Banks set to lose $280 billion to fintech startups by 2025

Global payment tech firms set to accelerate the trend for instant payments

Banks are set to lose out on an estimated $280 billion in revenue by 2025 as fintech and payment transfer startups muscle in, according to a report.

The global payments business was worth around $1.5 trillion this year, as reported by professional services firm Accenture, although this is expected to grow to $2 trillion in the next five years as new and innovative services for card payments and wire transfers become available.

However traditional banks are set to their market share as a result, with 15% of their global payments - $280 billion - going to startups.

The rise in fintech and payment startups is being fueled by a demand for greater flexibility and more affordable transfers. Many of these companies use technology to link bank accounts around the world, enabling fast payments without high conversion rates and hidden markups that banks usually apply.

"Rather than being at the forefront of the new wave of the booming payments market, banks are feeling the heat from new competition and seeing their margins squeezed," said Gareth Wilson, head of Accenture's global payments team according to Reuters.

"We face an inevitable world of instant, invisible and free payments, which spells trouble for banks that don't want to be relegated to the plumbing of payments."

Competition in this sector is already strong, with London-based TransferWise offering foreign exchange payments to retail and SMB customers with low fees. It's also big with Silicon Valley where Stripe and Square are on the rise.

Get the ITPro daily newsletter

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

Payments are becoming instant, dulling the need for credit, which is a large revenue stream for banks, according to Accenture. The greater competition could result in accelerating the trend towards free payments.

The fintech market, as a whole, is arguably one of the strongest in the UK, with firms like Monzo and OakNorth often featuring on so-called 'unicorn' lists. Challenger bank OakNorth has been seen its income grow from 77 million to 177.6 million in just 12 months - a year-on-year growth of 268%, according to Innovative Finance.

These digital financial startups are also proving popular career choices with LinkedIn recently naming seven UK fintech firms in it's top ten most searched for companies.

Bobby Hellard is ITPro's Reviews Editor and has worked on CloudPro and ChannelPro since 2018. In his time at ITPro, Bobby has covered stories for all the major technology companies, such as Apple, Microsoft, Amazon and Facebook, and regularly attends industry-leading events such as AWS Re:Invent and Google Cloud Next.

Bobby mainly covers hardware reviews, but you will also recognize him as the face of many of our video reviews of laptops and smartphones.

-

Bigger salaries, more burnout: Is the CISO role in crisis?

Bigger salaries, more burnout: Is the CISO role in crisis?In-depth CISOs are more stressed than ever before – but why is this and what can be done?

By Kate O'Flaherty Published

-

Cheap cyber crime kits can be bought on the dark web for less than $25

Cheap cyber crime kits can be bought on the dark web for less than $25News Research from NordVPN shows phishing kits are now widely available on the dark web and via messaging apps like Telegram, and are often selling for less than $25.

By Emma Woollacott Published

-

Is Rishi Sunak’s ‘Unicorn Kingdom’ a reachable goal or a mere pipedream?

Is Rishi Sunak’s ‘Unicorn Kingdom’ a reachable goal or a mere pipedream?Analysis Plunging venture capital investment and warnings over high-growth company support raise doubts over the ‘Unicorn Kingdom’ ambition

By Ross Kelly Published

-

Some Tech Nation programs could continue after Founders Forum acquisition

Some Tech Nation programs could continue after Founders Forum acquisitionNews The acquisition brings to a close a months-long saga over what the future holds for Tech Nation initiatives

By Ross Kelly Published

-

Podcast transcript: Startup succession: From Tech Nation to Eagle Labs

Podcast transcript: Startup succession: From Tech Nation to Eagle LabsIT Pro Podcast Read the full transcript for this episode of the ITPro Podcast

By Rory Bathgate Published

-

The ITPro Podcast: Startup succession: From Tech Nation to Eagle Labs

The ITPro Podcast: Startup succession: From Tech Nation to Eagle LabsITPro Podcast Some small firms are already lamenting the loss of Tech Nation, but Barclays Eagle Labs has much to offer the sector

By Rory Bathgate Published

-

Don’t count Barclays Eagle Labs out just yet – it can deliver in ways Tech Nation never has

Don’t count Barclays Eagle Labs out just yet – it can deliver in ways Tech Nation never hasOpinion Tech Nation has a great track record, but Eagle Labs has the experience, the financial clout, and a clear-cut vision that will deliver positive results for UK tech

By Ross Kelly Published

-

UK tech sector could face a ‘unicorn winter’ amid spiralling economic conditions

UK tech sector could face a ‘unicorn winter’ amid spiralling economic conditionsNews Tech Nation’s final piece of industry research calls for action to support continued ecosystem growth

By Ross Kelly Published

-

"It's still not great": Industry divided on government's SMB tax relief package

"It's still not great": Industry divided on government's SMB tax relief packageNews The government’s handling of R&D tax credits has left SMBs with a “sense of disbelief”

By Ross Kelly Published

-

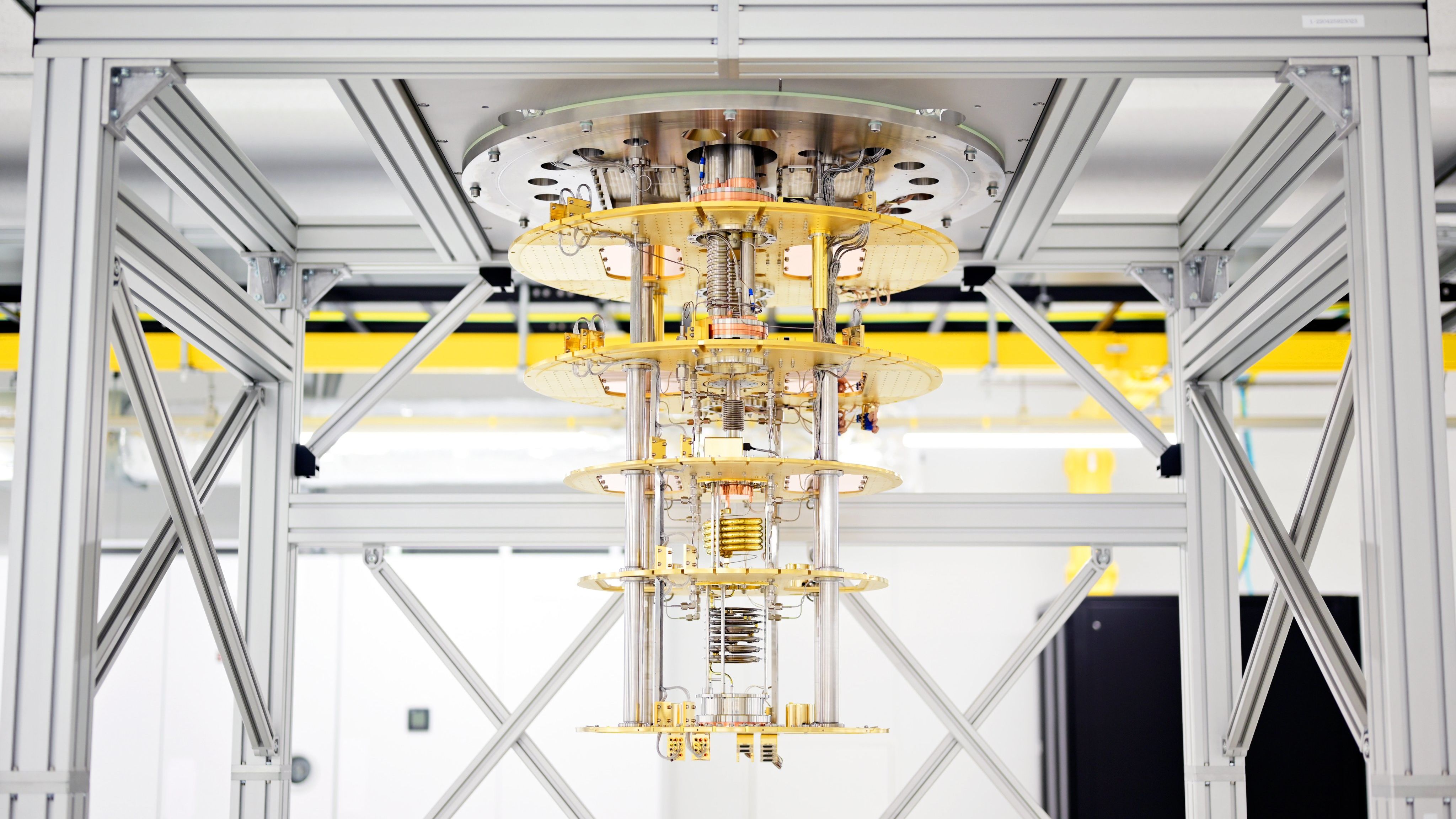

UK startup's Equinix deal marks step towards broad quantum computing access

UK startup's Equinix deal marks step towards broad quantum computing accessNews Businesses around the world will be able to use its quantum computing as a service platform through Equinix

By Zach Marzouk Published