Cloud: The springboard to business success

There are many advantages to using cloud-based platforms and services.

Can you imagine a world without email? Without Facebook or Twitter? Indeed, a world bereft of the connectivity to apps and services we rely on as business users and consumers?

A world without the internet seems not just unthinkable, but impossible and unworkable. Until recently, cloud computing was not given the same status by many.

But change is coming. By 2020, a corporate no cloud' policy will be as rare as a no internet' policy, according to analyst firm Gartner.

"Aside from the fact that many organisations with a no-cloud policy actually have some under-the-radar or unavoidable cloud usage, we believe that this position will become increasingly untenable," said Gartner's research vice president Jeffrey Mann.

"Cloud will increasingly be the default option for software deployment. The same is true for custom software, which increasingly is designed for some variation of public or private cloud."

Organisations that fail to realise the opportunities that cloud opens up and the barriers to entry, expansion and accelerated innovation in brings down, will be left behind.

An evolution

Cloud computing itself has moved on from something requiring demystification to a topic that is largely defined and discussed by outcomes rather than explanations. Individual business users want to know how to do their job more effectively and efficiently often more with less whilst delivering business value and proving their worth. While departmental heads and the higher echelons of business and IT decision makers want to help the organisation sell more, boost customer satisfaction, reduce churn and overheads and, ultimately, digitally transform so they remain fit for the future. The big question is how can they do all of this whilst keeping the lights on? The simple answer is cloud.

There are general benefits that any organisation adopting cloud-based services can expect to enjoy. These include but are not limited to:

- Move from CapEx to OpEx, enabling greater predictability of spend

- Only pay for what you need or will consumer rather than conservative and prohibitive IT predictive budgeting

- Greater agility

- A development model than enables you to fail-fast, move on but, hopefully, a greater chance of success too

- Flexibility

- Enhanced efficiency and productivity

- Increased transparency

- Accessibility and the ability to do anything, anywhere

- Disaster-recovery

- Baked in security

- Latest version always-on

- Better decision-making

Ultimately, though, the success of any organistion will be measured in two core ways: by reputation and financial health. Reputation can be greatly protected and enhanced by the speed and agility cloud offers, while finances can be affected positively by a move to cloud as well as managed much more effectively.

Financial management is one area that is increasingly being viewed with a cloud-focused lens. And with good reason as there are more granular benefits to be explored.

Financial folklore

For many reasons, whether regulatory, compliance, finance's paper-based legacy or something else, accounts departments across the board have not been seen as leading the charge when it comes to innovating, change or adopting new technology.

By the end of this decade, more than a third (36 percent) of enterprises plan to make use of cloud to support their transactional systems of record, according to a Gartner survey of senior finance executives carried out in 2017.

Interestingly, the study of more than 400 global financial decision makers, found that there was particularly high year-on-year grown when it came to using cloud for financial business applications.

The wider cloud industry has also recognised the valid and varied role cloud can play in transforming financial services, with the Cloud Industry Forum (CIF) setting up a dedicated special interest group (SIG) for this very reason in 2017.

"This is an incredibly exciting time for the financial services market - technology is being deployed to overturn previous norms, to bring new products and services to market, and to create a more sophisticated and seamless way of operating," said Ray Bricknell, who heads up the new CIF SIG as chairman.

Bricknell, currently managing director of Behind Every Cloud, and previously CTO at $8bn-listed hedge fund RAB Capital as well as holding roles at Barclays and Prudential among others, added: "Cloud computing offers a more agile and scalable IT infrastructure, providing the fundamentals for this kind of digital transformation. While financial services have generally been relatively slow to embrace this change, it is now accepted wisdom that the majority of commodity IT functions can be procured more cost effectively, reliably, and securely from CSPs."

Wider recognition

Small and mid-size organisations have also woken up to the idea of cloud-first or cloud-only with Gartner's study finding that 44.6 percent, 37.7 percent and 40.4 percent of small, medium and large enterprises were planning to adopt cloud over the next three years.

"We have found that most clients asking about these financial business application markets are solely interested in the cloud option," said John Van Decker, another of Gartner's research vice presidents.

"Many enterprises that currently run on-premises solutions want to move to newer solutions that put more control in the hands of the end user, and reduce the effort required when compared with on-premises upgrades."

Van Decker referred to cloud as a game changer for financial management business applications, adding that most platforms had now been re-architected in the cloud offering not just more predictable and sustainable revenue for vendors, but less strain on organisational IT support, which in turn frees up resources to add more value elsewhere.

Financial firms, rather than just finance departments, are also leaning towards cloud-based systems and services. Research firm IDC predicts that worldwide spending on industry cloud by these firms will increase by 24 percent in 2018. By 2021, total worldwide spending in this area is expected to hit $7.2 billion.

"Dozens of new industry collaborative clouds are emerging each year, helping to foster digital transformation, streamline industry value chains, and ultimately drive innovation, while most software vendors are also shifting their portfolios to focus more heavily on designing industry cloud solutions. Healthcare continues to lead the charge from a vertical standpoint, but many industries have picked up momentum, including manufacturing, financial services, and even government," said Eric Newmark, program vice president of industry cloud research at IDC.

"Though the market's tipping point is still a few years away, IDC believes the industry cloud market represents one of the largest vertical growth opportunities for technology vendors and professional services firms through 2025."

Cloud in action

ThinScale Technology is a case in point of the benefits that can be realised by moving financial elements of a business to the cloud.

"Technology moves so quickly, especially in the cloud space. Our systems and processes needed to be moving at the same pace," said Patricia McNeela, head of operations and finance at ThinScale Technology.

Brendan Kiely, the firm's co-founder and managing director, added: "Having a 360 view of your business is absolutely critical now... It gives us a canvas, upon which we can see our business."

Just some of the finance-specific benefits this company and others can expect include:

- An real-time view of what's happening

- Financial - and overall transparency for all key stakeholders

- One view of the truth/easily accessible and digestible dashboards

- The ability to make better-informed decisions based on accurate and real-time data

- Anytime/anywhere access on any device

- Customisation of reports in addition to templates for ease of information sharing

Ultimately, weighing up cloud vs on-premise pros and cons is the same, as with any implementation justification you'll need to make. And, like any investment, something that should be done once all parts of the equation have been taken into account. There is a wide array of services and solutions out there, many of which are modular so you can build on a foundation once you're familiar with the platform and what it can do/has to offer.

Now you've heard about what cloud has to offer financial decision makers and businesses generally, why not find out more about Sage Business Cloud Financials? It offers real-time, anywhere, anytime access and can be personalised so it's suited to your specific role.

Get the ITPro daily newsletter

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

ITPro is a global business technology website providing the latest news, analysis, and business insight for IT decision-makers. Whether it's cyber security, cloud computing, IT infrastructure, or business strategy, we aim to equip leaders with the data they need to make informed IT investments.

For regular updates delivered to your inbox and social feeds, be sure to sign up to our daily newsletter and follow on us LinkedIn and Twitter.

-

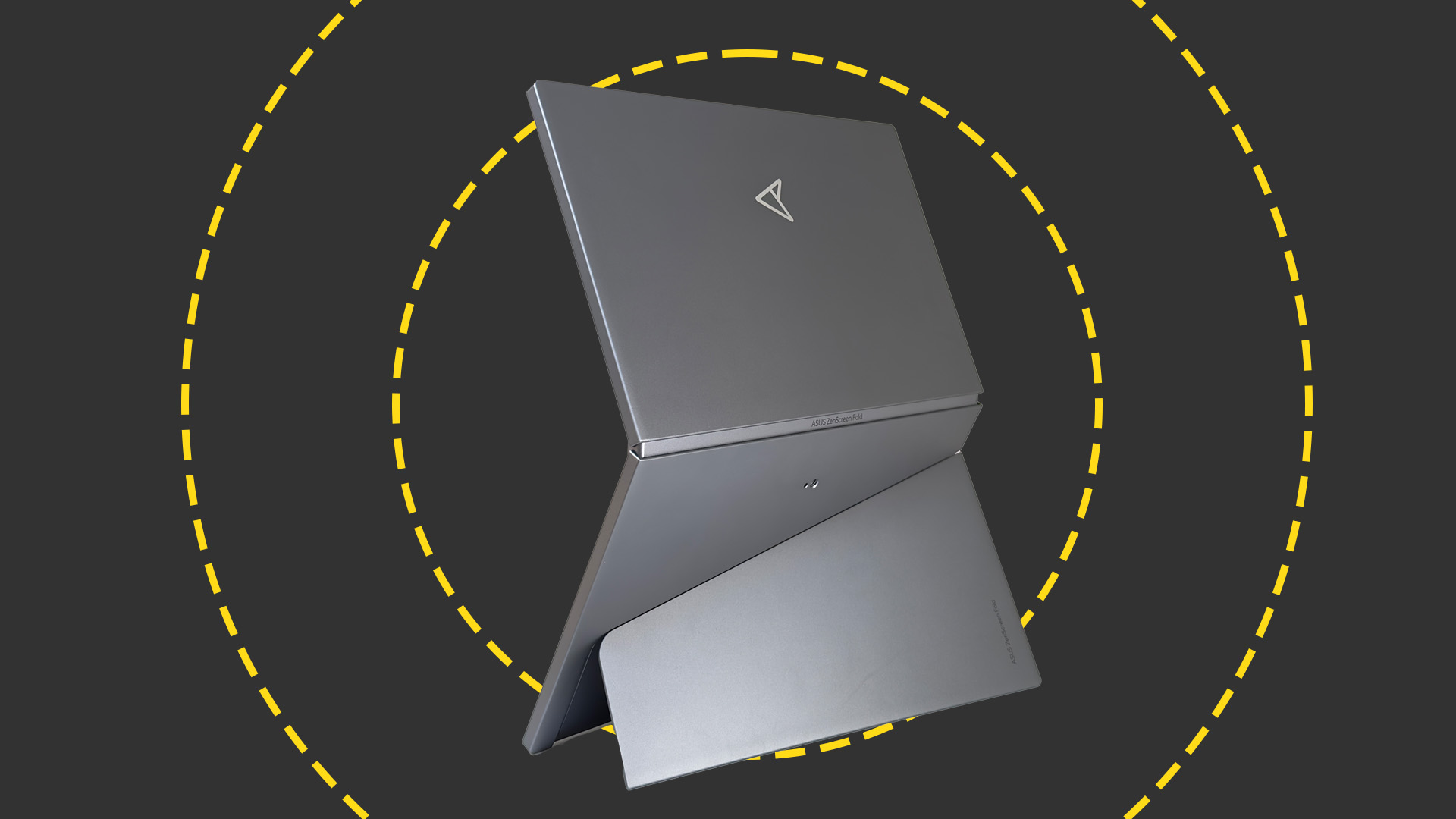

Asus ZenScreen Fold OLED MQ17QH review

Asus ZenScreen Fold OLED MQ17QH reviewReviews A stunning foldable 17.3in OLED display – but it's too expensive to be anything more than a thrilling tech demo

By Sasha Muller

-

How the UK MoJ achieved secure networks for prisons and offices with Palo Alto Networks

How the UK MoJ achieved secure networks for prisons and offices with Palo Alto NetworksCase study Adopting zero trust is a necessity when your own users are trying to launch cyber attacks

By Rory Bathgate

-

Unlock the potential of LATAM’s booming crypto market

Unlock the potential of LATAM’s booming crypto marketwhitepaper Strategic pathways for crypto companies looking to expand into Latin America

By ITPro

-

The customer knows best: How to ensure you’re delivering an effective digital payments experience

The customer knows best: How to ensure you’re delivering an effective digital payments experienceSponsored Tap into shifting customer trends with account information services that will give your business a competitive edge

By ITPro

-

How AI is accelerating digital transformation in the banking industry

How AI is accelerating digital transformation in the banking industrySupported Content Gen AI, fraud detection, and chatbots are all transforming the financial industry, but the cloud is the foundation for it all

By Bobby Hellard

-

What open banking means for the future of online transactions

What open banking means for the future of online transactionsOpen banking offers a faster, more automated future for transactions – but it has a rigid legal road to traverse

By ITPro

-

Embracing the future of financial services

Embracing the future of financial servicesWhitepaper Embedded Finance is leading the way. Discover how merchants could stand to gain the most.

By ITPro

-

The online cash revolution

The online cash revolutionwhitepaper Why adding eCash to the checkout unlocks more growth

By ITPro

-

Building an outstanding digital experience

Building an outstanding digital experiencewhitepaper Insight into how banks and financial services organizations can deliver the digital experiences customers and employees expect

By ITPro

-

How payments support the growth of software platforms

How payments support the growth of software platformswhitepaper Discover how Paysafe can help drive the growth and success of your software platform

By ITPro