Bitcoin news: Major retailers offer support for bitcoin payments

US customers can now pay for goods at Starbucks, Nordstrom, Whole Foods and others using an app

Previous Bitcoin news

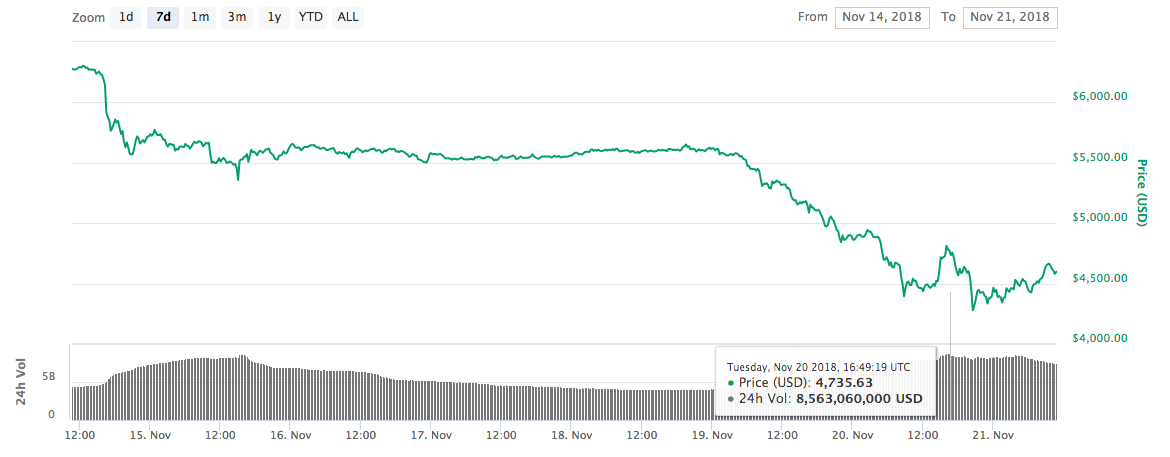

21/11/18: Bitcoin plummets to one-year low as market decline continues

The crypto that reached dizzying heights in 2017 has fallen further in value to a new 2018 low of $4,387 (3,432), taking its total losses to nearly 30% in the past week.

Bitcoin enjoyed a period of stability in September and October this year, hovering steadily in the $6,000 to $7,000 range but dropped suddenly below $5,600 (4,733), making it the lowest value since October 2017 at the time.

Bitcoin price from previous seven days (14/11/2018 - 21/11/2018) according to CoinMarketCap

The news comes in stark contrast to predictions from Bitcoin enthusiasts and Fundstrat Global Advisors' Tom Lee about the potential for the cryptocurrency to rise to an impressive high before the year is out.

In an interview with CNBC, Lee maintains that Bitcoin can reach a year-end value of $15,000 dollars, reducing his original prediction by $10,000. "There's a few things that could happen that could drive [a price increase], Lee said, without detailing hat these were.

"But these past few days have definitely been a negative development because we're talking about breaking to the downside of momentum."

The hard fork to Bitcoin Cash is expected to have played a contributing factor into the initial slump last week. The cryptocurrency born out of a hard fork to Bitcoin in August 2017, was forked on Thursday, splitting it into two separate blockchains.

Get the ITPro daily newsletter

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

Cryptocurrencies get hard forked only when the vast majority of the mining community associated with that currency is in favour. In Bitcoin's case, developers wanted to raise the block size limit, theoretically allowing for more, faster transactions on the new and upgraded blockchain.

15/11/2018: Bitcoin plummets to one-year low as market decline continues

The price of Bitcoin has slumped below $5,600 (4,377) for the first time in over a year on Wednesday, equating to 10% drop in its total value.

In a significant turn following a period of stability in recent months, which saw it hover between $7,000 and $6,000, the world's most funded cryptocurrency hit its lowest price point in since October 2017, stabilising at $5,322 (4,160) on Wednesday evening.

Bitcoin price (April-November 2018) according to CoinMarketCap

Experts suggest that the slump was expected and that an upcoming hard fork of Bitcoin Cash, expected on Thursday, has created widespread uncertainty across the market. This echoes Bitcoin Cash's own creation when it split from Bitcoin in July 2017.

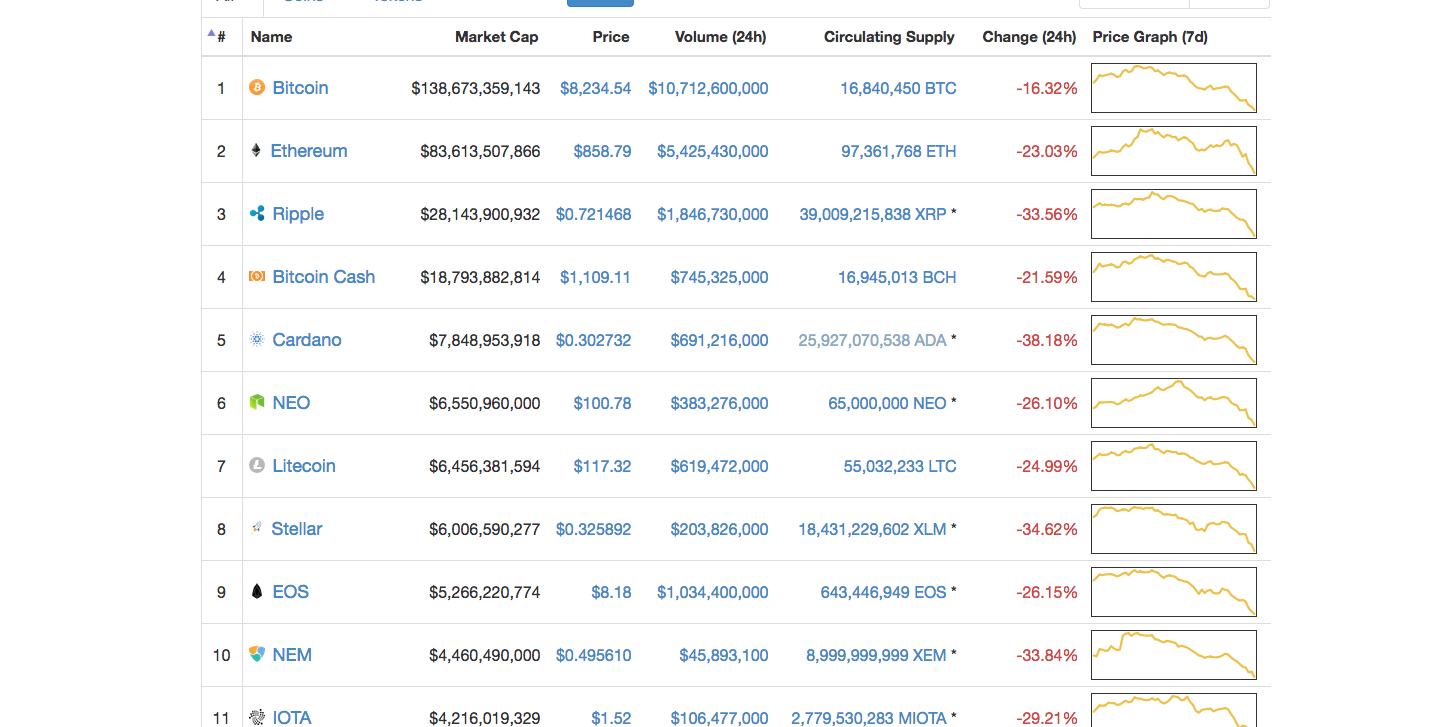

Following Bitcoin's plummet, other leading cryptocurrencies, including Ethereum, Litecoin and Ripple, also experienced drops of around 17%.

"It's safe to say that bitcoin cash's upcoming hard fork stirring uncertainty among crypto investors, and forecasters across crypto and traditional markets alike have predicted a prolonged bear market heading into 2019," said Donald Bullers, North American representative for the blockchain firm Elastos, in an email to The Independent.

2017 saw unprecedented demand for Bitcoin, seeing the currency surge from a $1,000 valuation to nearly $20,000 in a year. However, like most trends, it seems the hype has ebbed away, as the coin has endured a 60% drop in valuation over the course of 2018.

19/09/2018: MPs urge government to tame crypto "Wild West"

MPs have urged the government to reign in what is being described a "Wild West" cryptocurrency market, with calls for regulations to help protect against volatile price swings, anonymous activity and security vulnerabilities.

In February, the Treasury Committee announced it would be launching an investigation into the risks of cryptocurrencies for investors and the UK economy, in a bid to "scrutinise the regulatory response" from authorities.

The government's current approach to regulations has now been criticised for being too ambiguous and unsustainable in the long term, in the final report released on Wednesday.

The report argued that regulations would lead to better protections for consumers, enable sustainable growth for the market as a whole, and help reduce the risks associated with hacking and lost account details.

If enacted, Britain could become a "global centre for crypto-assets", the report added.

"Bitcoin and other crypto-assets exist in the Wild West industry of crypto-assets. This unregulated industry leaves investors facing numerous risks," said Nicky Morgan MP, chair of the Treasury Committee.

"It's unsustainable for the Government and regulators to bumble along issuing feeble warnings to potential investors, yet refrain from acting. If the Government decides that crypto-asset growth should be encouraged, appropriate and proportionate regulation could see the UK become a global centre for this activity."

The cryptocurrency industry relies largely on self-regulated bodies which adhere to a code of practice, however, this is voluntary and will inevitably lead to companies abusing the system, the report found. The Committee suggested at a minimum regulation should be introduced to address the risk of money laundering.

Interestingly, the Committee also hinted at the possibility of a deliberate stifling of the market, urging the government to assess whether the growth of cryptocurrencies should be encouraged in the context of the wider economy.

However, if regulatory action is favoured, online exchanges are likely to be the first target. Exchanges, where customers buy and sell cryptocurrencies, have featured in a number of high profile data breaches over the past year, companies which lacked any form of payment insurance, leaving customers out of pocket.

The report also assessed the feasibility of blockchain, the underlying technology that supports most cryptocurrencies on the market. While it found that development has been slow, costly to set up and often consumes large amounts of energy, there are potential use cases for the storage and management of data in the long term.

The European Union has similarly avoided introducing regulations to the market, largely due to its relative infancy.

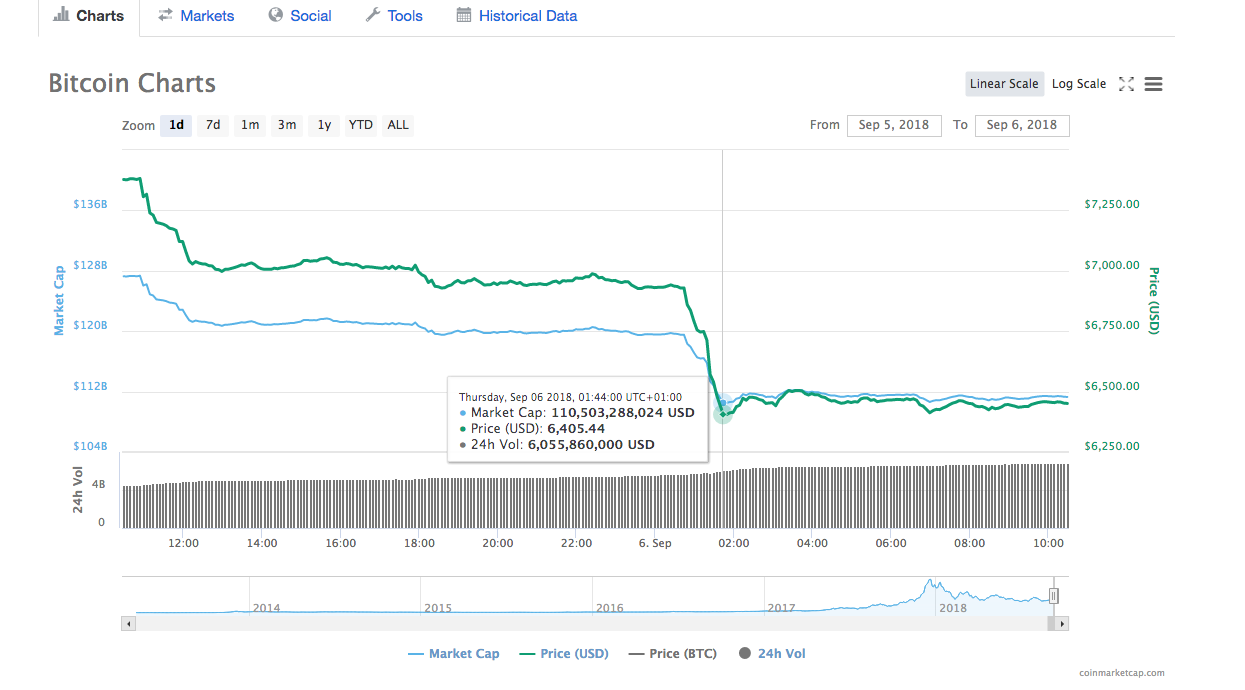

06/09/2018: Billions wiped from Bitcoin in less than an hour

The price of Bitcoin fell over $500 in the space of an hour earlier this morning during a sudden market slump that put every major cryptocurrency into the red.

Every one of the world's top 100 most traded cryptocurrencies was hit by the price crash, with most trading around 20% below their value just one day ago.

Bitcoin prices according to CoinMarketCap

The cause of the crash isn't clear but it seems to coincide with an announcement from Goldman Sachs that it will be ditching plans to launch a cryptocurrency trading platform.

A number of major sell-offs occurred shortly before the announcement, leading some to speculate on Twitter that investors may have had insider knowledge of the decision.

The slump saw billions wiped off the market value, with Bitcoin alone losing just over $9 billion within 60 minutes of trading. Ether, Bitcoin Cash, Monero and Litecoin all fell either just below or above 18%.

It's yet another blow for a market that's struggled to recover from a major crash in January, which saw the value of many cryptocurrencies effectively cut in half. Since that time, the market has seen similar, albeit less dramatic slumps, keeping the price of Bitcoin down between $5,000 and $7,000 -- a far cry from the $19,300 mark it enjoyed in December last year.

However, Bitcoin evangelists have celebrated the currencies relative stability over the past few months and, despite occasional slumps, maintain that the cryptocurrency is still capable of hitting $20,000 by the end of 2018.

23/08/2018: Following a shocking period of decline for virtual currency Bitcoin's value, it has finally started rising again, after traders took advantage of rival platform BitMEX's schedule maintenance.

When the alternative cryptocurrency went down and was therefore inaccessible for traders, Bitcoin's value simultaneously rose from around $6,450 to nearly $6,900 almost instantly as cryptocurrency speculators rushed to buy Bitcoin.

When maintenance on the BitMEX platform was finished, some users said they were still struggling to access the service, allowing Bitcoin to continue stabilising (although it did hit the high of $6,858.61 before declining again slightly). The company later revealed this was due to a DDoS attack, although it seems the system is back up and running now.

The price of Bitcoin according to Coinmarketcap.com

By the end of the day, the digital currency was almost back to its starting price, although analysts and digital currency commentators said this indicates that maybe Bitcoin's days aren't over and there is hope that it'll hit $10,000 again this year. Bitcoin is still down 66% compared to its $20,000 value at the tail-end of last year.

Other digital currencies also rose when BitMEX went down, although not to the same extent as Bitcoin. For example, Ethereum rose 1.72% to trade at $298.91, Ripple rose by 8.61% and Litecoin's value increased by 1.59% to hit $57.83.

07/08/2018: Bitcoin's value has fallen below $7,000 for the first time, following a 19-day drop - with other cryptocurrencies following suit.

This is the first time since July that Bitcoin's value has been sub $7,000, following a steady stream of increases and putting the year-to-date decline at 60%. Over the last two weeks, the cryptocurrency has dropped by 17% and over just three days has lost 48.76% of its value.

The price of Bitcoin according to CoinMarketCap

At its lowest point, Bitcoin hit $6,933.09 according to the CoinDesk Bitcoin Price Index (BPI). Although not as low as the year's low, which was $5785.43 in June. However, just one month later, the currency hit the annual high of $8,479.33.

One of the reasons Bitcoin may have dropped so suddenly is the news that Starbucks is set to team up with Intercontinental Exchange to bring together digital currencies and commerce. This seems to worried some as to what it means for traditional currency.

"If you really dig into it, the service would allow customers to convert their cryptocurrency at the time they're making the purchase," said Ryan Taylor, chief executive officer of Dash Core explained to Bloomberg. "They're clarifying that 'hey, we're not getting into cryptocurrency speculation here -- we're accepting dollars, same as we always have.'"

This trend shows the real volatile nature of cryptocurrencies. In fact, it's not just Bitcoin suffering from losses either. At the time of writing, Ethereum was down by 1.48%, XRP by 5.23% and Litecoin down 3.37%.

24/07/201: City of London police get cryptocurrency training

The City of London Police is teaching officers to understand cryptocurrencies, as more criminals turn to them as a method of fraud and money laundering.

The new one day course, called Cryptocurrencies for Investigators, is the first of its kind in the UK and will be taught by the force's Economic Crime Academy (ECA).

"In recent years the cryptocurrency market has grown considerably, with more and more people using it and investing their money," said Mike Betts, head of skills and development at the ECA.

"However, this surge in popularity has also given rise to more fraud in this area, with criminals identifying cryptocurrencies as a new way to defraud people and steal their money, and also launder money."

Officers who successfully complete the course will be able to understand how to detect, seize and investigate the use of cryptocurrencies and will be able to explain the investigative opportunities available to recover and trace them. The course also covers the criminal use of cryptocurrencies and the legal framework relevant to digital currency investigation.

So far the ECA has delivered a successful pilot course to City of London Police officers, with another scheduled in August for a regulatory body partner. It is hoped that the course will then be rolled out nationally in autumn.

"The Economic Crime Academy continues to develop national and international courses in response to emerging threats and this new course will provide training to counter the growing risks that cryptocurrencies pose," Betts added.

Bitcoin and other cryptocurrencies are used by criminals who value the lack of transparency around transactions, as well as the difficulty of tracing money flows. A recent incident saw the Indian Bitcoin exchange Coinsecure hit by a devastating cryptocurrency heist in April, where thieves made off with $3.3 million worth of digital coins.

The company posted an announcement on its homepage in April telling users that its systems had been breached and that the attackers had stolen around 438 bitcoin ($3.3 million).

18/7/2018: Bitcoin value soars above $7,000

Bitcoin grew above a $7,000 valuation yesterday, in what was one of the cryptocurrency's biggest upswings in over a year.

The volatile digital currency sunk below $10,000 in March after reaching to close to $20,000 a coin at the end of 2017, thanks to a combination of regulatory actions and warnings.

It's difficult to point to the exact reason for the rise, up from around $6,300 on Monday, but Bitcoin has had positive regulatory news in the market for digital currencies recently, and incoming Goldman Sachs boss David Solomon has said the bank wants to add more digital currency services.

Explaining the rally in Forbes, blockchain investor and advisor Oliver Isaacs pointed to positive developments and the impact they had on the markets.

"I think we are starting to see a strong positive shift in sentiment," he said. "Major recent positive news includes the CFA examination adding blockchain topics to its curriculum, a move that is most certainly going bring widespread knowledge and exposure of digital assets to Wall Street.

"In addition, Coinbase, which is the largest exchange in the world, has just been approved to list securities, representing significant progress in its bid to operate as an officially regulated crypto broker-dealer".

This is a rare upswing in the price of Bitcoin, which fell to its lowest point in eight months at the end of June, where the cryptocurrency dipped below $5,800, a price not seen since early November.

Such is the influence of Bitcoin on the market, the fall in value has been felt by almost every other major cryptocurrency.

29/06/2018: Bitcoin drops to eight-month low, wipes out end-of-year price surge

The price of Bitcoin has now fallen to its lowest point in eight months, officially undoing all the gains it made during its unprecedented climb at the end of 2017.

This week the cryptocurrency dipped below $5,800, a price not seen since early November.

The world's most funded cryptocurrency made headlines across mainstream media for its dramatic surge in value that saw the value of one virtual coin rise from around $1,000 at the start of 2017, to just under $20,000 by December.

Data courtesy of coinmarketcap.com

The hype created a buzz of interest among short-term investors looking for a quick return, despite warnings from financial institutions that the currency's volatility would almost certainly result in mass losses.

Those losses came following a sudden market sell-off between January and February that saw almost $8,000 wiped off the currency, and despite the occasional modest resurgence, Bitcoin has essentially been in free fall ever since.

Given the influence Bitcoin exerts on the market, the fall in value has been felt by almost every other major cryptocurrency.

Ether is currently priced at $416, while Bitcoin Cash, a currency created as a result of a fork in Bitcoin, is valued at $665, both of which hold a similar position held before the late November price surge.

A handful of currencies, including Ripple at $0.44, still retain some of their gains, however, these are a fraction of the prices seen in December.

The market has come under increased pressure from regulatory bodies seeking to protect investors from a volatile industry, while a series of breaches to cryptocurrency exchanges have undermined the trust that investments will remain secure.

28/06/2018: Facebook drops cryptocurrency ad ban

Facebook is to reverse a decision on banning cryptocurrency ads running on its social network.

The social network will immediately allow advertisers to promote cryptocurrency products again, backtracking on a previous decision to block them.

However, it said that advertisers wishing to do so must submit an application to help Facebook assess their eligibility including any licenses they have obtained, whether they are traded on a public stock exchange, and other relevant public background on their business.

"Given these restrictions, not everyone who wants to advertise will be able to do so. But we'll listen to feedback, look at how well this policy works and continue to study this technology so that, if necessary, we can revise it over time," said Rob Leathern, product management director at Facebook.

Facebook brought in the ban in January. At the time it said that too many firms were "not currently operating in good faith". It added that the ban was "intentionally broad" while it worked to better detect deceptive and misleading advertising practices.

While the ban has been partially rescinded, Facebook continues to prohibit ads that promote binary options - where traders bet on a market movement for a set amount of money - and initial coin offerings. It added that users of the social network should continue to report content that violates its Advertising Policies by selecting "report ad" in the upper right-hand corner of any advertisement.

Bitcoin has suffered a fall in its value to just above $6,000 after more than $20 million in Bitcoin was seized from illegal vendors on the Darknet by the Department of Justice (DoJ) in the US. According to a statement released by the DoJ, the operation involved the Secret Service, the Drug Enforcement Administration and the Postal Inspection Service, and was the nation's "first nationwide undercover operation targeting darknet vendors".

Law enforcement officials also seized illegal drugs, firearms, $3.6 million in cash and gold bars.

The digital currency could plummet further to $5,000 before summer ends, according to the Express, due to tough regulation in Japan and the hacking of some exchanges across Europe.

18/06/2018: Bitcoin could never replace flat currency, says central banking authority

Bitcoin could never replace fiat currency because it is a poor substitute for the institutional backing of money, according to a report from the Bank of International Settlements (BIS).

In a report called Cryptocurrencies: Looking beyond the hype, the Swiss-based umbrella group for the world's central banks rejected the notion that Bitcoin and blockchain could ever replicate bank-backed currencies on a national retail scale because they are 'unstable', and would struggle with the scale of transactions people make.

"The key issue with cryptocurrencies is their unstable value. This arises from the absence of a central issuer with a mandate to guarantee the currency's stability," BIS said in its report, a reference to Bitcoin's fluctuating value - it has fallen from a near-$10,000 valuation in early May to just $6,458 today.

"Well-run central banks succeed in stabilising the domestic value of their sovereign currency by adjusting the supply ... in line with transaction demand," BIS's report added. "They do so at high frequency, in particular during times of market stress but also during normal times." This ability to boost the number of currency tokens in circulation isn't possible with Bitcoin and other cryptocurrencies, which generally have a hard limit for the total number of tokens it is possible to create, and which become increasingly difficult to mine.

BIS also said that cryptocurrencies are also vulnerable to a breakdown in confidence because trust can evaporate at any time due to the fragility of the decentralised consensus through which transactions are recorded - where far-flung people confirm and record transactions via blockchain's distributed public ledger.

In addition, the bank suggests that using a blockchain to process a nation's daily volume of retail payments would prove too much for the typical storage capabilities of current smartphones.

"Even under optimistic assumptions, the size of the ledger would swell well beyond the storage capacity of a typical smartphone in a matter of days, beyond that of a typical personal computer in a matter of weeks and beyond that of servers in a matter of months," BIS said.

The report claims that "only supercomputers" possess the processing power needed to conduct every retail transaction on a blockchain, and even if there were sufficient supercomputers to create a decentralized network, millions of users would exchange files on the order of a magnitude of a terabyte. This massive volume of communication volume would impact the internet, according to the report.

16/05/2018: HTC planning to build blockchain phone

HTC is planning to build a new blockchain-powered phone featuring a built-in cryptocurrency wallet.

The touted Android device, known as Exodus, will come packaged with a universal wallet and hardware support for all major cryptocurrencies, including Bitcoin, as well as featuring decentralised applications.

Taiwanese manufacturer HTC is aiming to sync its Exodus devices to a native blockchain network, with each device acting as nodes, enabling cryptocurrency trading among users with ease.

Head HTC's business and corporate development Phil Chen, who founded the company's virtual reality system Vive, outlined these plans in an interview with The Next Web, also providing provisional schematics.

"Through Exodus, we are excited to be supporting underlying protocols such as Bitcoin, Lightning Networks, Ethereum, Dfinity, and more," Chen said. "We would like to support the entire blockchain ecosystem, and in the next few months we'll be announcing many more exciting partnerships together."

HTC's latest innovation follows in the footsteps of electronic manufacturing giant Foxconn, which last month announced it had agreed to build a blockchain-powered device developed by Sirin Labs.

The Finney, which is expected to ship in October, features a 'cold storage' crypto wallet, enabled via a physical switch, that, when flicked, immediately turns off all unencrypted communications - meaning the crypto wallet will be offline unless deliberately activated.

HTC's announcement continues a recent trend of companies taking up blockchain technology in a bid to refresh and enhance their products and services - with a range of sectors, from finance to automotive, indulging in the new technology's appeal.

Automakers such as BMW, Ford, Groupe Renault and General Motors, for instance, earlier this month came together to form a consortium that will explore how blockchain can reinvent mobility and address industry shifts.

But KPMG, meanwhile, believes blockchain still remains in the "hype stage" with results not expected till at least 2019 at the earliest.

Speaking to IT Pro in February, KPMG head of tech growth Patrick Imbach said: "I'm not sure actually whether some sort of tangible use-cases and commercial models based on blockchain technologies will evolve over the next months.

"We're still a little bit early in that process, I wouldn't expect any exciting commercial opportunities to arise in large numbers any time soon - in the UK, particularly."

The use and exchange of cryptocurrencies have been largely unregulated to date - but a handful of regulatory bodies have indicated plans to provide some oversight on trading in future, with the Financial Conduct Authority (FCA) last month announcing its intention to launch a regulatory review of cryptocurrencies.

30/04/2018: Unicef wants to use your CPU to mine cryptocurrency

Unicef wants to borrow your computer's processing power for a good cause - mining cryptocurrency.

Any digital coins the children's charity successfully mines via its Hopepage, which people can visit to 'donate' their CPU, are automatically donated to the charity's Australian arm, Unicef Australia, and spent on life-saving supplies such as clean water, food and vaccines for vulnerable children.

People can choose the level of processing power they want to let Unicef use, and Unicef can borrow it as long as users stay on its mining page.

"We wanted to leverage new emerging technologies to raise awareness about current humanitarian crises and raise funds to support children caught up in them," said Unicef Australia's director of fundraising and communication, Jennifer Tierney.

"We don't have a target in minas it is the first time a product like this is developed for the market. We're hoping to raise thousands, and we're asking people in Australia to make the Unicef Hopepage their homepage."

The donations platform is powered by Coinhive's AuthedMine.com, which offers a mining tool for the digital currency Monero that can be embedded into other websites. By donating CPU, Unicef is able to use processing power in bulk to solve complex equations that reward successful miners with new coins they can spend.

The Hopepage is currently supporting the charity's response to the Rohingya crisis and follows on from Unicef's previous cryptocurrency-driven fundraising platform, Game Chaingers, which started earlier this year.

Game Chaingers used cryptocurrency mining as a method to help raise donations for Syrian children caught up in the country's ongoing conflict, by asking gamers to install Claymore to generate Ethereum.

Picture: Shutterstock

13/04/2018: Indian Bitcoin exchange lost $3.3m in cryptocurrency heist

Indian Bitcoin exchange Coinsecure has confirmed it was hit by a devastating cryptocurrency heist, which saw crooks make off with $3.3 million worth of digital coins.

On Thursday, the company posted an announcement on its homepage telling users that its systems had been breached and that the attackers had stolen around 438 bitcoin ($3.3 million).

It announced the news in the form of a written statement penned by the Coinsecure team, as well as a copy of a complaint issued to New Delhi Police by CEO Mohit Kaira.

"Our system itself has never been compromised or hacked, and the current issue points towards losses caused during an exercise to extract BTG [Bitcoin Gold] to distribute to our customers, " said the firm in a statement.

Dr Saxena, chief security officer at Coinsecure, alerted Kaira that the exchange had been hit by "some attack" which had resulted in funds being "stolen from the company's bitcoin wallet".

"Our CSO, Dr. Amitabh Saxena, was extracting BTG and he claims that funds have been lost in the process during the extraction of the private keys," explained the company.

However, Kaira is not buying this story and has accused Saxena of orchestrating the entire heist. In the police complaint, he claims that Saxena is "making a false story to divert attention and might have a role to play in this entire incident".

The CEO explained that the "user funds are securely kept in our bitcoin wallet". Only Karia and Saxena have access to the private keys for the wallet.

He added: "The incident reported by Dr. Amitabh Saxena does not seem convincing to us." Kaira is also urging the authorities to cancel his passport because he "might fly out of the country soon".

The news comes as the Reserve Bank of India has implemented a new rule banning banks and other financial organisations from accepting cryptocurrencies.

B.P. Kanungo, deputy governor of the bank, said: "We have decided to ring-fence the RBI regulated entities from the risk of dealing with entities associated with virtual currencies.

"They are required to stop having a business relationship with the entities dealing with virtual currencies forthwith and unwind the existing relationship within a period of three months."

Max Heinemeyer, director of threat hunting at cyber security firm Darktrace, said it is becoming increasingly difficult for the police to handle cryptocurrency-related crime.

"There used to be a money trail that law-enforcement could trace back to offenders. Cryptocurrencies allow anonymous monetary transactions, basically eliminating the traceable money trail that was the biggest challenge for a lot of cyber-criminals in the past," he said.

"Criminals are notoriously adaptable and will follow the money wherever it goes, leading to an increase in the popularity of cryptojacking."

06/04/18: Monex confirms Coincheck buyout

Japanese online currency exchange Monex is to acquire Coincheck, a cryptocurrency exchange that became notorious earlier this year for suffering a major security breach.

The deal, which was first rumoured earlier this week, will cost Monex 3.6 billion yen (24 million) but give it full control over the company, with the current CEO and COO stepping down and Monex's CEO Toshihiko Katsuya taking over as head of the business.

Monex has had no dealings in Bitcoin or any kind of cryptocurrency previously, but the acquisition will give it a foot in the door of this increasingly lucrative market.

In a statement reported by CCN, Monex said: "We recognise blockchain technology and cryptocurrencies as next-generation technologies and platforms which are likely to drastically change the way people approach money."

"[T]he cryptocurrency exchange business plays a core part in a vision of 'MONEX's new beginning'. Therefore, the Company has resolved on 100% share acquisition of Coincheck which has been a pioneer among cryptocurrency exchanges," it added.

Coincheck has something of a chequered past, having fallen victim to a massive hack in January this year. The incident saw thieves take 523 million units of the digital currency NEM, which at the time was valued at $547 million (390 million), exceeding the infamous hack that brought down Bitcoin exchange Mt. Gox in 2014 and making it possibly the most expensive hack ever.

The company ended up paying its 260,000 customers a total of $440 million (313 million) in compensation for the loss and was ordered by Japanese financial authorities to tighten up its security.

Addressing this issue in its acquisition statement, Monex said: "We aim to build a secure business environment for customers by fully backing up Coincheck's enhancement process."

05/04/2018: Foxconn plans to manufacture 'blockchain phone'

Electronics manufacturing giant Foxconn has agreed to build a blockchain-centric phone that will help its owners securely store and trade cryptocurrency.

Developed by Sirin Labs, the device - dubbed Finney - will run the Android-based Sirin OS, and act as a device to securely store cryptocurrencies such as Bitcoin and Monero and convert cash from one cryptocurrency to another.

The phone will also feature a 'cold storage' crypto wallet, enabled via a physical switch, that, when flicked, immediately turns off all unencrypted communications - meaning the crypto wallet will be offline unless deliberately activated.

Furthermore, as Sirin OS makes use of the distributed ledger consensus found in blockchain systems, it is claimed to be fully tamper proof.

Accompanying a sleek design, provisional hardware specs include a 5.5in display, 64GB internal storage, 6GB of RAM with a 12MP main camera and 13MP front-facing camera.

The phone is expected to ship in October, with Sirin aiming to sell between 100,000 units to a few million in 2018, potentially adding to more than 25,000 pre-orders. Moreover, the device will initially be sold in eight new stores located in regions with the most active crypto communities, from Vietnam to Turkey, according to Bloomberg.

Foxconn, as one of the world's biggest electronics manufacturers, is known for producing some of the world's best-selling products - from iPhones to Kindles - and recently diversified its portfolio by agreeing a deal to purchase Belkin for $866 million.

But according to auditors KPMG, blockchain still remains in the "hype stage" with results not expected till at least 2019 at the earliest.

Speaking to IT Pro in February, KPMG head of tech growth Patrick Imbach said: "I'm not sure actually whether some sort of tangible use-cases and commercial models based on blockchain technologies will evolve over the next months.

"We're still a little bit early in that process, I wouldn't expect any exciting commercial opportunities to arise in large numbers any time soon - in the UK, particularly."

Finney is Sirin Labs' second smartphone device following the release of Solarin in 2016.

Marketed as an ultra-secure smartphone, Solarin was priced at $14,000, a princely sum compared to Finney's relatively modest pre-order price of $999. Users will also be able to pre-order Finney using SRN, Sirin's own token, at a discounted price.

04/04/2018: Monex considers buying Coincheck

Monex, a commercial foreign exchange service, has expressed an interest in buying Coincheck, the bitcoin business that was the victim of a huge digital money theft earlier this year.

If the deal, which was first reported by Reuters goes ahead, it will give Monex the opportunity to use Coincheck's trading platform and snipe its customers, transitioning them to its products instead, although it's unclear how many customers Coincheck has at present.

Monex, however, currently has 1.74 million customers and is estimated to hold 4.3 trillion yen (28 billion) in customer currency. At present, it doesn't have a cryptocurrency business, but has realised the potential and will look to Coincheck to provide guidance. Coincheck is estimated to be the fifth largest crypto currency exchange in Japan, which would give Monex quite the start to its virtual currency business.

It's thought that up to 380 million worth of digital currency was stolen from Coincheck in a high-profile attack in January, although the company hasn't formally revealed how much was taken. It did, however, pay back investors hit by the cyber attack 46 billion yen (307 million) from its own reserves.

Following the theft, the Japanese authorities came down hard on all the country's digital currency providers, accusing them of being lax over customer data protection and money laundering regulations.

27/03/2018: Twitter has said it will join Facebook and Google in banning adverts for initial coin offerings on its platform over concerns that users could be duped by misleading claims.

"Advertisement of Initial Coin Offerings (ICOs) and token sales will be prohibited globally," said a Twitter spokesperson, speaking to Bloomberg on Monday.

"We know that this type of content is often associated with deception and fraud, both organic and paid, and are proactively implementing a number of signals to prevent these types of accounts from engaging with others in a deceptive manner."

Adverts for token sales had increased in volume across social media sites following the rise in popularity of cryptocurrencies last year, allowing potential investors to trade cash for new speculative cryptocurrencies set up to support the launch of a new service.

While many of these ICOs are legitimate attempts at crowd-funding, users are frequently stung by projects that either fail to live up to promises or outright scam their investors out of their funds.

Facebook was the first to take action against this style of investment, banning all cryptocurrency adverts in January, while Google later said it would also start removing all adverts starting in June.

Twitter's new stance is not an outright ban, as it said it will be restricting adverts to only those cryptocurrency exchanges and wallet services that are offered through public companies already listed on major stock exchanges.

Bitcoin is hovering at just under $8,000 at the time of writing, and has yet to recover from the market slump at the start of the year which saw hundreds of billions wiped off the cryptocurrency market almost overnight.

19/03/2018: Cryptocurrency traders hit with substantial tax bills

Bitcoin owners may soon find themselves faced with a nasty tax bill that's worth more than the value of their coins, amid a market downturn that shows no signs of recovery.

Three months ago users were enjoying a cryptocurrency market surge that saw the price of Bitcoin surge to just shy of $20,000, only for the market to crash at the start of 2018, wiping more than half of the value of the currency.

For those that traded in the US, and therefore were subject to Internal Revenue Service tax laws, it's likely that they have capital gains to report that may be in excess of the value of any coins they now hold.

The issue was highlighted earlier this week when one Reddit user revealed they owed $50,000 to the IRS following trades valued at $120,000 - coins that are now worth $30,000.

"I took most of my savings and bought 8 bitcoins back in early 2017 for about $7200," a Reddit user who goes by the name 'thoway' said in a post. "Around December 2017, I got caught up in the altcoins frenzy and sold most of my bitcoins (about $120k worth) to buy a bunch of different coins."

"I didn't know this back then but it looks like I owe income taxes on those trades, which adds up to about $50k if I add up state (California) and federal. But with the crash that happened recently, I added up my altcoins and I only have like $30k worth. I only have about $5k in other savings."

"I feel like I might have accidentally ruined my life because I didn't know about the taxes..."

At the time of writing, Bitcoin was trading at $8,200, Ethereum at $521, and Litecoin at $153, all significantly down since the start of the year.

In November the IRS informed currency exchange Coinbase that it would need to provide the details of almost 15,000 users who had traded more than $20,000 in digital currencies between 2013 and 2015. The position is that failing to report capital gains could be considered tax evasion.

While IRS rules are fairly straightforward, the same can't be said of other countries struggling to deal with tax issues and consumer protections.

UK traders are currently subject to three-year-old guidelines, implemented when Bitcoin was worth just under 500, which state that those who buy or sell cryptocurrencies are subject to capital gains tax. This would force traders to pay 10% on transactions over 11,700 (the current exemption) if they are basic rate payers, or 20% for higher rate payers.

However, whether any profit is chargeable is judged on a "case by case basis", and that "depending on the facts, a transaction may be so highly speculative that it is not taxable or any losses relievable.. For example gambling or betting wins are not taxable and gambling losses cannot be offset against other taxable profits," the guidance reads.

Importantly, the UK has yet to make any demands similar to the IRS on cryptocurrency exchanges, but given the number of users trading in high value transactions, that could change.

14/03/2018: Google bans cryptocurrency adverts in new clampdown

Google is banning all advertising for cryptocurrencies and initial coin offerings, joining Facebook in a clampdown on speculative financial services.

Starting in June, the world's largest provider of digital ads will block promotions for platforms such as Bitcoin across its entire portfolio of services, including Youtube and any third-party websites that buy adverts from Google.

Adverts for cryptocurrencies, exchanges, digital wallets, trading advice, and initial coin offerings will all be banned under the revised policy, according to a brief Google statement released on Tuesday.

Other instruments, such as binary options trading and spread betting, which often sell themselves as get-rich-quick schemes to internet users, will also be banned.

Google hasn't given its reasoning for the ban, but it's likely to be in response to a rising number of online scammers trying to take advantage of the furore around cryptocurrencies by promising quick returns on investments.

It follows a decision by Facebook in January to ban all adverts for Bitcoin and similar crypto assets, which it made clear at the time was an attempt to protect its users from exaggerated promotions.

Initial coin offerings, which ask investors to fund a new cryptocurrency in order to support a service or product, have become particularly problematic for online advertisers. While there are many legitimate offerings, it's thought that only half of the ICOs in 2017 successfully made it out of their initial funding stages, and many were deliberate attempts to scam their investors.

The ban contributes to a much wider regulatory clampdown on the crypto market, with major markets in the US, China, Japan and South Korea having already made it clear that tougher regulations are on the horizon.

The tightening grip of the market since the New Year has meant the cryptocurrency market has struggled to recover from recent price adjustments, and has largely remained stagnant over the last three months. At the time of writing, one Bitcoin is worth $8,944, $10,000 less than its December high.

05/03/2018: Bitcoin heist sees 600 crypto-mining servers stolen in Iceland

Authorities in Iceland have reportedly arrested 11 people in connection with the theft of 600 cryptocurrency mining servers from data centres across the country.

Police believe that this was one of Iceland's biggest ever burglaries, with Icelandic publications branding it the "Big Bitcoin Heist".

Of the 11 arrested, only two people remained in custody after a hearing at Reykjanes District Court on Friday, Associated Press reported.

Police are still looking for the servers, which are apparently valued at $2 million. The heist happened in the southwestern Reykjanes peninsula, though the authorities did not name the companies that were affected.

Olafur Helgi Kjartansson, police commissioner for the region, described it as a "grand theft on a scale unseen before", adding that it was "a highly organised crime".

Prosecutors believe that the criminals behind the heist masterminded four burglaries in total. Three of them happened in December, while another occurred in January.

Cryptocurrencies, and Bitcoin in particular, are potentially lucrative assets for criminals, with their values rising, if volatile. Bitcoin, for instance, reached $20,000 at the end of 2017, but has since plunged to around $11,000. They also make it more difficult for police to follow criminal transactions due to their anonymous nature.

"The weakest point in any cybercrime operation used to be the monetisation - e.g. selling stolen data or transferring ransom money," Max Heinemeyer, director of threat hunting at cyber security firm Darktrace, told IT Pro. "There used to be a money trail that law enforcement could trace back to the offenders. Cryptocurrencies allow anonymous monetary transactions, basically eliminating the traceable money trail that was the biggest challenge for a lot of cyber criminals in the past."

Governments across the world have voiced concern about digital currencies, with China and South Korea already having implemented strict regulations on crypto-mining.

Last week, Bank of England Governor Mark Carney slammed cryptocurrencies for causing a "global speculative mania".

02/03/2018: Japan's crypto market to self-regulate after $530m heist

Sixteen of Japan's cryptocurrency exchanges have said they will form a self-regulatory body in order to garner trust in the highly volatile industry and undo the damage caused by a $530 million heist in January.

The group is to form an organisation that will enforce standards for cyber security and best practice across the industry, an effort that's almost certainly an attempt to get ahead of government-led regulations that some fear could stifle the cryptocurrency market in the country.

All 16 government registered exchanges have signed up to the organisation which seeks to operate under the country's Payment Services Act, as reported by Reuters, including bitFlyer and GMO Coin.

There's currently no name or launch date for the organisation, although sources have suggested the body will form at some time in the Spring.

It follows a $530 million hack on Tokyo-based crypto exchange Coincheck in January, which sparked alarm that the industry was doing very little to ensure customers are protected. Calls for industry-wide security standards were made when it was discovered Coincheck had stored funds in wallets connected to their networks rather than in isolated, offline wallets that many other exchanges favour.

An additional sixteen exchanges, including Coincheck, have also been permitted to continue operating while their applications to the self-regulatory body are reviewed.

If the body is able to self-regulate successfully, it could be a compromise to heavy-handed government oversight that threaten exchanges in South Korea, one of the most influential markets in the cryptocurrency industry.

02/03/2018: EU warns of crypto regulation if risks are not addressed

The European Union has warned that it will begin regulating cryptocurrencies if the market's volatility, born from spikes in the value of Bitcoin and others, is not addressed by the industry.

Policymakers have long been concerned by the lack of regulatory oversight of alt-currencies, which have grown incredibly popular over the past year, despite the significant risks to investors.

Bitcoin, in particular, has enjoyed cycles of huge success, peaking at $20,000 in late 2017, only to plummet dramatically the next month, wiping off hundreds of billions from the market.

The accelerated pace of the cryptocurrency market, matched against the digital transformation of societies, has posed concerns, particularly as the decentralised nature of the market means there's a lack of accountability or central regulatory body.

The anonymity it affords participants within its transactions has also created concerns that it will provide a major boost to illicit proceeds generated from drug sales and arms laundering.

"This is a global phenomenon and it's important there is an international follow-up at the global level," Valdis Dombrovskis, the EU's financial chief, said, as reported by the Guardian. "We do not exclude the possibility to move ahead by regulating cryptocurrencies at the EU level if we see, for example, risks emerging but no clear international response emerging."

Similarly, in a Reddit 'Ask Me Anything' session, founder and former CEO of Microsoft Bill Gates slammed cryptocurrencies by going so far as to say Bitcoin had "caused deaths" with its use in the drug trade.

The Treasury Committee recently announced it would be launching an inquiry into whether the technology is harmful, while Lloyds announced it was banning their customers from using credit cards to purchase bitcoin.

Elsewhere across Europe, there is a cautious pursuit of bitcoin. Germany and France have recognised its potential for innovation and growth but believe it presents substantial dangers to investors and, without the necessary regulatory frameworks, could be a boon to the financial crime industry.

22/02/2018: UK MPs launch inquiry into risks of cryptocurrencies

The UK's Treasury Committee has said it will investigate digital currencies and the underlying blockchain technology, in an effort to assess the potential benefits and risks facing consumers, businesses and the government.

The scope of the cross-party inquiry will include an assessment of the growing popularity of cryptocurrencies like Bitcoin, which in theory could lead to more stringent regulations for trading in the UK.

It aims to "scrutinise the regulatory response" to digital currencies from the likes of the Bank of England, the Financial Conduct Authority, and government ministers, and assess whether regulations could be rebalanced to provide "adequate protection for consumers and businesses without stifling innovation", according to a statement issued on Thursday.

Particular attention will be given to the risks that digital currencies pose to businesses and consumers, such as the market's volatility and its use as the currency of choice for cyber criminals and money launderers.

The Treasury Committee will also look at the development of distributed ledger technologies such as blockchain and its potential effects on UK financial institutions and infrastructure, which includes the central bank.

"This inquiry comes at the right time, as regulators and Governments wrestle with recent events in cryptocurrency markets," said Treasury Committee member and Labour MP Alison McGovern. "New technology offers the economy potential gains, but as recently demonstrated, it may also bring substantial risks.

"It is time that Whitehall and Westminster understood cryptocurrency better, and thought more clearly about the policy environment for blockchain technology."

The cross-party committee will take evidence from market experts as part of the investigation, before submitting a report to the government outlining its recommendations.

It's likely that the UK government will fall into line with other European countries looking to enact tougher regulations on the use of cryptocurrencies France and Germany have both signalled their desire to have the implications of cryptocurrencies placed on the agenda at the G20 summit in Argentina in March.

However, the UK's inquiry into digital ledger technology is most likely going to strike a more positive tone, as the likes of the Bank of England have already worked closely with blockchain startups on projects involving asset exchanges and the tracking of public money.

16/02/2018: Bitcoin exchange bug overcharged customers thousands

The Bitcoin exchange Coinbase has overcharged users thousands of dollars due to an error in its system, but will offer refunds.

Customers were charged multiple times for transactions, which Coinbase has explained as a result of a bug tied to how credit companies billed for the service. Having fixed the issue, the Bitcoin exchange has vowed to refund those affected.

Coinbase apologised for the error and said it was, "actively working with banks, processors and networks to improve the digital currency purchasing experience".

The popular Bitcoin exchange has attributed the error to changes in the Merchant Category Code, which is used by Visa to identify debit and credit transactions. After banks issued warnings they would no longer permit customers to buy cryptocurrencies using credit cards, the changes kicked into effect.

Users took to Coinbase's Reddit forum to voice their complaints, with one citing to a $67,000 charge and another being hit with $17,000.

"I made ALL of that money in crypto over the past 8 months. This is not good and I feel sick. I knew there is risk to lose money in this space, but not like this!! I may as well have burned it all. I hope Coinbase implodes!" raged Reddit user ipizi.

This will simply fuel worries echoed by banks and governments that cryptocurrency is posing a risk. Banks are largely concerned that consumers are investing in Bitcoin to pay off debts, and instead worsening their situation.

There are also concerns that the anonymous nature of cryptocurrency transactions is powering criminal behaviour such as money laundering and funding both the drugs sale and arms sale.

The Treasury will reportedly regulate Bitcoin and require traders in cryptocurrency to disclose their identities and report suspicious activity.

14/02/18: American news publication Salon has announced it is testing the use of cryptocurrency mining software to boost revenues.

In a bid to counter ad-blockers, which are often the main source of generating revenue for websites, Salon has explained that in a trial test it will give readers an option of accepting ads or allowing spare parts of their computer's processing power to be mined for Monero, a cryptocurrency that is similar to the well-known Bitcoin.

The progressive-leaning website described this to their readers as their intention to "contribute to the advancement of technological discovery, evolution and innovation."

It's believed the website is using CoinHive, a mining tool that was used to hack numerous government websites, including the British. However, Salon notifies users and requires them to agree to use the tool.

The computer's spare processing power is harnessed when users are browsing the Salon website and readers will reportedly hear their machine's cooling fans stir into life, as the computer begins to utilise more power.

This move by Salon represents a new method used by news websites to generate revenue many have used online subscriptions, pay-walls and donations to fund their journalism.

13/02/2018: Bitcoin requires more energy than powering Iceland

Bitcoin is causing serious power supply problems in Iceland according to energy executive Johann Snorri Sigurbergsson, saying the data centres supporting the virtual currency's use are consuming more power than all of the country's homes.

He added the Icelandic population is excited about jumping on Bitcoin mining opportunities, but if everyone who's expressed an interest in mining starts taking part, it's unlikely the energy infrastructure will be able to take it.

Almost all of Iceland's power comes from renewable sources and many of the companies building data centres in the country want to stick to their guns and make use of green energy.

"What we're seeing now is... you can almost call it exponential growth, I think, in the [energy] consumption of data centres," Sigurbergsson told the BBC. "I'm getting a lot of calls, visits from potential investors or companies wanting to build data centres in Iceland."

If all of these data centres were to go ahead, the country would run out of energy to supply both them and homes and businesses.

Just as a comparison, Iceland's population of 340,000 people use around 700 gigawatt hours every year. If Bitcoin mining continues to rise at its current rate, Bitcoin mining operations will use around 840 gigawatt hours of electricity in the very near future. This energy is used for powering the computers in the data centres, as well as cooling systems.

08/02/2018: Bitcoin stable again after crash

Yo-yoing digital currency Bitcoin is stable again today after its price plummeted to a two-month low of sub-$7,000.

The decline came after several banks around the world banned their customers from using credit cards to purchase cryptocurrencies, fearing they'd have to pay for unpaid debts that result from price fluctuations. On Tuesday, it was trading at just $6,430.30, down two-thirds on its all-time high of nearly $20,000 value from mid-December.

However, data on crypto currency go-to, Coinmarketcap.com, showed that Bitcoin surged by 26% in the last 24 hours to past the $8,000 mark following the temporary crash, along with many other popular digital currencies, including Ethereum, which is up 32%, Ripple and Bitcoin Cash, which both rose 22% and Cardano, which is up 25%. Bitcoin is now trading at $8,496.17 (at the time of writing).

Out of the top 10 most valuable cryptocurrencies, all have seen a boost of at least 20%. It's unknown what exactly caused the rise and fall and rise again of the currencies, but Bitcoin and the like are known for being particularly volatile, meaning there's no real way of knowing if it's prospering or about to take a nose dive into the black.

Nevertheless, the news of the currency's growth is encouraging news for investors, many of whom were probably a little sweaty palmed when news of the crash spread yesterday.

06/02/2018: Bitcoin is continuing to plummet in price and has hit the sub-$7,000 mark for the first time since last November.

On digital currency exchange Coinbase, the cryptocurrency is now trading at just $6,430.30 (at time of writing), down two-thirds on its all-time high of nearly $20,000 value from mid-December.

Coindesk spotted the same issue hitting other cryptocurrencies such as Ripple, which is down 14% and Ethereum's Ether, which has also dropped 13% in the last 24 hours.

The decline comes after several banks around the world banned their customers from using credit cards to purchase cryptocurrencies, fearing they'd have to pay for unpaid debts that result from price fluctuations.

However, according to CoinMarketCap, the current total market capitalisation of all digital currencies taken together is up, standing at $397 billion, which is a decent increase of 14% from Friday's figure of $348 billion.

05/02/2018: Lloyds Bank bans credit card customers from buying Bitcoin

Lloyds Banking Group has blocked its customers from buying Bitcoin and other cryptocurrencies with their credit cards.

Starting from today, the ban affects all eight million credit card customers of Lloyds Bank, Bank of Scotland, Halifax and MBNA.

The decision comes after Bitcoin saw a drop of 30% to just over $8,200 on Friday, the lowest it has been for almost five years, while it plunged further to $7,829 this morning from a high of nearly $20,000 over Christmas.

Lloyds is reportedly worried it will have to foot the bill for unpaid debts should the price of Bitcoin continue to drop. However, the ban is said to only affect credit card purchases, and customers will still be able to use their debit cards to buy cryptocurrencies.

Commenting on the decision, a Lloyds spokeswoman told the BBC: "We continually review our products and procedures and this is part of that."

IT Pro has contacted Lloyds for comment.

Lloyds isn't the only bank in the world declining purchases of cryptocurrencies. In the US, JPMorgan Chase, Bank of America, and Citigroup all halted purchases of Bitcoin and other cryptocurrencies on their credit cards on Saturday, as they don't want the credit risk associated with the transactions.

UK games platform Steam dropped support for Bitcoin last December due to the currency's fluctuations, which resulted in unpredictable transaction fees for users.

02/02/2018: A series of clampdowns and advertising bans have rocked the cryptocurrency market, sending prices plummeting and wiping off hundreds of billions of dollars almost overnight.

Bitcoin saw its price sink to $8,200 on Friday morning, officially undoing its December surge which saw prices rocket from $8,300 to just under $20,000 over the course of 30 days, marking the steepest decline in the currency's history.

The slide began after news emerged that Bitfinex, one of the world's largest cryptocurrency exchanges, was being investigated by the US Futures Trading Commission over its ties with a digital asset known as Tether.

Tether was designed to be a one-to-one with the US dollar, allowing for the benefits of cryptocurrency trading with the stability of a fiat currency. However, concerns were raised after critics claimed the reserves were under-capitalised, with more Tether tokens being created than the amount of US dollars being deposited to support the currency.

Current prices from coinmarketcap.com

There are currently two billion Tether tokens in circulation, yet Bitfinex has yet to provide evidence that there is $2 billion in its accounts.

The market was hit again when the Indian government said it would move to ban all cryptocurrency trading in the country, and yet again when Facebook announced it would be placing a ban on all cryptocurrency and ICO advertisements on its platform, citing mistrust of the industry and the potential for users to be misled by shaky investment opportunities.

The series of bullish moves against the cryptocurrency industry has meant the likes of Bitcoin, Ether, Bitcoin Cash and Litecoin have struggled to recover from its most recent slump following the now abandoned proposals by the South Korean government to ban trading in the country.

99 of the top 100 cryptocurrencies by market cap were down as much as 35% at the time of writing, including the surprise hit Ripple which is currently trading at $0.7, almost half that of its all-time high in December.

01/02/2018: Analysts warn price of Bitcoin could crash by 80% if being artificially pumped by Tether

Currency analysts have warned that the price of Bitcoin could crash by up to 80% if it turns out the price has been artificially pumped up by controversial crytpocurrency Tether.

The cryptocurrency experts warned on Wedsnesday that if the cryptocurrency Tether is revealed to have been artificially increasing Bitcoin's value, it would result in a "bloodbath" for investors.

Tether is a so-called "stablecoin" which aims to maintain a value of one US dollar per tether and is owned by trading company Bitfinex, which has recently come under scrutiny by a blogger identifying themselves as "Bitfinex'd".

The blogger has taken to Twitter and YouTube to warn that Tether has been plucked from thin air to boost the value of Bitcoin, leading to it being described by experts as the "ticking time bomb" of the cryptocurrency world, which could trigger an event similar to that of the 2014 collapse of the Mt. Gox exchange.

Nicholas Weaver, a professor from UC Berkeley's International Computer Science Institute, tweeted recently that a "bloodbath" would ensue if Tether fails to hold its value and reassure investors.

"At current prices, net new Bitcoin requires $18 million of net new dollars flowing in to maintain the price," his tweet read. "Yet there is a net $100 million a day of fake dollars in the form of Tethers. If that tether printing press ever breaks, there will be a true bloodbath on the cryptocurrency prices. Good."

Bitcoin expert David Gerard, author of Attack of the 50 Foot Blockchain, added that everyone in crypto "is very worried about the tether situation, and if these really count as dollars".

The warnings come not long after Japanese exchange Coincheck confirmed it had lost up to $530 million (372 million) in a huge hack on Friday.

31/01/18: Samsung has reportedly started mass production of a new range of chips designed to be used in cryptocurrency mining, with a major partnership already lined up with a Chinese hardware provider.

The tech giant is said to have perfected a range of application specific integrated circuit (ASIC) semiconductors, which are to be supplied to an as-yet unnamed Chinese hardware company from January, according to South Korean outlet The Bell.

The semiconductors are said to be bespoke chips designed to optimise the mining of cryptocurrencies which typically requires high-speed, high-efficiency hardware.

Bitcoin mining, in particular, requires vast amounts of computational power, something that has been served in recent years by large companies offering dedicated mining equipment, particularly in China where electricity costs are relatively cheap.

While Samsung has yet to confirm the report, it does coincide with the company's fourth quarter results, which, despite an overall decline for its Foundry business, pointed to increased sales in China thanks to new customer contracts. It also pointed to increased earnings over the next quarter due to a greater demand for cryptocurrency mining chips.

Paul Armstrong, author of 'Disruptive Technologies: Understand, Evaluate, Respond', said that competition from Samsung should stabilise the cryptocurrency mining market, which is currently dominated by the likes of Bitmain and Canaan Creative, both of which currently source their chips from Taiwan's TSMC.

"Samsung is a huge force in the industry and as Asian markets are polarised somewhat this goes a long way to adding some calm to choppy investor seas," said Armstrong, speaking to IT Pro. "One thing this move will do is keep Bitmain on their toes and should cause some more competition, which considering Bitmain's dominance is no bad thing.

"Time will tell what sort of impact this has on the market and Samsung's price and competitive edge but one thing this does show the world [is] Samsung isn't afraid of new technologies, placing a bet and getting their hands dirty; something many companies are increasingly bad at or cautious about doing."

26/01/2018: Prime Minister Theresa May has said the government is 'seriously considering' a clamp down on cryptocurrencies following fears that criminals are exploiting the anonymity of platforms such as Bitcoin.

"In areas like cryptocurrencies, like Bitcoin, we should be looking at these very seriously," said May, in an interview with Bloomberg. She added that because the use of Bitcoin has been "increasingly developing", a tougher stance may be required "precisely because of the way they are used, particularly by criminals".

Cryptocurrencies have long been used as a way to finance criminal activity online, with hackers exploiting the anonymity that platforms such as Bitcoin provide. More recently, criminals have started adopting other cryptocurrencies, particularly Monero which is designed to be even more difficult to trace.

May's comments echo calls from other nation states that more restrictions need to be placed on the use of cryptocurrencies. The market is still reeling from the news that South Korea is considering a complete plan on online cryptocurrency exchanges, a move that some fear would send the market into a nosedive.

Compared to the South Korean market, where some of the world's largest exchanges are headquartered, a clampdown in the UK, or even an outright ban, is unlikely to have a significant impact given that it boasts only one major exchange.

Cryptocurrencies have yet to fully recover from the new South Korean stance, with Bitcoin still operating at $10,000, over $9,000 below its all time high last month.

22/01/2018: Bitcoin will see a huge crash over the next year, Wall Street expert Peter Boockvar predicted yesterday, claiming that this is the only outcome of a "bubble like this".

In an interview with CNBC, the chief investment officer at Bleakley Advisory Group said the crash might be in the form of an epic plunge or a slow and steady drop. Nevertheless, he said it's coming and is thus in danger of dropping 90% from current levels.

"When something goes parabolic like this has, it typically ends up to where that parabola began," he told CNBC's Futures Now show.

"I wouldn't be surprised if over the next year it's down to $1,000 to $3,000." Currently Bitcoin is trading at $11,819, though it peaked at $19,000 briefly in December.

However, Yale economics professor Robert Shiller, who has also previously discribed Bitcoin as "the best example of a bubble", told Coin Telegraph on Friday that while Bitcoin "might totally collapse and be forgotten" it's also possible that it "could linger on for a good long time, it could be here in 100 years".

The predictions come after another analyst claimed Bitcoin could hit between $50,000 and $100,000 in 2018 (see below).

18/01/2018: Despite recent price fluctuations, Bitcoin's value could continue to rise throughout 2018 to reach between $50,000 and $100,000, an analyst has predicted.

This means its value would need to increase by 635% from its current highest value of $13,601.43.

Kay Van-Petersen, an analyst at Saxo Bank, thinks the virtual currency will rise significantly over the next year after correctly predicting its value previously. In December 2016, he said he thought Bitcoin's value would surpass a value of $2,000 in 2017. Sure enough, it reached that figure and beyond by May.

"First off, you could argue we have had a proper correction in Bitcoin, it has had a 50% pull back at one point, which is healthy," Van-Petersen said, reported by CNBC. "But we have still not seen the full effect of the futures contracts."

Previously, Van-Petersen said it wasn't likely the virtual currency would reach $100,000 for 10 years.

The journey to $100,000 won't be without bumps in the road, though, he said. It's likely the currency will continue to level out and then bump up, or re-rate as it's known, in stages.

But although Bitcoin is the market leader now, Van-Petersen thinks virtual currency fanatics should keep an eye on rival Ethereum too, because it's possible the outsider could overtake Bitcoin in future.

"Ethereum came after Bitcoin, it has a more unified leadership than Bitcoin," he said. "They seem to be a bit further along the way in regards to forming the solution to scaling issues. And you can see transactions on their side eclipses transactions across other cryptos."

17/01/2018: Bitcoin plunges below $10,000 following uncertainty in South Korea

Bitcoin plunged to below $10,000 on digital currency exchange Coinbase yesterday evening, along with several other major crytocurrencies, such as Ethereum, which dropped 30% to below $1,000.

While Wall Street said there was no apparent reason for Bitcoin's fall in stock price, breaking below $10,000 to $9969.01, it did follow comments from South Korean authorities regarding tougher regulation on digital currency trading.

Nevertheless, it only fell below the 'psychological benchmark' just briefly before it started to tick higher and above $10,000 again. At the time of writing, it was at $10,457.10

Bitcoin traders, and investors in other digital currencies, are still left with concerns as uncertainty looms around South Korea's government's attitude to cryptocurrencies, with the country being one of the largest crypto markets in the world. There's fears that the country could block such trading altogether after finance minister Kim Dong-yeon said banning crypto trading was "a live option".

The matter is currently being reviewed by the country's government. Such a ban would require a majority vote from the country's National Assembly, which the Evening Standard reports could take months or possibly years.

16/01/18: KFC embraces cryptocurrency hype with Bitcoin Bucket

Fast food favourite KFC has started selling a special Bitcoin edition bucket of its popular chicken - and you guessed it, you can buy it with Bitcoin.

The company's selection of poultry themed treats includes "10 Original Recipe Tenders, Waffle Fries, Med Side, Med Gravy and 2 Dips," and costs whatever the equivalent of CA$20 is at the time of purchase. At the time of writing, this was 0.0010102 Bitcoin.

However, the bucket can only be sold in Canadian KFC delivery zones, presumably because it's only been given the green light with a limited number of authorities. KFC explained its Bitcoin bucket is proving hugely popular. So popular, in fact, it keeps selling out of the selection buckets.

"A lot of you want to buy in Bitcoin, which means we keep selling out," the company said on its regional page. "Keep on checking in for restocks of this Bucket. Craving chicken now? Our Original Recipe is available for purchase and delivery with old-fashioned people money."

Even if you're not in Canada, or have no interest in buying KFC with Bitcoin, it's a handy tool to keep tabs on the value of Bitcoin at any time. The dynamically-updated page changes every few seconds so fanatics can make sure they get the best deal for their chicken.

"Despite the ups and downs of Bitcoin, the Colonel's Original Recipe is as good as always," the company said. "So, trade your Bitcoins for buckets and invest in something finger lickin' good."

11/01/2018: Confusion over South Korean crypto ban sends Bitcoin tumbling

Confusion over reports South Korea was ready to announce a complete ban on cryptocurrency trades that later turned out to be incorrect has caused the price of Bitcoin to plummet, sending shockwaves through the market.

Reports surfaced earlier today that the South Korean justice ministry was preparing a bill to ban the trading of all digital currencies on exchanges operating in the country.

Justice minister Park Sang-ki said that there were "great concerns regarding virtual currencies and the justice ministry is basically preparing a bill to ban cryptocurrency trading through exchanges," according to Reuters.

The news wasn't entirely unexpected, given comments made by South Korean prime minister Lee Nak-yeon that suggested the craze might "corrupt the nation's youth".

As a result, the price of Bitcoin fell through the floor, tumbling from an already relatively low position of just under $15,000 to $13,100 in a matter of hours. At the time of writing the currency has yet to recover, hovering at $13,200. Ether, Litecoin, Ripple and Dash were also down following the news.

However, South Korea's financial watchdog, the FSC, has said government ministries are only discussing the possibility of further restrictions, within the context of trade regulations, and that several ministers are divided on how best to regulate the market.

"...the FSC is mapping out measures to restrict [cryptocurrency] transactions to some extent," which may eventually lead to "an all-out ban," said FSC chairman Choi Jong-ku, speaking to a Yonhap reporter. "The restriction is aimed at minimising side effects of bitcoin transactions and reducing speculative investment."

This means that while a potential ban on cryptocurrency exchanges is being discussed, there are no immediate plans to ban trades in the country, although the current ban on ICOs will remain in effect.

The confusion proved to further highlight Bitcoin's volatility, and its delicate ties to the South Korean market, which is heavily invested in cryptocurrencies. South Korean currently sees the 5th highest volume of global Bitcoin trades, comparable to the whole of Europe.

11/01/2018: Warren Buffett doesn't think Bitcoin or other cryptocurrencies will last, he has told CNBC, suggesting trading virtual currencies is not a good idea and will not end well for those involved.

"In terms of cryptocurrencies, generally, I can say with almost certainty that they will come to a bad ending," the investor and chairman of Berkshire Hathaway said on CNBC's Squawk Box programme.

Buffett's vice chairman, Charlie Munger, supported his boss's position, adding that it's not only cryptocurrencies causing problems - venture capital is also a trend that won't last. He said there's too much money in VC, comparing it to the dotcom bubble.

"Bitcoin and the other cryptocurrencies are also bubbles," he said. Investors "are excited because things are going up at the moment and it sounds vaguely modern. ... But I'm not excited," he added.

Buffet also said he would avoid "going short" on any investment in Bitcoin. This process involves selling shares of borrowed stock, which the investor then hopes the value of which will increase over time, then returning them to the investor to make a profit.

"When it happens or how or anything else, I don't know," he added. "If I could buy a five-year put on every one of the cryptocurrencies, I'd be glad to do it but I would never short a dime's worth."

"We don't own any, we're not short any, we'll never have a position in them," he said. "I get into enough trouble with things I think I know something about. Why in the world should I take a long or short position in something I don't know anything about."

08/01/2018: Visa moves to block Bitcoin payment cards

Visa has blocked access to a range of prepaid Bitcoin credit cards, stopping users from being able to use them to make transactions or withdraw funds in Sterling or Euros.

Cards issued by BitPay, Cryptopay and Bitwala, which are operated by WaveCrest, have all stopped working as of 5th January. The card issuers are now returning all funds to users.

Visa explained that it had made the decision to revoke WaveCrest's Visa membership because it failed to comply with the payment providers operating rules.

"The termination of WaveCrest's Visa membership does not affect other Visa issuers' card programmes, including those using fiat funds converted from cryptocurrency," Visa said in a statement. "Visa is committed to the security of its ecosystem and compliance with Visa's operating rules is critical for ensuring the safety and integrity of the Visa payment system."

Visa said that the cards had been suspended due to "continued non-compliance with our operating rules", adding that all card programmes must comply with its membership regulations, as well as all applicable laws in their company of operation.

"Following an announcement from our card issuer on behalf of Visa Europe, Bitwala cards are taken out of operation starting today. Our team is holding an emergency meeting to resolve the issue with the card holders best interest in mind and will make an update shortly," Bitwala said on Twitter.

London-based Cryptopay said: "Unfortunately, our card issuer instructed us to cease all Cryptopay prepaid cards starting January 5th, 2018. All funds stored on cards are safe and will be returned to your Cryptopay accounts ASAP."

BitPay said it was in talks with alternative providers about getting its card back up and running in Europe, although it didn't say who it was talking to or any further details about the situation.

03/01/2018: Peter Thiel helps Bitcoin return to growth with 10% spike

Bitcoin soared in value on Tuesday following the announcement that Peter Thiel's Founders Fund now own "hundreds of millions of dollars" worth of the cryptocurrency.

The price of Bitcoin spiked by over 10% to hit around $14,500 per coin after the fund bought $15 to 20 million of the digital currency, according to a report by The Wall Street Journal, with the fund telling investors that the bet is now worth over five times its principal investment.