SoftBank pulls plug on sale of Arm to Nvidia due to "significant" challenges

UK chipmaker's CEO steps down as it now heads for a flotation on the stock market

Nvidia and SoftBank have agreed to terminate an agreement for the US company to acquire UK chipmaker Arm due to "significant regulatory challenges".

Instead, SoftBank will look to float Arm on the stock market by 2023, the Japanese firm said in a statement.

Since it was announced in 2020, Nvidia's takeover of Arm has been met with scepticism from various parties within the semiconductor industry. and has also been the subject of regulatory investigations from a number of governing bodies around the world.

The UK's Competition and Market's Authority (CMA) said the deal warranted an "in-depth" investigation because it could potentially give Nvidia the power to restrict access to Arm's intellectual property. Similar concerns were cited by regulators in the US and EU, but with the deal now cancelled, the CMA has stated that it is no longer interested in pursuing an investigation.

Finding a way to appease regulators and also justify the $40 billion price tag has proven "overwhelmingly challenging", according to CCS Insight analyst, Geoff Blaber. He said the deal was also disruptive to Arm and its lucrative ecosystem; its licensees collectively shipped an average of 22 billion chips annually over the previous three years.

"As predicted, opposition was considerable and shone a light on the strategic importance of Arm's technology and the vital need for Arm to remain independent," Blaber told IT Pro.

"The $40 billion price tag was such a sizeable premium that it left Softbank with no plan B. An IPO is the best route forward for the Arm ecosystem and will be applauded across the industry but it's certainly not a positive outcome for Softbank."

Get the ITPro daily newsletter

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

Arm to go public

The collapse of the acquisition appears to have resulted in executive changes for Arm, with CEO Simon Segars stepping down, effective immediately, according to a company statement. Industry veteran Rene Haas will now step into the role to lead the company through its IPO, while Segars takes up a position on the board of directors.

RELATED RESOURCE

"Rene is the right leader to accelerate Arm's growth as the company starts making preparations to re-enter the public markets," said Masayoshi Son, the CEO of SoftBank. "I would like to thank Simon for his leadership, contributions and dedication to Arm over the past 30 years."

The company has previously gone to market, making its initial debut in 1998, but it was brought by investment group SoftBank in 2016. It's thought that SoftBank agreed to the sale of Arm so that it could shore up its finances after sling money on other investments, such as the shared office space firm WeWork and even Uber.

Bobby Hellard is ITPro's Reviews Editor and has worked on CloudPro and ChannelPro since 2018. In his time at ITPro, Bobby has covered stories for all the major technology companies, such as Apple, Microsoft, Amazon and Facebook, and regularly attends industry-leading events such as AWS Re:Invent and Google Cloud Next.

Bobby mainly covers hardware reviews, but you will also recognize him as the face of many of our video reviews of laptops and smartphones.

-

Should AI PCs be part of your next hardware refresh?

Should AI PCs be part of your next hardware refresh?AI PCs are fast becoming a business staple and a surefire way to future-proof your business

By Bobby Hellard Published

-

Westcon-Comstor and Vectra AI launch brace of new channel initiatives

Westcon-Comstor and Vectra AI launch brace of new channel initiativesNews Westcon-Comstor and Vectra AI have announced the launch of two new channel growth initiatives focused on the managed security service provider (MSSP) space and AWS Marketplace.

By Daniel Todd Published

-

UK financial services firms are scrambling to comply with DORA regulations

UK financial services firms are scrambling to comply with DORA regulationsNews Lack of prioritization and tight implementation schedules mean many aren’t compliant

By Emma Woollacott Published

-

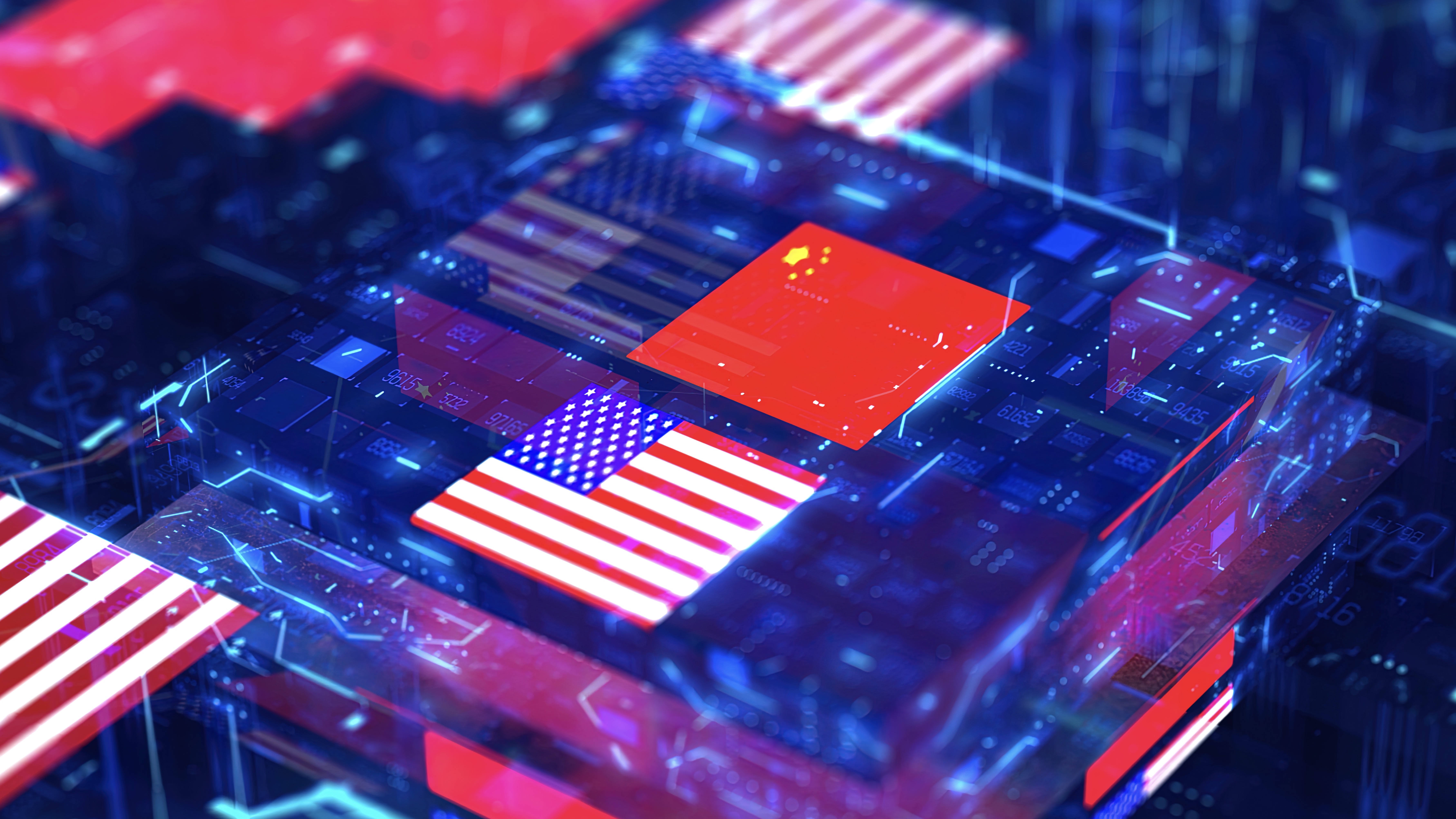

What the US-China chip war means for the tech industry

What the US-China chip war means for the tech industryIn-depth With China and the West at loggerheads over semiconductors, how will this conflict reshape the tech supply chain?

By James O'Malley Published

-

Former TSB CIO fined £81,000 for botched IT migration

Former TSB CIO fined £81,000 for botched IT migrationNews It’s the first penalty imposed on an individual involved in the infamous migration project

By Ross Kelly Published

-

Microsoft, AWS face CMA probe amid competition concerns

Microsoft, AWS face CMA probe amid competition concernsNews UK businesses could face higher fees and limited options due to hyperscaler dominance of the cloud market

By Ross Kelly Published

-

Online Safety Bill: Why is Ofcom being thrown under the bus?

Online Safety Bill: Why is Ofcom being thrown under the bus?Opinion The UK government has handed Ofcom an impossible mission, with the thinly spread regulator being set up to fail

By Barry Collins Published

-

Can regulation shape cryptocurrencies into useful business assets?

Can regulation shape cryptocurrencies into useful business assets?In-depth Although the likes of Bitcoin may never stabilise, legitimising the crypto market could, in turn, pave the way for more widespread blockchain adoption

By Elliot Mulley-Goodbarne Published

-

UK gov urged to ease "tremendous" and 'unfair' costs placed on mobile network operators

UK gov urged to ease "tremendous" and 'unfair' costs placed on mobile network operatorsNews Annual licence fees, Huawei removal costs, and social media network usage were all highlighted as detrimental to telco success

By Rory Bathgate Published

-

Labour plans overhaul of government's 'anti-innovation' approach to tech regulation

Labour plans overhaul of government's 'anti-innovation' approach to tech regulationNews Labour's shadow innovation minister blasts successive governments' "wholly inadequate" and "wrong-headed" approach to regulation

By Keumars Afifi-Sabet Published