Alibaba Cloud is in a "race to the bottom" on pricing — and it will be its undoing

Alibaba Cloud price cuts could unlock nominal gains for the provider, but this tactic will merely prompt a battle of attrition with US giants

Alibaba Cloud price cuts won’t be enough to stave off western hyperscaler advances, experts have told ITPro, as the firm will likely end up damaging its own revenue streams.

The cloud vendor revealed plans to slash prices for its customers outside of China by an average of 23% across a wide range of its cloud products, with price cuts reaching as big as 59% in some cases.

The price reductions are now available to users in Singapore, Indonesia, the United Arab Emirates (UAE), Japan, the US, and Germany, as well as some other regions.

This builds on previous price cuts from the cloud provider, which slashed costs for services in early 2023 by up to 50% in a bid to stave off increasingly stiff competition across Asia.

These cuts were made in areas of elastic computing services and services reliant on Nvidia-based V100 and T4 graphics processors.

This earlier move highlighted a long-running trend among Chinese cloud providers in the APAC region centered around undercutting western competition.

Analysis from the Wall Street Journal in early 2023 found that Chinese cloud companies typically offer prices between 20% to 40% lower than their American counterparts.

Get the ITPro daily newsletter

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

The move also comes in the wake of some serious strategic changes in Alibaba’s cloud division in which plans for an initial public offering (IPO) were scrapped over uncertainties about chip exports.

Alibaba Cloud is on a “race to the bottom”

Alibaba’s current plans point toward a concerted effort to essentially keep its neck in the game due to intense competition in Asia.

The company does boast a strong foothold and has invested significantly in the region in recent years, unveiling a new cloud region in Singapore in late 2022 supported by up to $1 billion in funding.

But western hyperscalers such as AWS, Microsoft, and Google Cloud are also establishing an ever-stronger grip on the region - particularly in key battlegrounds like Southeast Asia and Japan.

The trio have all unveiled huge investments in Singapore, Malaysia, Thailand, and Japan in recent years, with Microsoft and Google both confirming plans to expand in Japan within the last month.

With competition heating up, industry stakeholders have questioned whether Alibaba’s tactics can be sustained long-term. Eldar Tuvey, CEO and founder of Vertice, told ITPro the recent cuts will likely deliver negligible benefits in terms of its market standing outside of China.

“A race to the bottom in a fight over unit costs for compute or other resources is unlikely to make Alibaba a major player or wrestle dominance from established players,” Tuvey said.

While these cuts are good for the consumer, Tuvey said, driving down prices will ultimately lead to a situation where other major players end up cutting prices to stay competitive.

“Some customers may jump ship to the likes of Alibaba in the short term, but ultimately users will go for the vendor that is best aligned to what they need,” Tuvey added.

Alibaba’s footing in the global marketplace is tenuous

Though the firm dominates in China, holding over 30% of the Infrastructure as a Service market according to Statista, AWS still leads the pack in the Asia Pacific (APAC) region as a whole.

AWS, along with Microsoft Azure and Google Cloud Platform (GCP), also hold significant sway in the global cloud market landscape, and it’s unlikely that Alibaba is poised to gain a significant share of that.

“Making headway against industry giants like Amazon (AWS) and Microsoft (Azure) is a formidable challenge for Alibaba, predominantly due to these firms’ entrenched positions in the Western markets,” Kate Leaman, chief market analyst at AvaTrade, told ITPro.

Leaman was careful to point out, however, that Alibaba’s foothold in Asia constitutes a “strong base” from which the firm could expand its services globally, providing it was able to leverage certain strengths.

RELATED WHITEPAPER

“The most important element for Alibaba is leveraging its strengths in data analytics, artificial intelligence (AI), and e-commerce integrations, which allows it to offer differentiated services that resonate with an international audience,” Leaman said.

While the company’s price cut could prove successful, she added, the strategy is very much dependent on whether Alibaba can function at a viable level while also operating at a radically lower price point.

“This strategy could prove to be successful in attracting price-sensitive customers and those looking to diversify their cloud service providers,” Leaman said.

“However, the success is also dependent on Alibaba’s ability to continue providing high service quality and innovation at lower price points,” she added.

George Fitzmaurice is a former Staff Writer at ITPro and ChannelPro, with a particular interest in AI regulation, data legislation, and market development. After graduating from the University of Oxford with a degree in English Language and Literature, he undertook an internship at the New Statesman before starting at ITPro. Outside of the office, George is both an aspiring musician and an avid reader.

-

Geekom Mini IT13 Review

Geekom Mini IT13 ReviewReviews It may only be a mild update for the Mini IT13, but a more potent CPU has made a good mini PC just that little bit better

By Alun Taylor

-

Why AI researchers are turning to nature for inspiration

Why AI researchers are turning to nature for inspirationIn-depth From ant colonies to neural networks, researchers are looking to nature to build more efficient, adaptable, and resilient systems

By David Howell

-

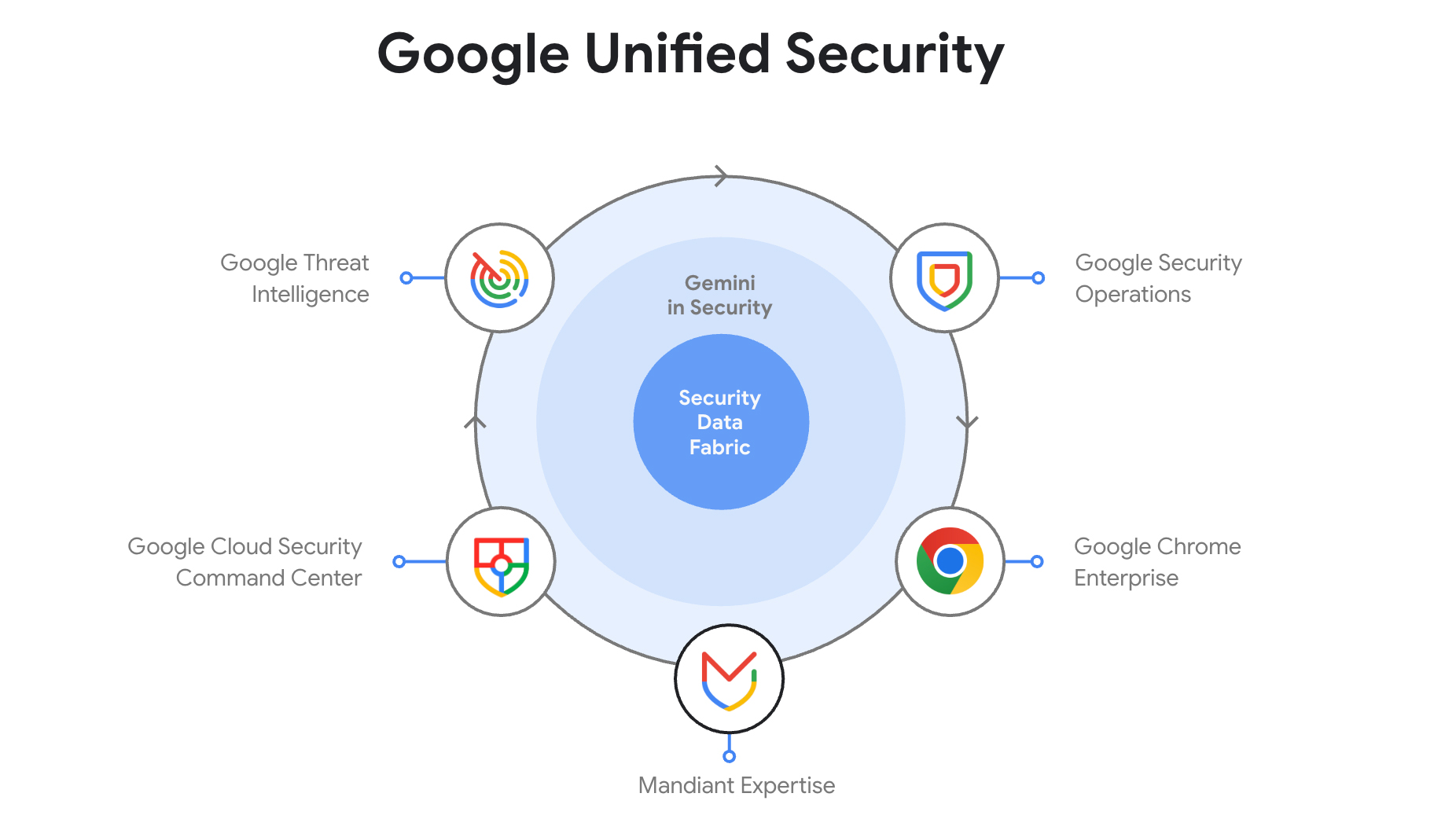

Google Cloud wants to tackle cyber complexity – here's how it plans to do it

Google Cloud wants to tackle cyber complexity – here's how it plans to do itNews Google Unified Security will combine all the security services under Google’s umbrella in one combined cloud platform

By Rory Bathgate

-

Google Cloud Next 2025: All the live updates as they happened

Google Cloud Next 2025: All the live updates as they happenedLive Blog Google Cloud Next 2025 is officially over – here's everything that was announced and shown off in Las Vegas

By Rory Bathgate

-

Google Cloud Next 2025 is the hyperscaler’s chance to sell itself as the all-in-one AI platform for enterprises

Google Cloud Next 2025 is the hyperscaler’s chance to sell itself as the all-in-one AI platform for enterprisesAnalysis With a focus on the benefits of a unified approach to AI in the cloud, the ‘AI first’ cloud giant can build on last year’s successes

By Rory Bathgate

-

The Wiz acquisition stakes Google's claim as the go-to hyperscaler for cloud security – now it’s up to AWS and industry vendors to react

The Wiz acquisition stakes Google's claim as the go-to hyperscaler for cloud security – now it’s up to AWS and industry vendors to reactAnalysis The Wiz acquisition could have monumental implications for the cloud security sector, with Google raising the stakes for competitors and industry vendors.

By Ross Kelly

-

Google confirms Wiz acquisition in record-breaking $32 billion deal

Google confirms Wiz acquisition in record-breaking $32 billion dealNews Google has confirmed plans to acquire cloud security firm Wiz in a deal worth $32 billion.

By Nicole Kobie

-

Microsoft’s EU data boundary project crosses the finish line

Microsoft’s EU data boundary project crosses the finish lineNews Microsoft has finalized its EU data boundary project aimed at allowing customers to store and process data in the region.

By Nicole Kobie

-

AWS expands Ohio investment by $10 billion in major AI, cloud push

AWS expands Ohio investment by $10 billion in major AI, cloud pushNews The hyperscaler is ramping up investment in the midwestern state

By Nicole Kobie

-

Microsoft hit with £1 billion lawsuit over claims it’s “punishing UK businesses” for using competitor cloud services

Microsoft hit with £1 billion lawsuit over claims it’s “punishing UK businesses” for using competitor cloud servicesNews Customers using rival cloud services are paying too much for Windows Server, the complaint alleges

By Emma Woollacott