Facebook pays £4.1 million in UK tax

Social network earned over $6 billion in worldwide profits

Facebook has been granted a tax break worth 11.3 million, which can be used to offset against future tax bills, despite reaching $6.19 billion in worldwide profits in its latest accounts.

The company paid 4.16 million in UK tax in 2015, according to BuzzFeed News, citing recently-published accounts, and questions have been raised once again as to whether large corporations are paying their fair share. The social network, worth $370 billion, promised to increase contributions to UK tax after paying just 4,327 in 2014, sparking outrage from campaigners.

The tax credit comes after Facebook announced losses in its UK arm, increasing from 28.5 million to 52.5 million.

However following a rule change in the UK, the company was able to offset around 15.5 million of bonus scheme payments after paying staff more than 71 million in bonuses last year, leading to 11.3 million credit.

Following the introduction of former Chancellor George Osborne's new punitive diverted profits tax targeting multinationals, Facebook announced in March that advertising sales would no longer be routed through Dublin, and instead transferred sales activity to London on 1 April.

Turnover for that period in 2015 doubled to 210 million, excluding the estimated hundreds of millions generated from UK advertising revenue.

According to a memo to UK staff at the time, seen by the BBC, Facebook said: "In light of changes to tax law in the UK, we felt this change would provide transparency to Facebook's operations in the UK."

Get the ITPro daily newsletter

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

However some have suggested the company has once again used the system to avoid paying their fair tax.

Speaking to the BBC, professor of practice in international political economy, Richard Murphy, said: "Facebook's UK accounts do not represent its real sales in this country. The UK accounts just record the cost it incurs in the UK, with a bit of profit added on to keep HMRC happy."

"Facebook's UK accounts are an exercise in opacity, when what we really need is transparency," said Murphy.

The rule changes in the UK have already contributed to greater tax bills for Facebook, potentially appeasing tax avoidance campaigners. However these changes will likely provide a boost in revenue for 2016 accounts and, with a considerable tax credit, it is unclear what future tax payments from Facebook will look like.

A Facebook spokesperson said: "We are proud that in 2015 we have continued to grow our business in the UK and created over 300 new high skilled jobs. The UK is now home to some of the most innovative technologies in the world including our investment in a high tech solar powered plane centre in Somerset that will help bring the internet to remote areas of the world. We pay all the taxes that we are required to under UK law."

Dale Walker is a contributor specializing in cybersecurity, data protection, and IT regulations. He was the former managing editor at ITPro, as well as its sibling sites CloudPro and ChannelPro. He spent a number of years reporting for ITPro from numerous domestic and international events, including IBM, Red Hat, Google, and has been a regular reporter for Microsoft's various yearly showcases, including Ignite.

-

Cleo attack victim list grows as Hertz confirms customer data stolen

Cleo attack victim list grows as Hertz confirms customer data stolenNews Hertz has confirmed it suffered a data breach as a result of the Cleo zero-day vulnerability in late 2024, with the car rental giant warning that customer data was stolen.

By Ross Kelly

-

Lateral moves in tech: Why leaders should support employee mobility

Lateral moves in tech: Why leaders should support employee mobilityIn-depth Encouraging staff to switch roles can have long-term benefits for skills in the tech sector

By Keri Allan

-

Oracle buys healthcare company Cerner for $28.3 billion

Oracle buys healthcare company Cerner for $28.3 billionNews The enterprise software company is aiming to use the acquisition as its anchor asset into the healthcare sector

By Zach Marzouk

-

Future Technologies and Intel announce the opening of Atlanta Innovation Center

Future Technologies and Intel announce the opening of Atlanta Innovation CenterNews New 10,000-square-foot facility offers a working environment to develop and test industry 4.0 use cases

By Praharsha Anand

-

Aruba reimagines the office for post-coronavirus work scenarios

Aruba reimagines the office for post-coronavirus work scenariosNews AI-powered, cloud-native networking solutions will help firms accelerate business recovery

By Sarah Brennan

-

Modernise your SAP from edge, to core, to cloud

Modernise your SAP from edge, to core, to cloudWhitepapers How to align your business strategy to tomorrow’s digital world with SAP

By ITPro

-

The future of enterprise computing starts now

The future of enterprise computing starts nowWhitepaper It’s time to consider a change in device deployment strategy

By ITPro

-

Designing for enterprise automation

Designing for enterprise automationWhitepapers Strategy and governance for data capture, robotics and autonomics

By ITPro

-

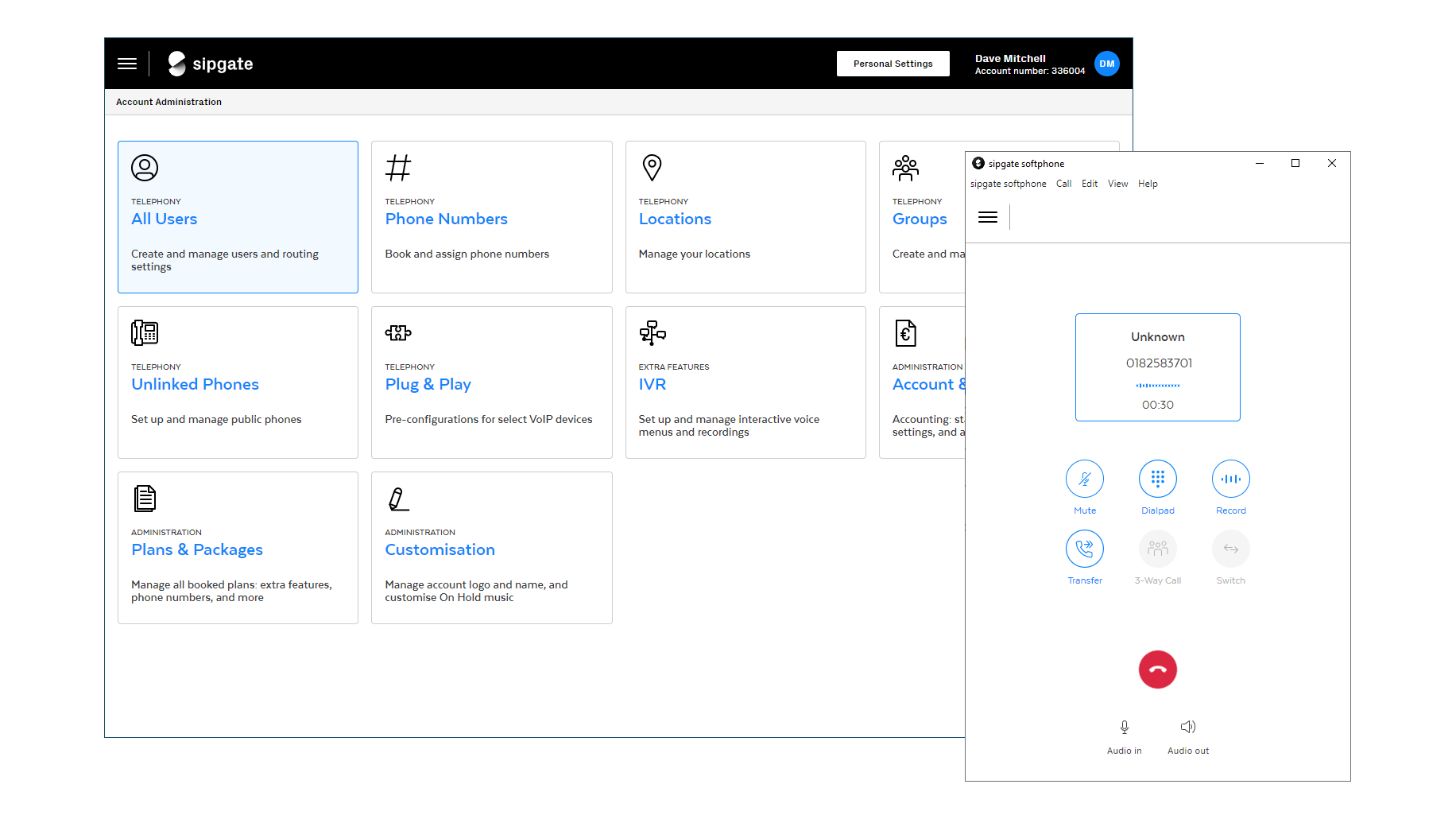

Sipgate Team review: Cost-conscious cloud calling

Sipgate Team review: Cost-conscious cloud callingReviews An affordable hosted service for small businesses, with flexible licensing plans and good call-handling features

By Dave Mitchell

-

Logitech MeetUp review

Logitech MeetUp reviewReviews Great 1080p image quality but 4K video streaming is still an expensive luxury

By Dave Mitchell