Are risk-averse VCs harming UK start-ups' growth prospects?

Investors focus too much on user numbers and want 'finished products', finds report

Start-ups are struggling to find the money to scale as VCs ignore them and invest in bigger companies, new research has found.

The hype around multi-billion valuations of the likes of Facebook, Snapchat and Uber instead grabs VCs' attention, according to the TechMutiny Insights report, meaning early-stage start-ups suffer from a lack of cash.

Joshua Davidson, founder and MD of learning apps firm Night Zookeeper, said that he was forced to use his company's own resources to launch the business, despite winning many tech pitch contests. He has now began a campaign for Series A round funding from VCs.

He said: "We're now used on five continents. We have 60 kids per school buying this although we're not experts in book publishing. We see a high level of enthusiasm for our brand. But I don't think many senior media and entertainment executives that we've spoken to have necessarily understood the full potential."

Henrik Eklund, founder of personalised video news service Newstag, told TechMutiny that investors need to reevaluate how they measure the success of a start-ups, with them currently focusing too much on user numbers. When these start to fall, he said, VCs tend to lose interest.

"The market, including myself, gets swept away by high numbers even though they're not relevant," he said. "That leads to a situation where you can have amazing numbers in the billions, which in the old media model would correlate to billions in dollars, but in reality is just an output that will continuously fall in value as the supply in endless.

"It is more valuable to have 1,000 people having a personalised experience than exposing your brand, message, value, to 18 million eyeballs."

Get the ITPro daily newsletter

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

Governments around the world want to emulate the success of Silicon Valley, the report stated, with digital technologies predicted to account for 25 per cent ($24,600 billion) of global gross domestic product by 2020.

Ciprian Borodescu, CEO and co-founder of Webcrumbz, the venture behind mobile publishing firm Appticles, said: "The difficulty rises when you are ready to get to the next level. What happens afterwards? I have been told there is a lot of money there, but not many start-ups manage to find it."

Investors are still in the transition phase, says UK tech entrepreneur Jonathan Chippindale, adapting to a fast-moving start-up scene based on risky ventures.

"Technology, by nature, is innovative and because it is new, brands don't have the tools to assess its value. Innovation means higher risks, despite the greater rewards. It can take only seconds to move on from something new just because you find it difficult.

"As a tech start-up, you need two to three years of R&D, and no one is going to support that. What investors want is a working prototype that can be inserted immediately into the brands. That can take two to three years without bringing in any revenue."

Caroline has been writing about technology for more than a decade, switching between consumer smart home news and reviews and in-depth B2B industry coverage. In addition to her work for IT Pro and Cloud Pro, she has contributed to a number of titles including Expert Reviews, TechRadar, The Week and many more. She is currently the smart home editor across Future Publishing's homes titles.

You can get in touch with Caroline via email at caroline.preece@futurenet.com.

-

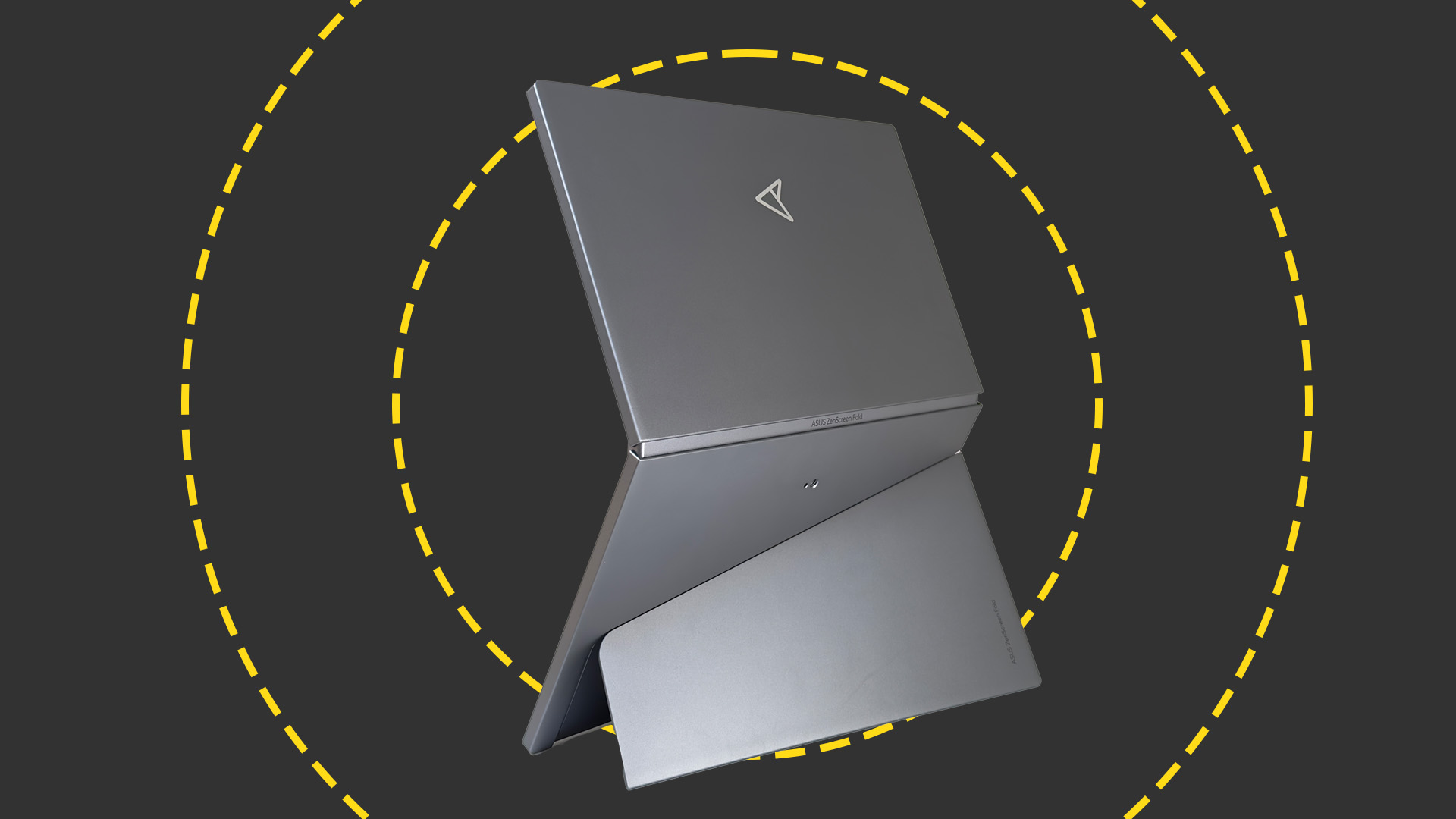

Asus ZenScreen Fold OLED MQ17QH review

Asus ZenScreen Fold OLED MQ17QH reviewReviews A stunning foldable 17.3in OLED display – but it's too expensive to be anything more than a thrilling tech demo

By Sasha Muller

-

How the UK MoJ achieved secure networks for prisons and offices with Palo Alto Networks

How the UK MoJ achieved secure networks for prisons and offices with Palo Alto NetworksCase study Adopting zero trust is a necessity when your own users are trying to launch cyber attacks

By Rory Bathgate

-

Is Rishi Sunak’s ‘Unicorn Kingdom’ a reachable goal or a mere pipedream?

Is Rishi Sunak’s ‘Unicorn Kingdom’ a reachable goal or a mere pipedream?Analysis Plunging venture capital investment and warnings over high-growth company support raise doubts over the ‘Unicorn Kingdom’ ambition

By Ross Kelly

-

Some Tech Nation programs could continue after Founders Forum acquisition

Some Tech Nation programs could continue after Founders Forum acquisitionNews The acquisition brings to a close a months-long saga over what the future holds for Tech Nation initiatives

By Ross Kelly

-

Podcast transcript: Startup succession: From Tech Nation to Eagle Labs

Podcast transcript: Startup succession: From Tech Nation to Eagle LabsIT Pro Podcast Read the full transcript for this episode of the ITPro Podcast

By Rory Bathgate

-

The ITPro Podcast: Startup succession: From Tech Nation to Eagle Labs

The ITPro Podcast: Startup succession: From Tech Nation to Eagle LabsITPro Podcast Some small firms are already lamenting the loss of Tech Nation, but Barclays Eagle Labs has much to offer the sector

By Rory Bathgate

-

Don’t count Barclays Eagle Labs out just yet – it can deliver in ways Tech Nation never has

Don’t count Barclays Eagle Labs out just yet – it can deliver in ways Tech Nation never hasOpinion Tech Nation has a great track record, but Eagle Labs has the experience, the financial clout, and a clear-cut vision that will deliver positive results for UK tech

By Ross Kelly

-

UK tech sector could face a ‘unicorn winter’ amid spiralling economic conditions

UK tech sector could face a ‘unicorn winter’ amid spiralling economic conditionsNews Tech Nation’s final piece of industry research calls for action to support continued ecosystem growth

By Ross Kelly

-

"It's still not great": Industry divided on government's SMB tax relief package

"It's still not great": Industry divided on government's SMB tax relief packageNews The government’s handling of R&D tax credits has left SMBs with a “sense of disbelief”

By Ross Kelly

-

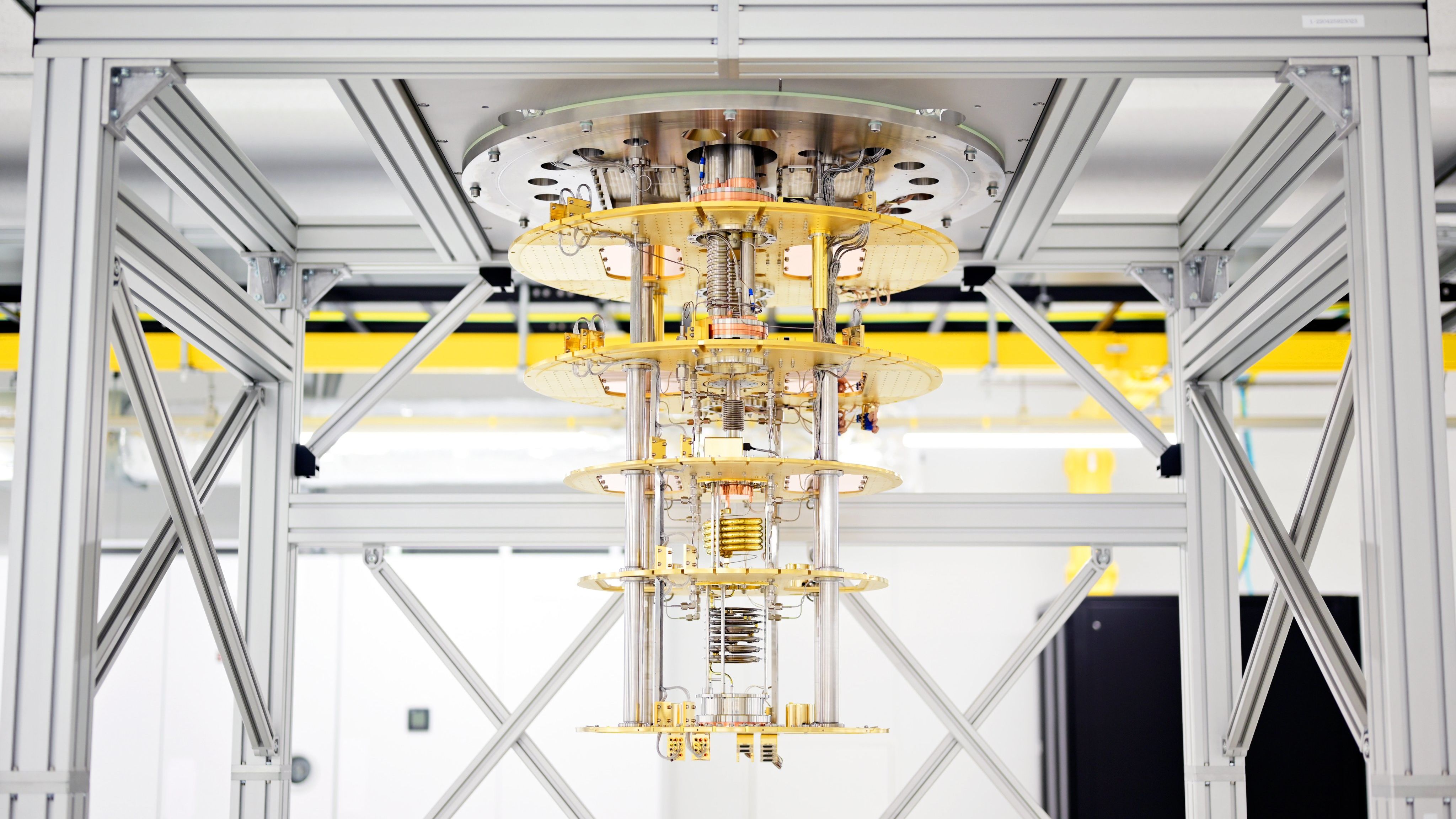

UK startup's Equinix deal marks step towards broad quantum computing access

UK startup's Equinix deal marks step towards broad quantum computing accessNews Businesses around the world will be able to use its quantum computing as a service platform through Equinix

By Zach Marzouk