A senior Google Cloud exec just accused Microsoft of targeting a cloud industry monopoly

Google Cloud VP Amit Zavery has warned Microsoft’s bullish cloud and generative AI focus could harm competition

A senior Google Cloud executive has heavily criticized Microsoft’s cloud computing practices amid claims that the tech giant is pursuing a monopoly in the industry that could harm long-term competition.

Google Cloud vice president Amit Zavery told Reuters the company has serious concerns over Microsoft’s current trajectory in the cloud computing industry, warning that it could be seeking to establish a stranglehold in the space akin to that it held in software.

“We worry about Microsoft wanting to flex their decade-long practices where they had a lot of monopoly on the on-premise software before, and now they are trying to push that into cloud now.”

"They are creating this whole walled garden, which is completely controlled and owned by Microsoft, and customers who want to do any of this stuff, you have to go to Microsoft only," he said.

Long-term, the company’s practices could create a monopoly over emerging technologies such as generative AI, Zavery warned, and result in it creating a “walled garden” in which customers are locked into platforms such as Azure.

"If Microsoft cloud doesn't remain open, we will have issues and long-term problems, even in next generation technologies like AI as well, because Microsoft is forcing customers to go to Azure in many ways,” he warned.

Zavery urged regulators on both sides of the Atlantic to act on the matter.

Get the ITPro daily newsletter

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

"I think regulators need to provide some kind of guidance as well as maybe regulations which prevent the way Microsoft is building the Azure cloud business, not allow your on-premise monopoly to bring it into the cloud monopoly," he said.

The criticism marks the latest in a long-running spat between Microsoft and competitors in the cloud computing industry amid heightened regulatory scrutiny over its practices.

Regulators in the UK, for example, are investigating whether providers such as Microsoft and Amazon Web Services (AWS) maintain a stranglehold over the country’s cloud computing market.

In October 2023, Ofcom called for an official antitrust investigation into the state of competition in the industry, specifically highlighting Microsoft and AWS as potentially inhibitive to growth and competition in the space.

Ofcom, which has referred the investigation to the Competition and Markets Authority (CMA), said its probe identified “features that make it more difficult for UK businesses to switch and use multiple cloud suppliers”.

A key concern highlighted by the probe centered around ‘egress fees’, whereby customers are required to pay to switch providers entirely, or adopt a multi-cloud method in which they use multiple providers.

“Our market study has identified features that make it more difficult for UK businesses to switch and use multiple cloud suppliers,” Ofcom said at the time.

“We are particularly concerned about the position of the market leaders Amazon and Microsoft.”

Late last year, tensions between the three hyperscalers escalated after AWS and Google both hit out at Microsoft licensing practices. The two firms claimed that Microsoft is creating “challenging conditions” for customers as its licensing practices deter them from switching to alternative providers.

Microsoft changed its licensing terms in 2019 and 2022 following complaints to EU regulators in a bid to make it easier for smaller providers to compete in the European cloud computing market.

But AWS and Google contested the benefits of these changes, arguing that they resulted in little change and are still locking customers into Microsoft products and services.

“To use many of Microsoft’s software products with these other cloud services providers, a customer must purchase a separate license even if they already own the software,” AWS said at the time. “This often makes it financially unviable for a customer to choose a provider other than Microsoft.”

Microsoft has made efforts to calm industry concerns and potential antitrust scrutiny in recent weeks. In early February, the tech giant revealed it had begun talking with European cloud industry trade body, CISPE.

In 2022, CISPE filed a complaint with EU regulators over its alleged anti-competitive practices.

CISPE confirmed that talks with the tech giant could focus on resolving lingering concerns related to “unfair software licensing” practices for infrastructure providers and customers.

We are glad MSFT is coming to the table to negotiate with CISPE regarding its complaint with the EC on anticompetitive licensing in Europe. This is a step in the right direction, acknowledging that these restrictions have no technical basis and can be modified at MSFT discretionFebruary 26, 2024

in a post on X today (February 27), Zavery said he welcomed the move, describing it as a positive step to improving competition.

“We are glad MSFT is coming to the table to negotiate with CISPE regarding its complaint with the EC on anticompetitive licensing in Europe,” he said. “This is a step in the right direction, acknowledging that these restrictions have no technical basis and can be modified at MSFT discretion

Microsoft is making serious gains in cloud computing and AI

Microsoft’s success in the cloud computing and generative AI markets over the last 18 months has been no secret.

Since the emergence of ChatGPT in November 2022, the tech giant has recorded remarkable growth on a wave of interest in AI technologies.

Working with OpenAI, Microsoft has embedded generative AI features and tools across the entirety of its core product offerings, spanning Windows, Azure, and even security products.

RELATED WHITEPAPER

In January, Microsoft leapfrogged Apple as the world’s most valuable company, reaching a market capitalization of $2.887 trillion. Much of this has been due to its huge successes in cloud computing and generative AI.

Microsoft’s Q2 earnings for 2024, released at the end of January, showed it recorded a 24% year-on-year growth across its overall cloud business.

The tech giant’s Intelligent Cloud segment, which includes Azure, recorded $25.8 billion in revenue.

Speaking at the time, Microsoft CEO Satya Nadella attributed the growth to surging interest in generative AI, noting that the company had expanded its customer base.

“We now have 53,000 Azure AI customers, over one-third are new to Azure over the past 12 months,” Nadella said. “Our new models of service offering makes it easy for developers to use LLMs from our partners like Cohere, Meta, and Mistral on Azure, without having to manage underlying infrastructure.”

Ross Kelly is ITPro's News & Analysis Editor, responsible for leading the brand's news output and in-depth reporting on the latest stories from across the business technology landscape. Ross was previously a Staff Writer, during which time he developed a keen interest in cyber security, business leadership, and emerging technologies.

He graduated from Edinburgh Napier University in 2016 with a BA (Hons) in Journalism, and joined ITPro in 2022 after four years working in technology conference research.

For news pitches, you can contact Ross at ross.kelly@futurenet.com, or on Twitter and LinkedIn.

-

Bigger salaries, more burnout: Is the CISO role in crisis?

Bigger salaries, more burnout: Is the CISO role in crisis?In-depth CISOs are more stressed than ever before – but why is this and what can be done?

By Kate O'Flaherty Published

-

Cheap cyber crime kits can be bought on the dark web for less than $25

Cheap cyber crime kits can be bought on the dark web for less than $25News Research from NordVPN shows phishing kits are now widely available on the dark web and via messaging apps like Telegram, and are often selling for less than $25.

By Emma Woollacott Published

-

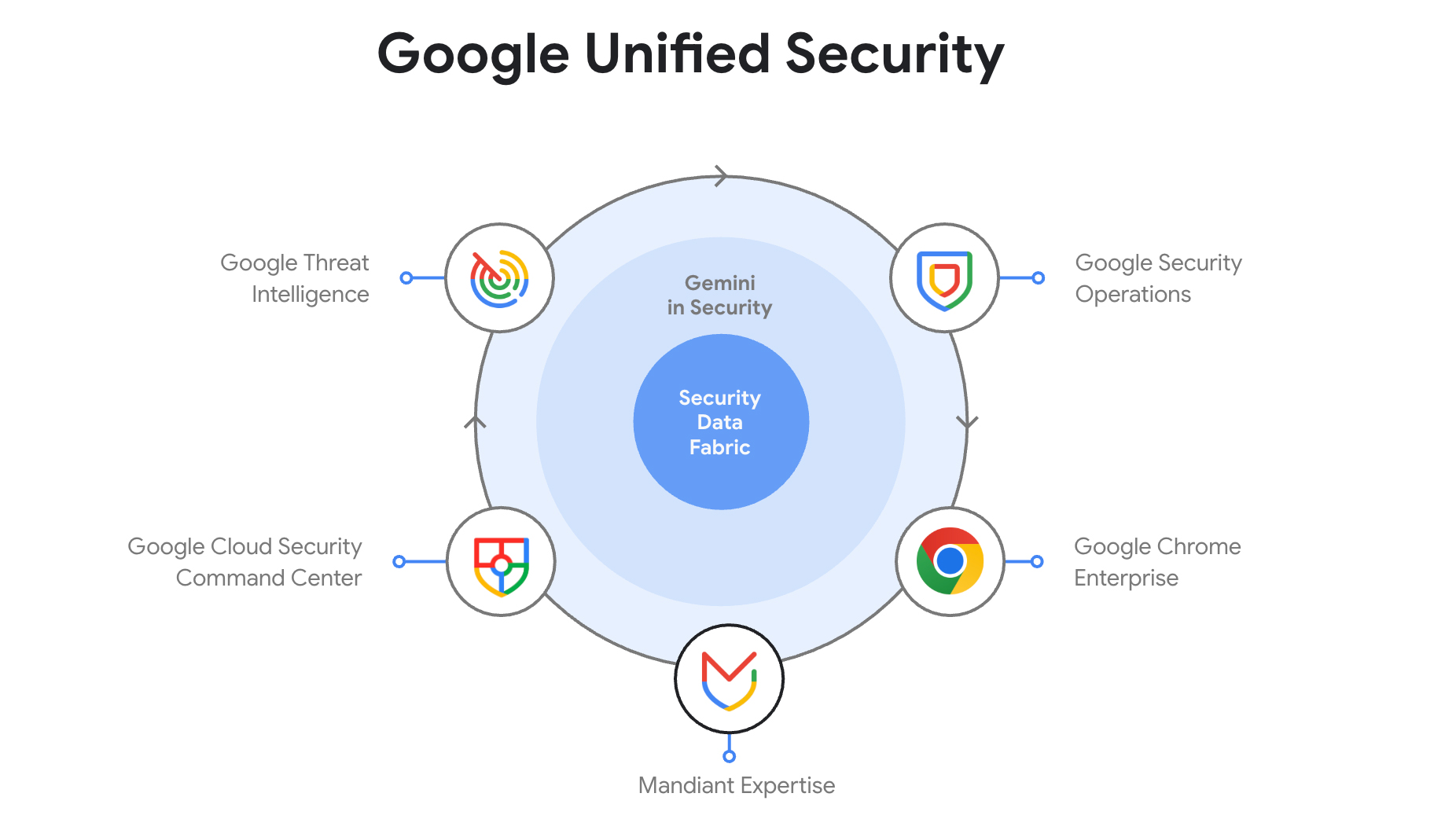

Google Cloud wants to tackle cyber complexity – here's how it plans to do it

Google Cloud wants to tackle cyber complexity – here's how it plans to do itNews Google Unified Security will combine all the security services under Google’s umbrella in one combined cloud platform

By Rory Bathgate Published

-

Google Cloud Next 2025: All the live updates as they happened

Google Cloud Next 2025: All the live updates as they happenedLive Blog Google Cloud Next 2025 is officially over – here's everything that was announced and shown off in Las Vegas

By Rory Bathgate Last updated

-

Google Cloud Next 2025 is the hyperscaler’s chance to sell itself as the all-in-one AI platform for enterprises

Google Cloud Next 2025 is the hyperscaler’s chance to sell itself as the all-in-one AI platform for enterprisesAnalysis With a focus on the benefits of a unified approach to AI in the cloud, the ‘AI first’ cloud giant can build on last year’s successes

By Rory Bathgate Published

-

The Wiz acquisition stakes Google's claim as the go-to hyperscaler for cloud security – now it’s up to AWS and industry vendors to react

The Wiz acquisition stakes Google's claim as the go-to hyperscaler for cloud security – now it’s up to AWS and industry vendors to reactAnalysis The Wiz acquisition could have monumental implications for the cloud security sector, with Google raising the stakes for competitors and industry vendors.

By Ross Kelly Published

-

Google confirms Wiz acquisition in record-breaking $32 billion deal

Google confirms Wiz acquisition in record-breaking $32 billion dealNews Google has confirmed plans to acquire cloud security firm Wiz in a deal worth $32 billion.

By Nicole Kobie Published

-

Microsoft’s EU data boundary project crosses the finish line

Microsoft’s EU data boundary project crosses the finish lineNews Microsoft has finalized its EU data boundary project aimed at allowing customers to store and process data in the region.

By Nicole Kobie Published

-

AWS expands Ohio investment by $10 billion in major AI, cloud push

AWS expands Ohio investment by $10 billion in major AI, cloud pushNews The hyperscaler is ramping up investment in the midwestern state

By Nicole Kobie Published

-

Microsoft hit with £1 billion lawsuit over claims it’s “punishing UK businesses” for using competitor cloud services

Microsoft hit with £1 billion lawsuit over claims it’s “punishing UK businesses” for using competitor cloud servicesNews Customers using rival cloud services are paying too much for Windows Server, the complaint alleges

By Emma Woollacott Published