Complete ID review

Our Complete ID review will take a closer look at this identity monitoring service to help you decide whether it’s worth the money.

-

+

Great deal for Costco members

-

-

Limited security tools

-

-

Alerts aren’t customizable

Complete ID is an identity theft and credit monitoring service from Experian, one of the three major credit agencies. The service is only available to Costco members, but the price represents the kind of incredible deal for which Costco is known. Complete ID isn’t the best identity theft protection option on the market, but it’s a great option if you’re already a Costco member.

Complete ID: Plans and pricing

Complete ID requires a Costco membership (which starts at $60 per year) in order to sign up. The service costs $13.99 per person a month, but Costco Executive members get discounted pricing of $8.99 per person per month. You can also add identity monitoring for up to five children for $3.99 a month ($2.99 a month for Executive members).

Complete ID: Features

Complete ID offers a limited set of features compared to other identity monitoring services. That said, it covers all the basics well at a fraction of the cost of competing services.

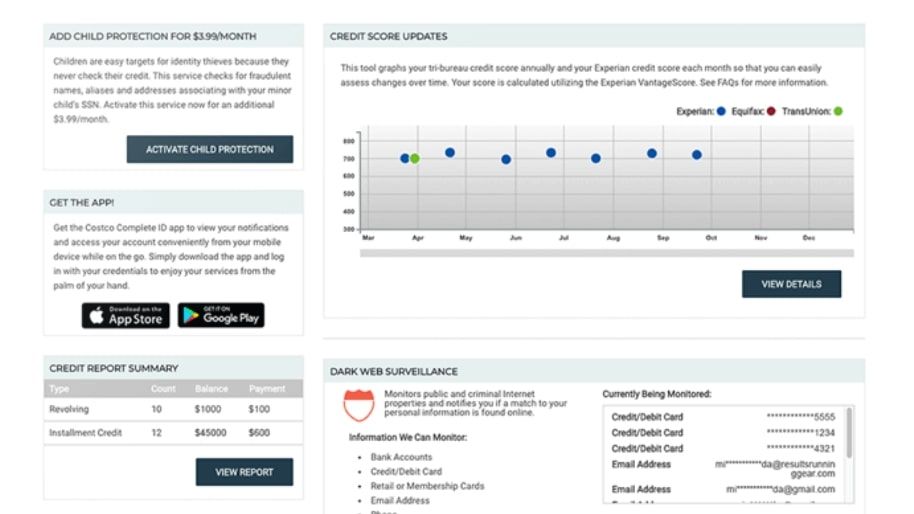

To start, Complete ID monitors for any unauthorized use of your identity. The service automatically scans criminal databases, court records, change of address records, and financial accounts for your name. It also scans the dark web for your personal information, including your social security number. If Complete ID finds a match in any of its scans, you’ll receive a notification.

The service also offers in-depth credit monitoring, which makes sense given that Complete ID is owned by Experian. You get full credit reports from Experian, Transunion, and Equifax, along with alerts anytime a new account is opened using your information.

Perhaps the best part of Complete ID is that if your identity is stolen, you’re covered by up to $1 million in insurance to cover lost income, legal fees, and other damages. There’s no deductible to access this money, which makes the low monthly subscription fee an even sweeter deal.

In addition, Complete ID provides you with a dedicated identity restoration specialist. They can help you get new identification documents, work with credit agencies to restore your financial history, and wipe away any records forged under your name. You get direct contact information for your dedicated specialist, which can make the months-long process of restoring your identity feel a bit more smooth.

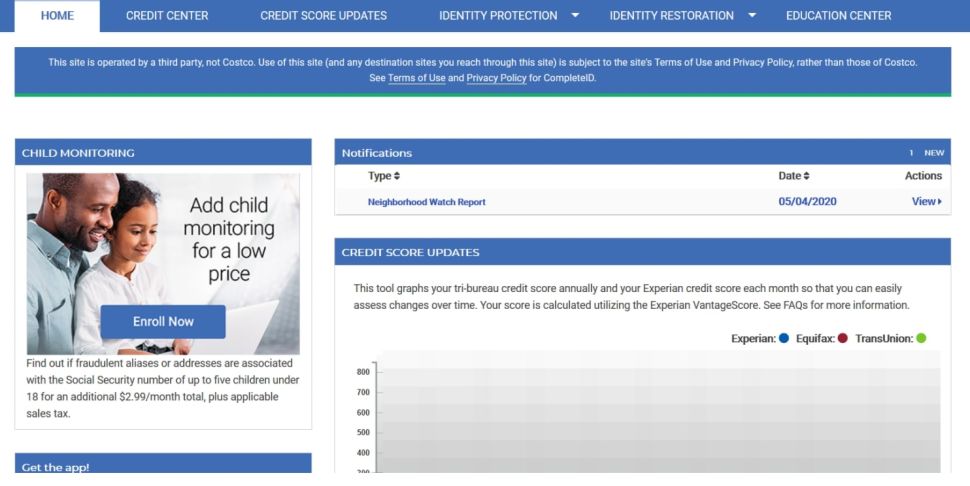

Complete ID: Interface and in use

Complete ID’s online interface is relatively easy to use, although sorting through alerts and other information isn’t as simple as it could be. To start, you can add personal details like your social security, passport, and driver’s license numbers to your account to enable comprehensive monitoring.

Once that’s set up, Complete ID will automatically collect information and add it to your online dashboard. Much of the dashboard is dedicated to credit monitoring, and the interface looks a lot like the credit reporting you might already receive from your bank or credit card provider. It’s not overly informative, although your credit score is graphed over time so that it’s easy to see if there’s a sudden change.

The alert system in Complete ID was also a little disappointing. You can opt to receive notifications about suspicious activities by email or push notification through the mobile app, but you cannot get alerts by text message. Alerts were also relatively few and far between. While no one wants to be bombarded with identity theft warnings, it would be nice to feel as if the service was picking up a bit more information in its scans.

Complete ID: Support

Complete ID’s support team is available by phone 24/7 every day of the year to answer questions and respond to identity theft incidents. One of the best things about this service is that you are assigned a dedicated identity restoration specialist when you report an incident, and that same agent remains your point of contact until your case is resolved.

The competition

Complete ID doesn’t have many of the bells and whistles of competing services. Norton LifeLock, for example, offers a suite of security tools that includes a VPN, cloud backup, webcam blocking, and a password manager. The online interface is also easier to use, and you have more control over how you receive alerts about suspicious activity. IdentityForce offers many of the same features, and it’s similarly easier to use than Complete ID.

That said, LifeLock costs $12.49 a month and IdentityForce costs $23.95 a month with credit monitoring. If you already have a Costco membership, and especially an Executive membership, Complete ID covers the essentials at a significantly cheaper price.

Final verdict

Complete ID doesn’t go above and beyond when it comes to features, but it’s still a fairly reliable identity theft monitoring service. You get credit monitoring and dark web monitoring among other essentials, plus up to $1 million in insurance coverage and dedicated support in the event of identity theft. We’d like to see a more robust user interface and more customizable alerts, but this isn’t a deal-breaker.

Overall, Complete ID is worthwhile if you already have a Costco membership. If you don’t, we recommend an alternative like Norton LifeLock or IdentityForce.

Get the ITPro daily newsletter

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

Michael is a prolific author in business and B2B tech, whose articles can be found on Business Insider, Entrepreneur, TechRadar Pro, IT Pro Portal, Tom's Guide, and more, covering everything from international tech regulations to corporate finance and emerging tech brands and markets. A successful copywriter and entrepreneur, Michael has worked with dozens of SaaS and tech companies, and has his finger firmly on the pulse of B2B tech, finance and business.

-

‘Phishing kits are a force multiplier': Cheap cyber crime kits can be bought on the dark web for less than $25 – and experts warn it’s lowering the barrier of entry for amateur hackers

‘Phishing kits are a force multiplier': Cheap cyber crime kits can be bought on the dark web for less than $25 – and experts warn it’s lowering the barrier of entry for amateur hackersNews Research from NordVPN shows phishing kits are now widely available on the dark web and via messaging apps like Telegram, and are often selling for less than $25.

By Emma Woollacott Published

-

Redis unveils new tools for developers working on AI applications

Redis unveils new tools for developers working on AI applicationsNews Redis has announced new tools aimed at making it easier for AI developers to build applications and optimize large language model (LLM) outputs.

By Ross Kelly Published

-

Google layoffs continue with "hundreds" cut from Chrome, Android, and Pixel teams

Google layoffs continue with "hundreds" cut from Chrome, Android, and Pixel teamsNews The tech giant's efficiency drive enters a third year with devices teams the latest target

By Bobby Hellard Published