Australia and Singapore complete blockchain trial of cross-border trade

The countries are hoping to remove the need for paper documents and reduce transaction costs

Australia and Singapore have complete a blockchain trial to prove trade documents can be issued and verified digitally across two independent systems, removing the need for paper documents and reducing cross-border transaction costs.

The trial was carried out as part of the Australia-Singapore Digital Economy Agreement to make cross-border trade simpler between the two countries, and involved the Australian Border Force (ABF), the Infocomm Media Development Authority of Singapore (IMDA) and Singapore Customs. It successfully tested the interoperability of two digital verification systems, the ABF’s Intergovernmental Ledger (IGL) and IMDA’s TradeTrust reference implementation.

The authorities involved said that by using this blockchain-based, decentralised approach, transactions can become “more cost effective and offers scalability without the need for expensive data exchange infrastructure, lowering barriers to the adoption of paperless cross-border trade”.

They added that it showed Australia’s capability in issuing high integrity digital trade documents that can be instantly authenticated, provenance traced and digitally processed. QR-codes embedded with unique proofs are inserted into digital Certificates of Origin (COO), allowing for “immediate verification for authenticity and integrity of the document when scanned or machine-read”.

COO’s are usually issued on paper and businesses regularly wait days to receive a hard-copy document via courier before dispatching to multiple parties, and paper trade documents are generally required by authorities to prove authenticity and integrity.

“ABF is proud to pioneer cutting-edge digital verification projects in Australia. We understand this collaboration is among the first to involve multiple government agencies from two countries to achieve cross-border document interoperability,” said ABF commissioner Michael Outram. “Digital verification and verifiable documents show promise as a ‘circuit-breaker’ to disrupt persistent paper-based evidence required by authorities.”

Other participants included in the trial included the Australian Chamber of Commerce and Industry, Australian Industry Group, ANZ Bank, DBS Bank, Standard Chartered and Rio Tinto.

Get the ITPro daily newsletter

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

In July, the Australian government invested over $5.6 million (£3 million) in two companies through its Blockchain Pilot Grants programme to investigate the capacity of blockchain to enhance the productivity and competitiveness of the country’s minerals and food and beverage sectors. One company was going to investigate how this technology can be used to create a digital certification for critical minerals while the other was going to research how to implement the blockchain to automate key reporting processes.

Zach Marzouk is a former ITPro, CloudPro, and ChannelPro staff writer, covering topics like security, privacy, worker rights, and startups, primarily in the Asia Pacific and the US regions. Zach joined ITPro in 2017 where he was introduced to the world of B2B technology as a junior staff writer, before he returned to Argentina in 2018, working in communications and as a copywriter. In 2021, he made his way back to ITPro as a staff writer during the pandemic, before joining the world of freelance in 2022.

-

Bigger salaries, more burnout: Is the CISO role in crisis?

Bigger salaries, more burnout: Is the CISO role in crisis?In-depth CISOs are more stressed than ever before – but why is this and what can be done?

By Kate O'Flaherty Published

-

Cheap cyber crime kits can be bought on the dark web for less than $25

Cheap cyber crime kits can be bought on the dark web for less than $25News Research from NordVPN shows phishing kits are now widely available on the dark web and via messaging apps like Telegram, and are often selling for less than $25.

By Emma Woollacott Published

-

Accenture bolsters industrial AI services with Flutura acquisition

Accenture bolsters industrial AI services with Flutura acquisitionNews Bangalore-based AI specialist will help “power industrial AI-led transformation” for Accenture’s global clients

By Daniel Todd Published

-

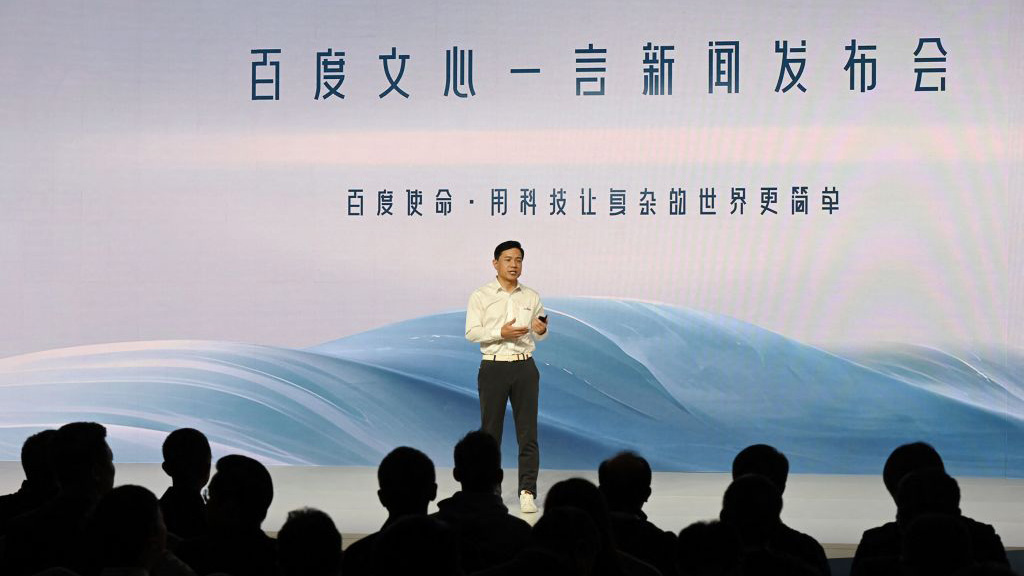

Baidu unveils 'Ernie' AI, but can it compete with Western AI rivals?

Baidu unveils 'Ernie' AI, but can it compete with Western AI rivals?News Technical shortcomings failed to persuade investors, but the company's local dominance could carry it through the AI race

By Rory Bathgate Published

-

HPE Cray supercomputer to boost Singapore’s met office weather forecasting

HPE Cray supercomputer to boost Singapore’s met office weather forecastingNews The new system provides twice the speed of its predecessor and has a peak performance of 401.4 teraflops

By Zach Marzouk Published

-

National banks build blockchain CBDC platform for faster international payments

National banks build blockchain CBDC platform for faster international paymentsNews The banks ran a pilot test where 164 payment and foreign exchange transactions were completed, totalling over $22 million over the six weeks

By Zach Marzouk Published

-

Fujitsu and Keio University partner on automated internet 'trust layer'

Fujitsu and Keio University partner on automated internet 'trust layer'News The pair want to create an interface that draws information from different sources, like experts or physical tools like sensors, to verify the authenticity of data posted on the internet

By Zach Marzouk Published

-

Mapping an entire country: Meet Singapore’s digital twin

Mapping an entire country: Meet Singapore’s digital twinIn-depth Digital twins are the future of urban planning – disclosing insights we could have once only dreamed of

By Nicole Kobie Published

-

Toshiba smashes AI engineer recruitment targets

Toshiba smashes AI engineer recruitment targetsNews The company has also outlined seven principles to help train human resources to research, develop, and use AI

By Zach Marzouk Published

-

Fujitsu taps India’s AI talent with new research centre in Bengaluru

Fujitsu taps India’s AI talent with new research centre in BengaluruNews The company aims to boost the number of its researchers in the country to 50 by 2024

By Zach Marzouk Published