Bank of England investigates launch of Bitcoin-like digital currency

Report outlines benefits of central banks adopting digital currencies to speed up payments

The Bank of England is exploring the potential for circulating Bitcoin-esque digital currency.

Central banks could copy the technology behind digital currencies to reinvent the payments system, according to the Bank of England's One Bank Research Agenda report.

The publication looks at possible ways monetary policy could interact with other issues, including climate change, and raises the topic of digital currencies to investigate how such innovation could transform money transfers.

It read: "Digital currencies, potentially combined with mobile technology, may reshape the mechanisms for making secure payments, allowing transactions to be made directly between participants.

"While existing private digital currencies have economic flaws which make them volatile, the distributed ledger technology that their payment systems rely on may have considerable promise."

The central bank was interested in using digital currencies' distributed ledger system, which speeds up transactions and verifies them securely without the need for a third-party.

The central bank said officially-endorsed digital currencies could be used to undertake interbank settlements, and be made available to a wider range of banks and financial institutions.

Get the ITPro daily newsletter

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

However, it warned that a digital currency would make a central bank's money more widely available, which could have a negative impact on deposits stored with commercial banks.

At the same time, the Bank of England warned it would have to adjust the distributed ledger system to give it more control over digital transactions.

"Further research would also be required to devise a system which could utilise distributed ledger technology without compromising a central bank's ability to control its currency and secure the system against systemic attack," the report read.

Digital currencies raise regulatory issues as well as technological challenges, it added, starting with the need to create a secure protocol to transfer money over the internet.

Companies offering currency exchanges and digital wallets would operate on top of this platform, and would require further regulation.

Chancellor George Osborne welcomed the research on Twitter, suggesting fintech companies could flourish using an approved digital currency.

The news comes after Dell became the latest company to accept Bitcoin payments from UK SMBs.

-

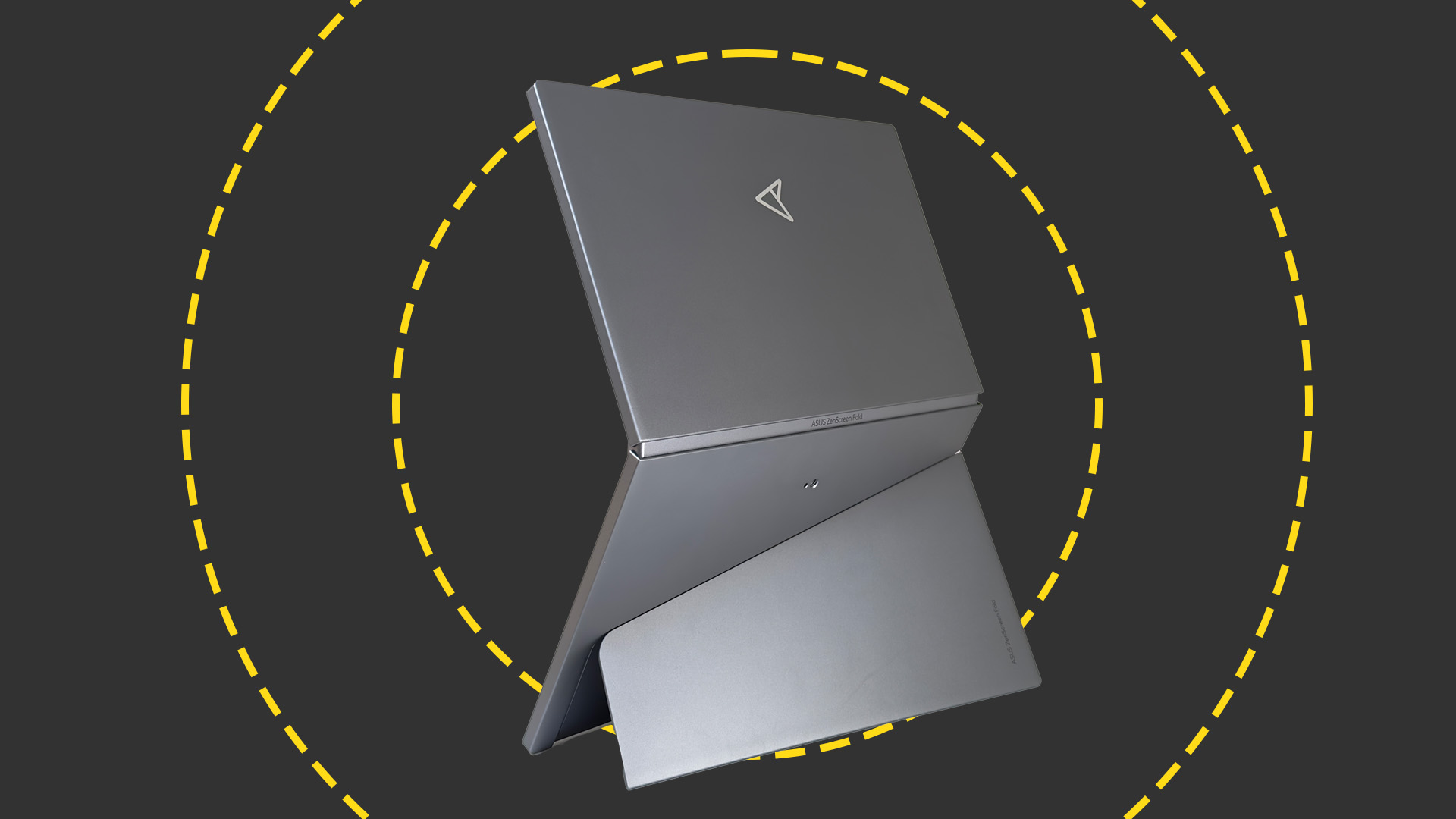

Asus ZenScreen Fold OLED MQ17QH review

Asus ZenScreen Fold OLED MQ17QH reviewReviews A stunning foldable 17.3in OLED display – but it's too expensive to be anything more than a thrilling tech demo

By Sasha Muller

-

How the UK MoJ achieved secure networks for prisons and offices with Palo Alto Networks

How the UK MoJ achieved secure networks for prisons and offices with Palo Alto NetworksCase study Adopting zero trust is a necessity when your own users are trying to launch cyber attacks

By Rory Bathgate

-

IMF urges El Salvador to remove Bitcoin as legal tender

IMF urges El Salvador to remove Bitcoin as legal tenderNews The country sought a $1.3 billion loan from the IMF last year, although this has been reportedly hindered by the fund’s Bitcoin concerns

By Zach Marzouk

-

Cryptocurrency: Should you invest?

Cryptocurrency: Should you invest?In-depth Cryptocurrencies aren’t going away – but big questions remain over their longevity, the amount of energy they consume and the morals of investing

By James O'Malley

-

IT Pro News in Review: Record profits in tech, hackers turn to new languages for malware, Amazon's Bitcoin plans

IT Pro News in Review: Record profits in tech, hackers turn to new languages for malware, Amazon's Bitcoin plansVideo Catch up on the most important news of the week in just two minutes

By ITPro

-

El Salvador offers its citizens free Bitcoin

El Salvador offers its citizens free BitcoinNews Bukele doubles down on crypto commitment with a giveaway

By Danny Bradbury

-

Square and Blockstream to build a solar Bitcoin mining facility

Square and Blockstream to build a solar Bitcoin mining facilityNews Solar mining plant will aim to temper concerns of power consumption from Bitcoin mining

By Danny Bradbury

-

What are altcoins and how do they work?

What are altcoins and how do they work?In-depth The alternatives to Bitcoin explained

By Rene Millman

-

Steve Wozniak sues YouTube over Bitcoin scam videos

Steve Wozniak sues YouTube over Bitcoin scam videosNews Lawsuit claims YouTube is aware of the Bitcoin giveaway scams but hasn’t taken videos down

By Sarah Brennan

-

Bitcoin scam exposes the personal details of 250,000 people

Bitcoin scam exposes the personal details of 250,000 peopleNews The UK and Australia represent approximately 93% of users hit by the crypto-scam

By Tyler Omoth