HP: it's all about the software, stupid

The hardware giant is to restructure again, at the cost of 27,000 jobs. But it is the vendor's software strategy that is now being questioned.

Profits declined 31 per cent in the second quarter; the company is planning 27,000 redundancies worldwide, or eight per cent of its workforce, and it is looking for savings of $3.5 billion a year (2.2 billion).

Whitman has said these savings will be ploughed back into R&D, one area where HP is still regarded as a world leader. But the continued restructuring and troubles at the company, including the departure of Autonomy founder Mike Lynch, are prompting observers to suggest far more radical action.

"Should SAP buy HP?" asks Ian Murphy, research analyst at Creative Intellect Consulting. "It would make sense and with HP continuing to haemorrhage jobs, they are increasingly looking like prey, not predator."

There would be savings through merging the companies' professional services businesses, but a combined group could keep its server hardware, in a model similar to that of Oracle/Sun, he says. The PC and printer arms could be sold off.

HP's restructuring is painful but necessary to restore market and customer confidence after last year.

Ray Wang, principal analyst at Constellation Research, argues that it is HP's failure to make the move to software that is counting against them. "HP's recent layoffs reflect the reality of not making the shift to software fast enough in the enterprise services play," he says.

"HP had a great start with efforts to move into business intelligence and big data with Knightsbridge, Vertica, and Autonomy, but it seems that those efforts to build out a strong enterprise software team have not progressed.

Get the ITPro daily newsletter

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

"Add the lack of good integration with [services arm] EDS, and this has become a tougher challenge than anyone at HP realized," he adds.

So HP's attempt to follow IBM's route away from hardware into software and services appears, if not stalled, to be stalling. Drastic action might now be needed to convince customers to stick with HP, and to convince markets that more radical steps still, such as a break-up of the business, is not the best option.

But this, suggests John Madden, principal analyst at Ovum, is something Whitman has yet to demonstrate.

"HP's restructuring is painful but necessary in order to restore market and customer confidence after last year," he says. "We've been down this road before, of course, and the market remains skeptical about how these operational changes will enable HP's stability, especially for its enterprise business.

"As of now we've seen the major pieces of Meg Whitman's restructuring and operations plan. The key missing piece is her long-term company vision and strategy.

"Even with this restructuring, the question still remains: just what kind of company does HP want to be next year, three years, or five years from now?"

-

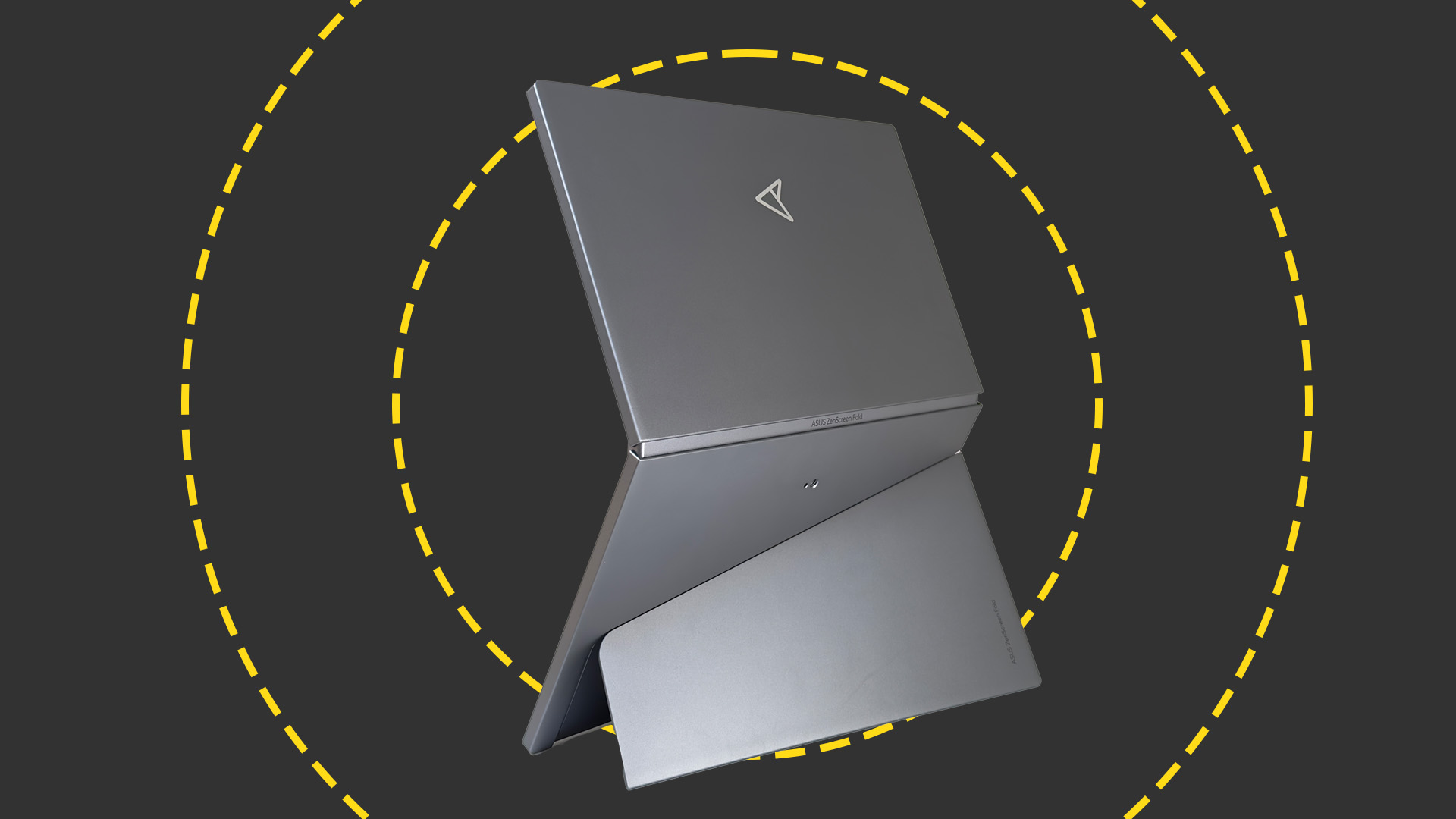

Asus ZenScreen Fold OLED MQ17QH review

Asus ZenScreen Fold OLED MQ17QH reviewReviews A stunning foldable 17.3in OLED display – but it's too expensive to be anything more than a thrilling tech demo

By Sasha Muller

-

How the UK MoJ achieved secure networks for prisons and offices with Palo Alto Networks

How the UK MoJ achieved secure networks for prisons and offices with Palo Alto NetworksCase study Adopting zero trust is a necessity when your own users are trying to launch cyber attacks

By Rory Bathgate

-

IT Pro Panel: Tackling technical recruitment

IT Pro Panel: Tackling technical recruitmentIT Pro Panel With the recruitment market shifting, how can businesses both retain their best staff and fill gaping talent shortages?

By Adam Shepherd

-

Podcast transcript: Why techies shouldn’t become managers

Podcast transcript: Why techies shouldn’t become managersIT Pro Podcast Read the full transcript for this episode of the IT Pro Podcast

By IT Pro

-

The IT Pro Podcast: Why techies shouldn’t become managers

The IT Pro Podcast: Why techies shouldn’t become managersIT Pro Podcast Managing people is a completely different skillset to managing technology - so why do we keep pushing people from one to the other?

By IT Pro

-

Podcast transcript: How umbrella companies exploit IT contractors

Podcast transcript: How umbrella companies exploit IT contractorsIT Pro Podcast Read the full transcript for this episode of the IT Pro Podcast

By IT Pro

-

The IT Pro Podcast: How umbrella companies exploit IT contractors

The IT Pro Podcast: How umbrella companies exploit IT contractorsIT Pro Podcast Is tighter regulation needed to stop workers from being cheated out of earnings?

By IT Pro

-

Data scientist jobs: Where does the big data talent gap lie?

Data scientist jobs: Where does the big data talent gap lie?In-depth Europe needs 346,000 more data scientists by 2020, but why is the gap so big?

By Zach Cooper

-

Four tips for effective business collaboration

Four tips for effective business collaborationOpinion Collaboration is about more than just removing office walls

By Esther Kezia Thorpe

-

IT Pro Panel: The truth about talent

IT Pro Panel: The truth about talentIT Pro Panel Why is it still so hard to find good people?

By Adam Shepherd