Vendor Loyalty vs. Customer Choice Pt 1

Steve Mackey from Spectra Logic asks if you're an Innovating VAR or a Brand VAR?

As with all businesses, a VAR must make important decisions when developing its business model. One fundamental decision being which side of the table does it sit on? Is the model for an Innovating VAR or a Brand VAR?

The Brand VAR – develops very close relationships with a small number of strong vendors, well known brands that customers trust and will buy. It exhibits strong loyalty and provides vendors with what they want; an extension to the vendor sales teams with reach into all sizes of prospect from SMB to enterprise

With this model, there is a lot to be gained as vendors tend to provide a variety of benefits and incentives such as the best discounts, volume rebate schemes for target fulfillment, marketing funds, executive level attention, close support, funded heads, account and deal introduction by direct sales, free training and even sales leads. In these circumstances, the objective for a VAR is clearly to bag a share of a very lucrative existing market for a vendor’s products. Many customers will standardise on a small number of vendor’s offerings and then the task for the VAR is one of selling the benefits of say price and service that this particular VAR can bring to the customer.

Increasing revenue for these VARs is about taking vendor brand share from other channel partners or developing net new business from working with complimentary vendor approved products i.e. bundling hardware with appropriate software. If a VAR is entirely or nearly brand exclusive it can probably rely on a high degree of assistance from the vendor as a ‘safe pair of hands’ for new business, so a high degree of co-operation can be achieved in hunting out true net new business for both parties. For larger, non-exclusive VARs dealing with a selection of strong brands there is a lot of investment made by vendors in trying to increase their brand share within the VAR, possibly the route to take to maximise edge benefits; marketing funds, funded heads and rebates.

Services are a great extension to a brand VARs offering. Broadening the portfolio to include integration, financial, support and even outsourcing services is a natural way of increasing share of spend with existing customers and tighter integration with vendors.

The barriers to entry for this model are high from both sides. For a vendor they need existing demand and market share, broad portfolios, strong brand, marketing and channel programmes. In other words this is business for the big beasts. For the channel partners they also tend to be big on muscle: large organisations, strong revenues, extensive customer lists. Or alternatively offer very specialised relationships and skills into niche, hard to get to markets. Marketing programmes tend to focus on loyalty, promotion and incentives and VARs want as much contribution from vendors in the form of marketing funds, funded heads and rebates.

But the model can break. New, disruptive technologies with strong propositions and ROIs will most often appear from small start-up vendors. Customers will demand the solutions and technologies they see and may demand these from their close partner VARs or develop relationships with new suppliers. Which brings us to: Innovating VARs.

ChannelPro Newsletter

Stay up to date with the latest Channel industry news and analysis with our twice-weekly newsletter

The Innovating VAR – keeps close to new technology developments and trends. These VARs seek out start-ups with new solutions that can provide real benefits to customers. They tend to build close relationships with customers around specialised technology segments such as: security, storage, virtualisation and or with customers in specific vertical industries. Developing a close relationship with customers as trusted advisors, these VARs are partners who can bring real value to the table by monitoring the market, trying out new technologies and solutions and making recommendations.

Innovating VARs have a looser more flexible vendor set than the Brand VAR with less vendor loyalty. When start-ups become more successful they expand their channels, or get acquired by larger vendors. A successful Innovating VAR will have a queue of small start-ups and vendors with the latest and best products queuing at its door for access to its customers, but the process of industry monitoring and of making sound new product selections is both costly and risky. The Innovating VAR and its customers will want to be innovative but not reckless. The big sell of course for these VARs is best of breed and innovation. New technology has the ability to lower a company’s costs and provide competitive edge, the best innovating VARs can provide that with the lowest risk of introduction.

Increasing revenue for these VARs is about bringing more products to their close customer set and bringing new customers into the fold through acquisition. New vendors really want the former but experience says that even with the best new mouse trap on the block, getting access to an Innovating VAR’s customer set will involve a quid pro quo of the vendor generating some opportunity and passing it back to the VAR – a great way for innovating VARs to get new customers into the fold.

The barriers to entry into this model are different. The Innovating VAR needs the close, trusting relationship with its customers, built on previous success that means that it can repeatedly introduce new offerings and its customers can be confident in the solutions that are presented. Product selection, testing, skills adoption, integration and technical support mean that technical skill levels and resource levels are high. This is appreciated and necessary but perhaps not always chargeable. Marketing programmes need to focus on customer education, keeping customers up to date on emerging industry trends and technologies, customer success stories and reference projects. Marketing contributions from vendors are expected to share costs of the VARs programmes but also to bring sales leads to the table from their own marketing campaigns.

It is a high cost business model for a VAR and not without risks. A customer needs to have a high degree of confidence in the VAR’s recommendations and its ability to deliver and support any solution. Often this comes down to VAR confidence and relationships with individuals: sales and technical. Innovative VARs are built around key people. As technologies mature, competition increases and differentiation narrows, customers move to lower risk suppliers, strong brands and bigger companies. Relationships at customer side tend to be from key decision making individuals and these individuals move on. Innovating VARs can both win or lose from this, as their contacts move to a new prospect, or as they lose a key relationship within a key customer account.

Shades of grey?

This is all a gross over simplification of course. The channel is far more complex than this and the position of each individual company is not so black and white. The positioning of these two contrasting strategies though does help identify some of the motivations from both vendor and channel side. In my various roles in vendor channel management spanning over 20 years, I have always implored my channel sales managers to spend more time understanding their partner or prospective partner’s business models. This avoids the pitfall many sales people follow in persisting to try to sell into a VAR that is clearly not a good match with their own model and should be qualified out for every one’s benefit.

In addition, I impart that the key to any successful ongoing relationship is to identify where there is a good match between vendor and channel partner objectives and work that as hard as possible. Too many vendors have ‘one size fits all’ channel programmes and a take it or leave it attitude.

In part two we will look at some common elements of vendor channel programmes and how they fit the innovating or brand VAR models.

ITPro is a global business technology website providing the latest news, analysis, and business insight for IT decision-makers. Whether it's cyber security, cloud computing, IT infrastructure, or business strategy, we aim to equip leaders with the data they need to make informed IT investments.

For regular updates delivered to your inbox and social feeds, be sure to sign up to our daily newsletter and follow on us LinkedIn and Twitter.

-

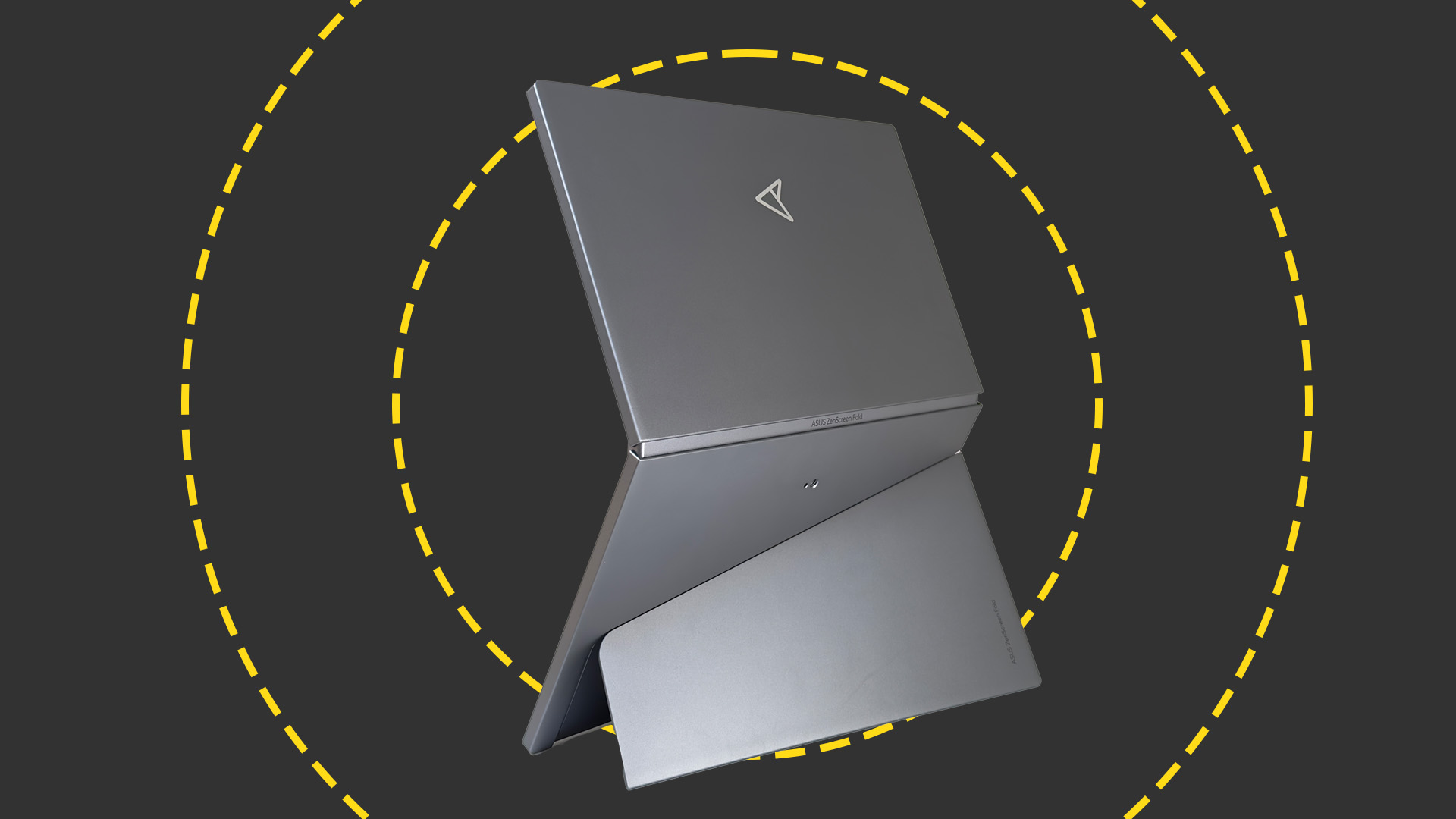

Asus ZenScreen Fold OLED MQ17QH review

Asus ZenScreen Fold OLED MQ17QH reviewReviews A stunning foldable 17.3in OLED display – but it's too expensive to be anything more than a thrilling tech demo

By Sasha Muller

-

How the UK MoJ achieved secure networks for prisons and offices with Palo Alto Networks

How the UK MoJ achieved secure networks for prisons and offices with Palo Alto NetworksCase study Adopting zero trust is a necessity when your own users are trying to launch cyber attacks

By Rory Bathgate