Tech firms “deeply concerned” with Digital Services Tax

The 2% levy is drafted into law as the tech community is spooked by US reaction to French measures

A trade association for UK tech companies has claimed the government's Digital Services Tax (DST) will slow investment and raise consumer costs just as the government has drafted the measure into law.

After the chancellor Philip Hammond proposed a 2% levy on the revenues of companies like Google and Facebook in October, the government yesterday inserted the policy into its draft 2019/20 Finance Bill.

The move, however, has coincided with threats by the US government to investigate a similar levy on big tech revenue proposed by France. Current French proposals suggest imposing a 3% levy on firms with an annual revenue of more than 670 million, backdated to early 2019.

The response has made the UK's tech community wary over Britain's own plans to introduce such a tax, according to techUK, because it puts their members at risk of "retaliation" from the US president Donald Trump.

"There is no doubt that the system for international taxation needs to evolve to deal with a digitising economy," said techUK's associate director for policy, Giles Derrington.

"To do that we need smart and innovative solutions developed at a global level. As a revenue tax targeted on a narrowly defined set of companies, the Digital Services Tax is not one of those smart measures.

"The US Government has said that this proposal risks creating new non-tariff barriers to trade, and there is a real risk that the Government is putting the UK at risk of retaliation from the US Government that would hurt British businesses and consumers."

Get the ITPro daily newsletter

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

The DST will slap a 2% levy on the revenues of profitable search engines, social media platforms and online marketplaces that generate more than 500 million per year. This is expected to raise more than 400 million per year from 2022/23 and beyond.

"There is one standout example of where the rules of the game must evolve now if they are to keep up with the emerging digital economy," Hammond said when first announcing the measure last year.

"Digital platforms delivering search engines, social media, and online marketplaces have changed our lives, our society and our economy. Mostly for the better. But they also pose a real challenge for the sustainability and fairness of our tax system.

"The rules have simply not kept pace with changing business models and it is clearly not sustainable or fair that digital platform businesses can generate substantial value in the UK without paying tax here in respect of that business."

TechUK has also argued the there are too many unanswered questions about how the tax will work in practice, claiming it would lead to "bizarre outcomes" such as potentially raising costs which are in turn passed on to consumers, and reducing competition.

As part of the implementation, meanwhile, Her Majesty's Revenue and Customs (HMRC) will incur costs of up to 8 million to install new IT systems and processes, as well as hire additional staff, to administer the tax.

The European Union (EU), at one stage, also proposed imposing a 3% revenue tax on major multinational tech firms, but indefinitely delayed these plans after opposition from Denmark, Ireland and Sweden.

The contents of the Finance Bill, including changes to the IR35 rules, will undergo a consultation process before they are formally ratified in the 2019 Budget during autumn.

Keumars Afifi-Sabet is a writer and editor that specialises in public sector, cyber security, and cloud computing. He first joined ITPro as a staff writer in April 2018 and eventually became its Features Editor. Although a regular contributor to other tech sites in the past, these days you will find Keumars on LiveScience, where he runs its Technology section.

-

Cleo attack victim list grows as Hertz confirms customer data stolen

Cleo attack victim list grows as Hertz confirms customer data stolenNews Hertz has confirmed it suffered a data breach as a result of the Cleo zero-day vulnerability in late 2024, with the car rental giant warning that customer data was stolen.

By Ross Kelly

-

Lateral moves in tech: Why leaders should support employee mobility

Lateral moves in tech: Why leaders should support employee mobilityIn-depth Encouraging staff to switch roles can have long-term benefits for skills in the tech sector

By Keri Allan

-

UK financial services firms are scrambling to comply with DORA regulations

UK financial services firms are scrambling to comply with DORA regulationsNews Lack of prioritization and tight implementation schedules mean many aren’t compliant

By Emma Woollacott

-

What the US-China chip war means for the tech industry

What the US-China chip war means for the tech industryIn-depth With China and the West at loggerheads over semiconductors, how will this conflict reshape the tech supply chain?

By James O'Malley

-

Former TSB CIO fined £81,000 for botched IT migration

Former TSB CIO fined £81,000 for botched IT migrationNews It’s the first penalty imposed on an individual involved in the infamous migration project

By Ross Kelly

-

Microsoft, AWS face CMA probe amid competition concerns

Microsoft, AWS face CMA probe amid competition concernsNews UK businesses could face higher fees and limited options due to hyperscaler dominance of the cloud market

By Ross Kelly

-

Online Safety Bill: Why is Ofcom being thrown under the bus?

Online Safety Bill: Why is Ofcom being thrown under the bus?Opinion The UK government has handed Ofcom an impossible mission, with the thinly spread regulator being set up to fail

By Barry Collins

-

Can regulation shape cryptocurrencies into useful business assets?

Can regulation shape cryptocurrencies into useful business assets?In-depth Although the likes of Bitcoin may never stabilise, legitimising the crypto market could, in turn, pave the way for more widespread blockchain adoption

By Elliot Mulley-Goodbarne

-

UK gov urged to ease "tremendous" and 'unfair' costs placed on mobile network operators

UK gov urged to ease "tremendous" and 'unfair' costs placed on mobile network operatorsNews Annual licence fees, Huawei removal costs, and social media network usage were all highlighted as detrimental to telco success

By Rory Bathgate

-

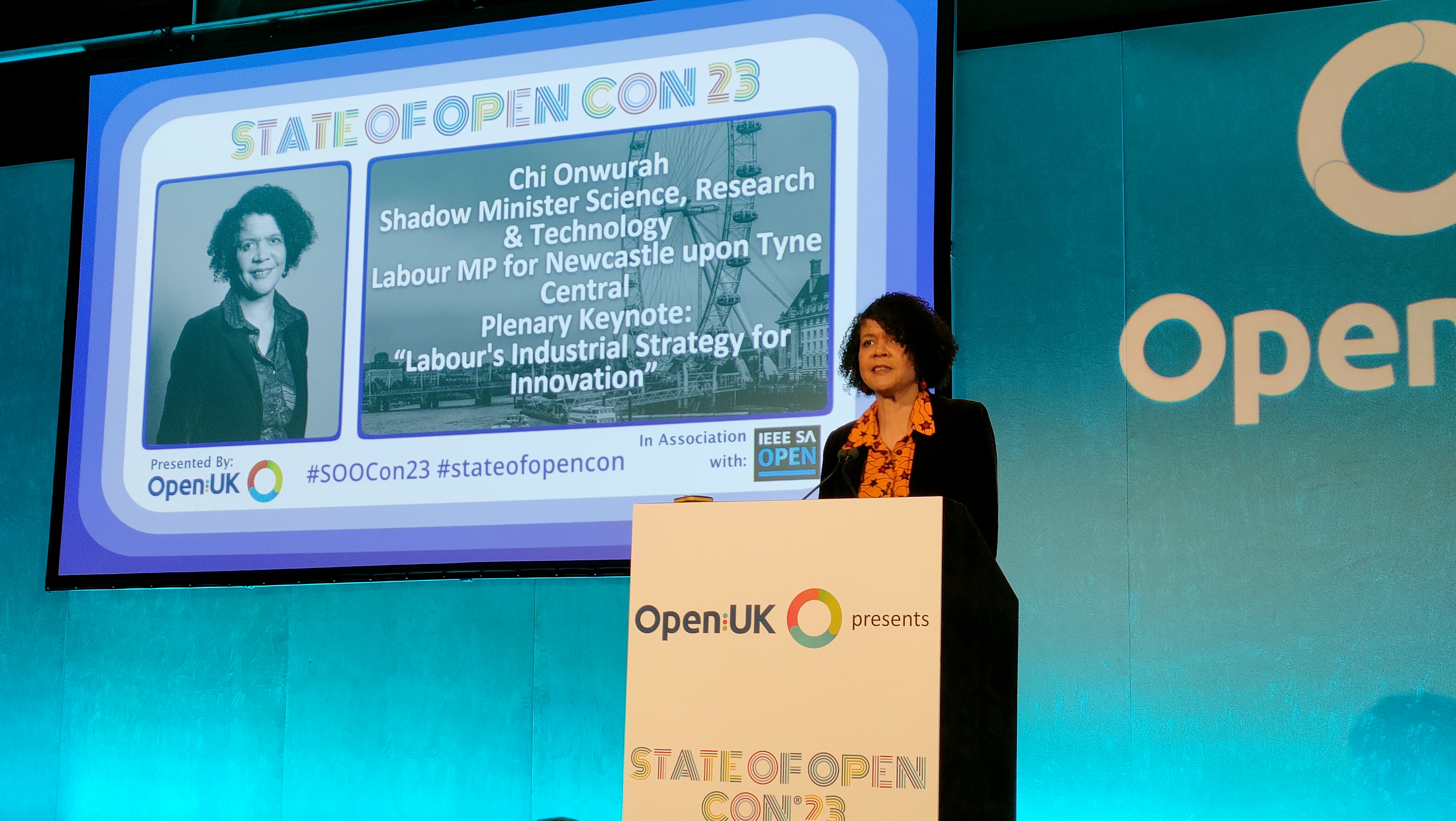

Labour plans overhaul of government's 'anti-innovation' approach to tech regulation

Labour plans overhaul of government's 'anti-innovation' approach to tech regulationNews Labour's shadow innovation minister blasts successive governments' "wholly inadequate" and "wrong-headed" approach to regulation

By Keumars Afifi-Sabet