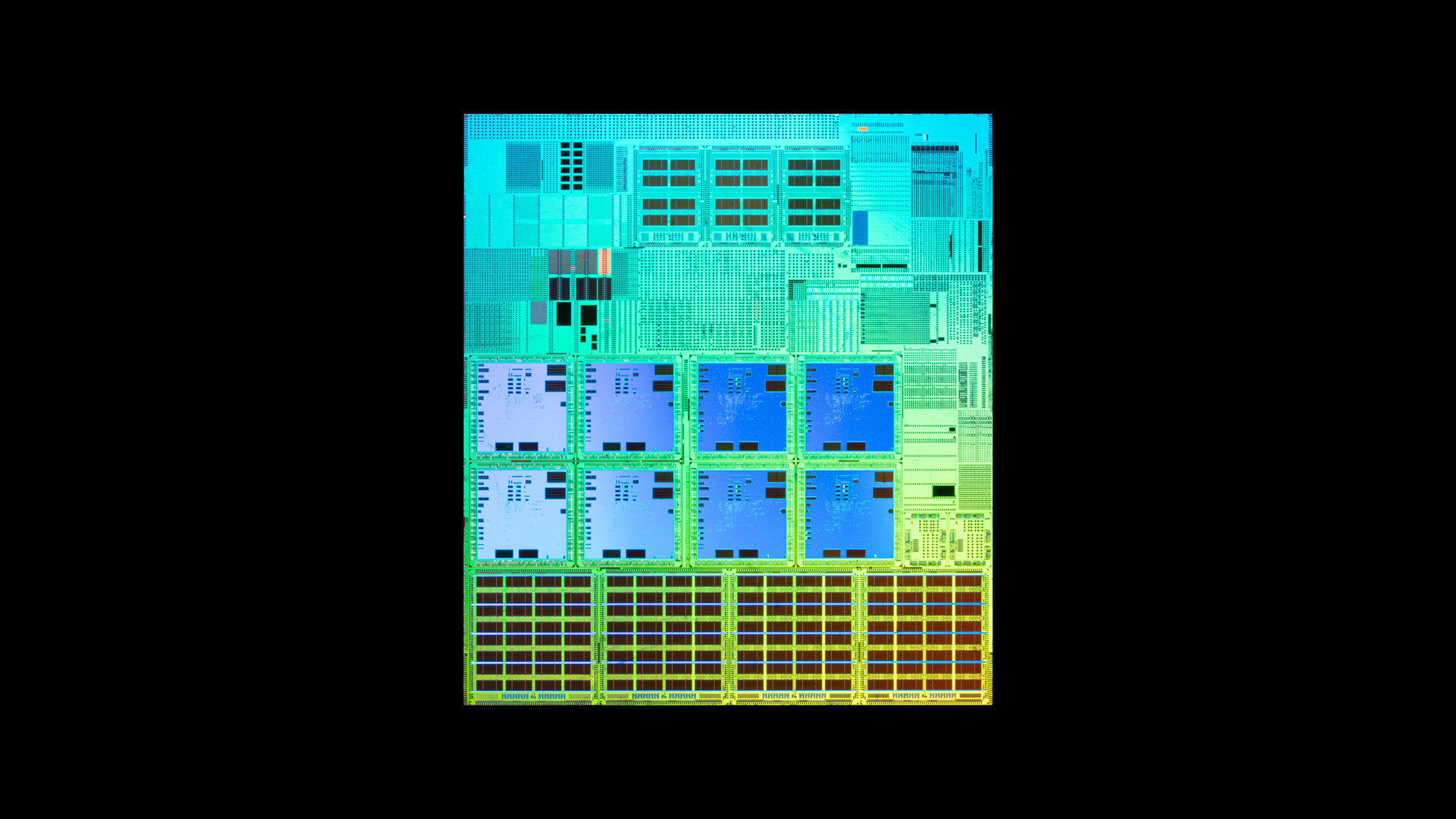

What is Microsoft Maia?

What is Microsoft Maia?Explainer Microsoft's in-house chip is planned to a core aspect of Microsoft Copilot and future Azure AI offerings

-

If Satya Nadella wants us to take AI seriously, let’s forget about mass adoption and start with a return on investment for those already using it

If Satya Nadella wants us to take AI seriously, let’s forget about mass adoption and start with a return on investment for those already using itOpinion If Satya Nadella wants us to take AI seriously, let's start with ROI for businesses