Startups should build not sell, says ex-Google exec

Tech giant's former CFO is advising UK firms to not get caught up in the cog of big US companies

A former Google financial chief has warned UK startups to "not sell up" when big US tech firms look to acquire them.

Instead, Patrick Pichette is advising they take control of their destiny and build themselves into "true global players".

Pichette, who is also on the board for Twitter and the Trudeau Foundation, worked as CFO for Google from 2008 to 2015 and had a large role in a number of acquisitions, such as DeepMind in 2014. However, since leaving the tech giant, he sees it differently.

"My counsel is, why would you sell yourself?" he said to The Telegraph. "You'll be caught in the big cog of Amazon or Google when you could actually control your own destiny, be independent, build what you want to build."

One of the biggest UK acquisitions in recent years was that of DeepMind, which was snapped up by Google for 400 million in 2014. The tech giant purchased the London-based startup for its AI technology and research, but Pichette said there was so much potential for it to grow itself.

"And if you have the potential to become a true global player, absolutely, my counsel would be not to sell," he added. "My counsel would be to build."

At the time, Google claimed it would preserve the structure at DeepMind, keeping it separate from its operations. But, that has come under scrutiny this week after it was announced that one of its co-founders had taken leave in a mutual decision.

Get the ITPro daily newsletter

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

"Mustafa's taking some time out right now after ten hectic years," a DeepMind spokesperson said.

Pichette, who left Google in 2015, helped to orchestrate that deal, but now advises companies not to sell out early on.

This year, he became a partner for a venture capital firm in his native Canada, called Inovia Capital, which has reportedly set aside a $400 million fund for growth-stage companies and $200 million for early-stage, in the region. On top of this, Pichette has taken over as the chairman of Oxford University's venture fund and next month he is launching a new seed-stage programme to coach entrepreneurs.

"I think of myself as just the conduit," he added. "At the end of the day, when I've finished my meetings, I can go and have a good dinner right? These people go back to the office, they continue to code. They're the real heroes. I'm just chipping in."

Currently, despite uncertainty around Brexit, the UK's tech sector continues to grow, with reports of record-breaking investment. In 2018, the country managed to attract 5% of global high-tech scaleup investment, placing it fourth in the world - ahead of Germany, France and Sweden.

"The UK continues to exceed all predictions when it comes to tech growth. This report shows how the UK is a critical hub when it comes to global technology developments, with scale-up tech investment being the highest in Europe, and only surpassed by the US, China and India," said Tech Nation's CEO Gerard Grech.

This, of course, makes the UK a ripe feeding ground for acquisitions, with AI as a particular area of interest. In 2018, Facebook snapped up London-based Bloomsbury AI.

Bobby Hellard is ITPro's Reviews Editor and has worked on CloudPro and ChannelPro since 2018. In his time at ITPro, Bobby has covered stories for all the major technology companies, such as Apple, Microsoft, Amazon and Facebook, and regularly attends industry-leading events such as AWS Re:Invent and Google Cloud Next.

Bobby mainly covers hardware reviews, but you will also recognize him as the face of many of our video reviews of laptops and smartphones.

-

Third time lucky? Microsoft finally begins roll-out of controversial Recall feature

Third time lucky? Microsoft finally begins roll-out of controversial Recall featureNews The Windows Recall feature has been plagued by setbacks and backlash from security professionals

By Emma Woollacott Published

-

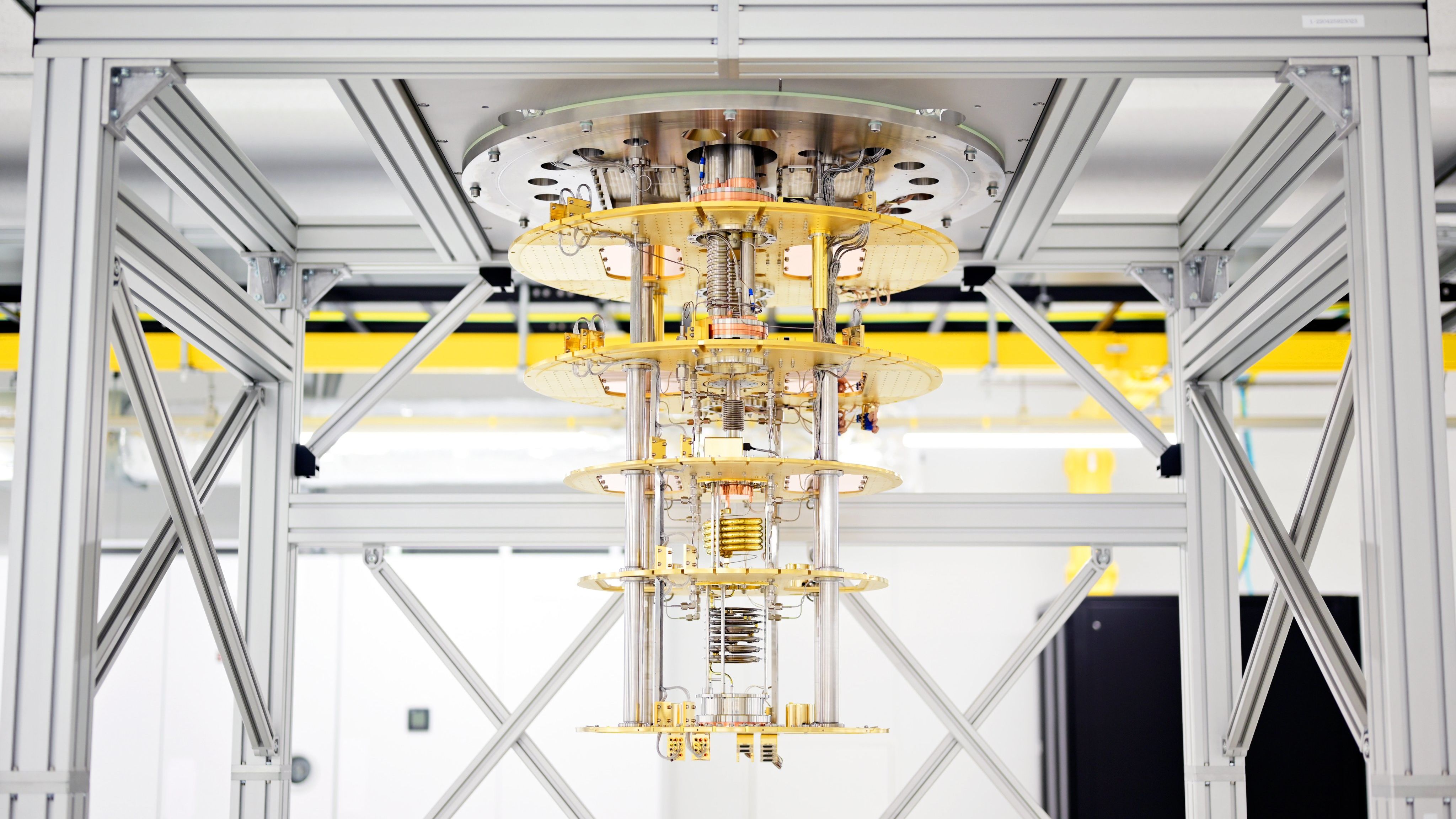

The UK government wants quantum technology out of the lab and in the hands of enterprises

The UK government wants quantum technology out of the lab and in the hands of enterprisesNews The UK government has unveiled plans to invest £121 million in quantum computing projects in an effort to drive real-world applications and adoption rates.

By Emma Woollacott Published

-

Is Rishi Sunak’s ‘Unicorn Kingdom’ a reachable goal or a mere pipedream?

Is Rishi Sunak’s ‘Unicorn Kingdom’ a reachable goal or a mere pipedream?Analysis Plunging venture capital investment and warnings over high-growth company support raise doubts over the ‘Unicorn Kingdom’ ambition

By Ross Kelly Published

-

Some Tech Nation programs could continue after Founders Forum acquisition

Some Tech Nation programs could continue after Founders Forum acquisitionNews The acquisition brings to a close a months-long saga over what the future holds for Tech Nation initiatives

By Ross Kelly Published

-

Podcast transcript: Startup succession: From Tech Nation to Eagle Labs

Podcast transcript: Startup succession: From Tech Nation to Eagle LabsIT Pro Podcast Read the full transcript for this episode of the ITPro Podcast

By Rory Bathgate Published

-

The ITPro Podcast: Startup succession: From Tech Nation to Eagle Labs

The ITPro Podcast: Startup succession: From Tech Nation to Eagle LabsITPro Podcast Some small firms are already lamenting the loss of Tech Nation, but Barclays Eagle Labs has much to offer the sector

By Rory Bathgate Published

-

Don’t count Barclays Eagle Labs out just yet – it can deliver in ways Tech Nation never has

Don’t count Barclays Eagle Labs out just yet – it can deliver in ways Tech Nation never hasOpinion Tech Nation has a great track record, but Eagle Labs has the experience, the financial clout, and a clear-cut vision that will deliver positive results for UK tech

By Ross Kelly Published

-

UK tech sector could face a ‘unicorn winter’ amid spiralling economic conditions

UK tech sector could face a ‘unicorn winter’ amid spiralling economic conditionsNews Tech Nation’s final piece of industry research calls for action to support continued ecosystem growth

By Ross Kelly Published

-

"It's still not great": Industry divided on government's SMB tax relief package

"It's still not great": Industry divided on government's SMB tax relief packageNews The government’s handling of R&D tax credits has left SMBs with a “sense of disbelief”

By Ross Kelly Published

-

UK startup's Equinix deal marks step towards broad quantum computing access

UK startup's Equinix deal marks step towards broad quantum computing accessNews Businesses around the world will be able to use its quantum computing as a service platform through Equinix

By Zach Marzouk Published