Meet Bitcoin Gold - the second split from Bitcoin this year

What Bitcoin's second hard fork means for the cryptocurrency

The blockchain that supports Bitcoin has split again this week, creating yet another variant on the world's most popular cryptocurrency. The hard fork means Bitcoin and Bitcoin Cash are now joined by a third currency known as Bitcoin Gold, all of which operate as discrete currencies on separate blockchains.

But what exactly does this mean and what effect will this have on Bitcoin?

How did we end up with Bitcoin Gold?

Bitcoin currency is an evolving technology, and its growing popularity has exposed limitations in the design of its blockchain. However, being decentralised, the currency has no owner or single development group, and development decisions are reached when the community as a whole agrees overwhelmingly to a proposal.

In August, Bitcoin experienced its first hard fork when the community failed to reach agreement on how to improve transaction speeds (after an initial compromise appeared to have worked), leading to a splinter group founding its own currency known as Bitcoin Cash.

Now Bitcoin faces yet another issue needing community consensus - specifically the claim that the growing cost of Bitcoin mining - the process has pushed out smaller miners who traditionally used modest computing equipment, and is now dominated by mining farms using sophisticated application-specific integrated circuits (ASICs).

This had led to a number of developers in the community to voice concerns over the amount of control that miners have over the network.

Bitcoin Gold claims to solve this by redesigning its own network in such a way that prevents the use of ASICs in favour of smaller and cheaper graphics cards. It hopes doing so will attract more users and miners to its currency, and wrestle control away from large companies offering mining farm services and products.

Get the ITPro daily newsletter

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

What happens to my bitcoins?

As was the case with the Bitcoin Cash fork, Bitcoin Gold operates on a cloned version of the existing Bitcoin blockchain network, which will then be tweaked to the developer's liking. This means that any bitcoins you own will still be in your wallet once the currency splits.

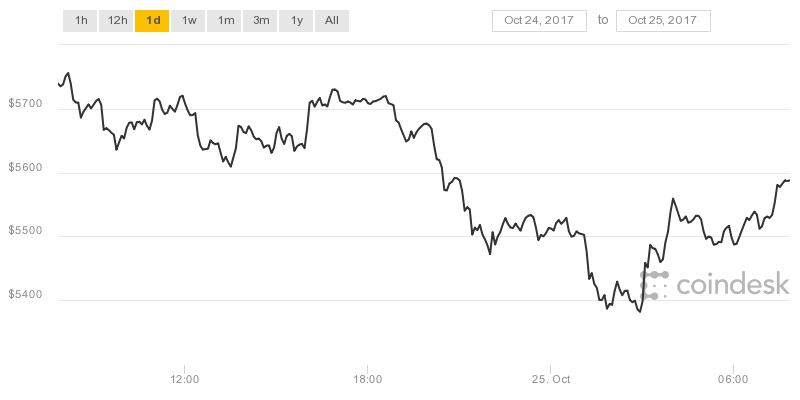

However, the value of a bitcoin could potentially fluctuate after the split, as users are now able to buy Bitcoin Gold with bitcoins at a rate of 1 to 1. Bitcoin slumped to five-day low of $5,300 following the official launch of the new currency, but has since recovered to $5,600 at the time of writing. That's a fairly modest fluctuation given how notoriously volatile the currency is.

Yet this isn't exactly a surprise, as Bitcoin barely felt the Bitcoin Cash split and has continued to hit record highs since August, recently reaching $6,000.

Will Bitcoin Gold be a success?

Although it's never certain how much of a hit a new cryptocurrency will be, early signs suggest Bitcoin Gold will struggle. There was a great deal of enthusiasm around Bitcoin's initial fork in August, and early reports showed some early traction for Bitcoin Cash. However, after hitting an initial peak of $700, it has since lost almost half its value and has seen very little growth over the past month.

There's a chance that Bitcoin Gold could do better, particularly as it claims to be more accessible to mine, however it's received nowhere near the same enthusiasm from the community as Bitcoin Cash.

Some have criticised Bitcoin Gold's developers for causing an unnecessary fork, while others have pointed out that by moving more mining onto cheaper GPUs simply gives more power to companies such as Nvidia and AMD, who both manufacture graphics cards crucial for mining.

The developers behind Bitcoin Gold are currently operating on a private network, which means that early investors in the currency will not be able to secure their funds until it goes public next month.

Dale Walker is a contributor specializing in cybersecurity, data protection, and IT regulations. He was the former managing editor at ITPro, as well as its sibling sites CloudPro and ChannelPro. He spent a number of years reporting for ITPro from numerous domestic and international events, including IBM, Red Hat, Google, and has been a regular reporter for Microsoft's various yearly showcases, including Ignite.

-

Cleo attack victim list grows as Hertz confirms customer data stolen

Cleo attack victim list grows as Hertz confirms customer data stolenNews Hertz has confirmed it suffered a data breach as a result of the Cleo zero-day vulnerability in late 2024, with the car rental giant warning that customer data was stolen.

By Ross Kelly

-

Lateral moves in tech: Why leaders should support employee mobility

Lateral moves in tech: Why leaders should support employee mobilityIn-depth Encouraging staff to switch roles can have long-term benefits for skills in the tech sector

By Keri Allan

-

IMF urges El Salvador to remove Bitcoin as legal tender

IMF urges El Salvador to remove Bitcoin as legal tenderNews The country sought a $1.3 billion loan from the IMF last year, although this has been reportedly hindered by the fund’s Bitcoin concerns

By Zach Marzouk

-

Cryptocurrency: Should you invest?

Cryptocurrency: Should you invest?In-depth Cryptocurrencies aren’t going away – but big questions remain over their longevity, the amount of energy they consume and the morals of investing

By James O'Malley

-

IT Pro News in Review: Record profits in tech, hackers turn to new languages for malware, Amazon's Bitcoin plans

IT Pro News in Review: Record profits in tech, hackers turn to new languages for malware, Amazon's Bitcoin plansVideo Catch up on the most important news of the week in just two minutes

By ITPro

-

El Salvador offers its citizens free Bitcoin

El Salvador offers its citizens free BitcoinNews Bukele doubles down on crypto commitment with a giveaway

By Danny Bradbury

-

Square and Blockstream to build a solar Bitcoin mining facility

Square and Blockstream to build a solar Bitcoin mining facilityNews Solar mining plant will aim to temper concerns of power consumption from Bitcoin mining

By Danny Bradbury

-

What are altcoins and how do they work?

What are altcoins and how do they work?In-depth The alternatives to Bitcoin explained

By Rene Millman

-

Steve Wozniak sues YouTube over Bitcoin scam videos

Steve Wozniak sues YouTube over Bitcoin scam videosNews Lawsuit claims YouTube is aware of the Bitcoin giveaway scams but hasn’t taken videos down

By Sarah Brennan

-

Bitcoin scam exposes the personal details of 250,000 people

Bitcoin scam exposes the personal details of 250,000 peopleNews The UK and Australia represent approximately 93% of users hit by the crypto-scam

By Tyler Omoth