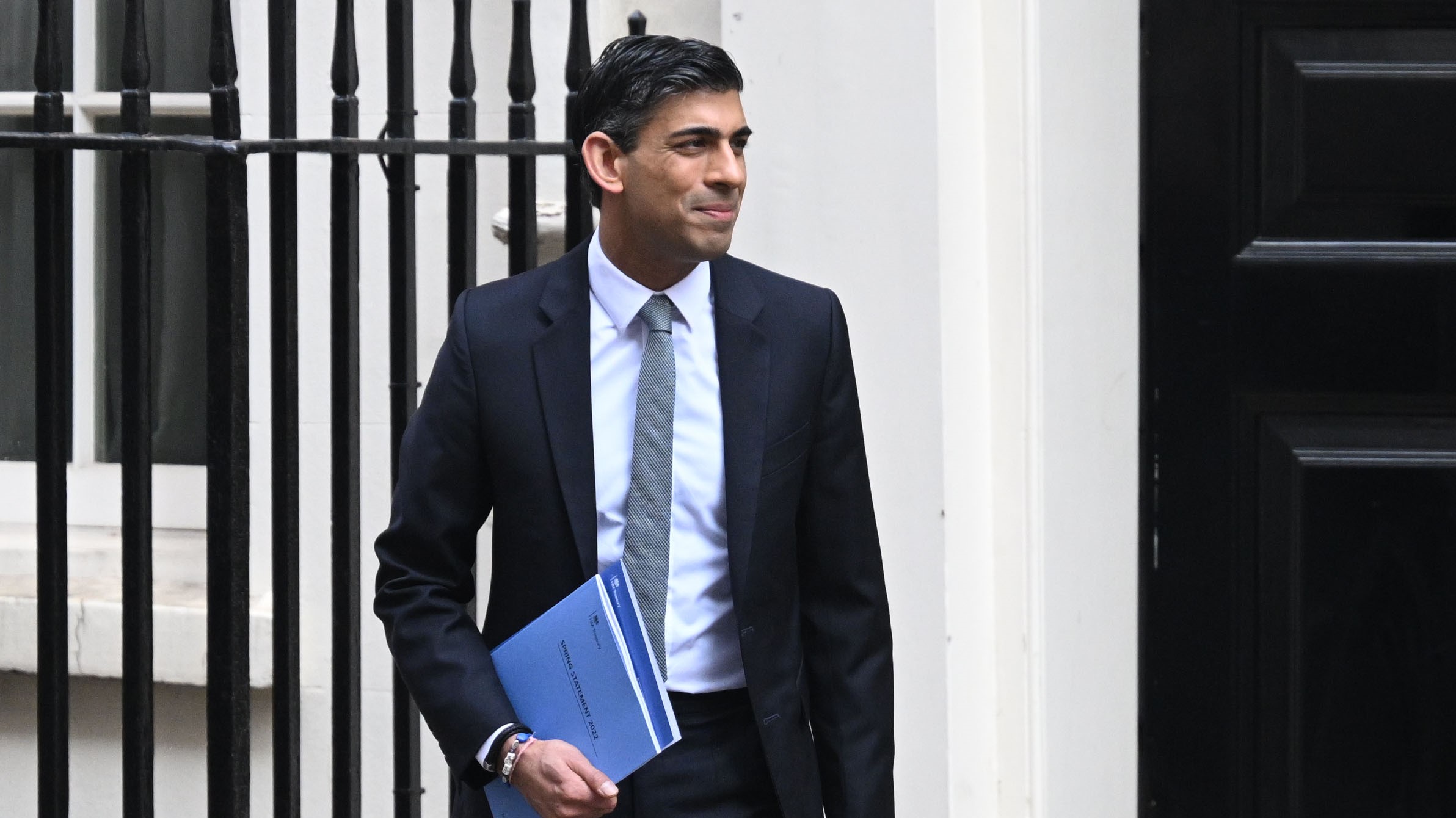

Why Rishi Sunak's NFT gambit will backfire on UK fintech

Plans for the Royal Mint to launch an NFT – part of wider government cryptoasset measures – is more than just another PR misstep

Non-fungible tokens (NFTs) have surged in popularity in recent years, despite a chorus of voices condemning the trend as little more than a Ponzi scheme. Investors are ploughing millions of dollars, pounds, or whatever they can find, into these cryptoassets, while bystanders continue to gawp with widening mouths at the unfurling horrors (Nyan Cat cost how much?!).

What better way, then, for the embattled Rishi Sunak to cap off a rocky few days than by throwing himself, and the government, head-first into this utter minefield.

Branded an “emblem of the forward-looking approach the UK is determined to take”, Sunak has commissioned the otherwise serious Royal Mint to launch its own blockchain-based asset this summer. Sunak has gleefully positioned this NFT front-and-centre of a wider package of measures to boost UK fintech, although many of these steps will have been lost amid the noise. Indeed, his Royal Mint NFT is a needless distraction that might set back any efforts to reign in this flaming wilderness.

The reality is that NFTs have become synonymous with corporate exploitation and hypercapitalist greed. The market is as fast-growing as it gets, with $44bn (£32bn) worth of cryptocurrency sent to NFT-related smart contracts last year, up from $106m (£78m) in 2020, according to Chainalysis.

There’s a good reason, though, we haven’t yet reached a consensus on whether or not the whole thing’s just a massive scam unfolding in broad daylight. Not only are artists continuously getting fleeced (some things never change) but the advent itself has muddied the waters of what ownership actually means.

RELATED RESOURCE

Revolutionising the lending process with IBM Cloud Paks

Achieving a customer-centric future by modernising infrastructure and reducing risk

Minted onto Ethereum-based smart contracts, anybody can create an NFT – digitally immortalising an asset – without seeking permission, and trade it freely through a litany of marketplaces. It can be especially egregious for those who hold the copyright to valuable works, like photos or artwork, as there’s essentially no recourse for somebody if their work is ‘stolen’ and minted as an NFT, before being sold on for sizeable profits.

Big brands, too, are finding increasingly exploitative ways to extract money from their customers for little meaningful value in return. A string of household names, like Pizza Hut and Pringles, are urging their customers to buy their NFTs to reap the flimsy benefits of digital gifts, exclusive access, and other gimmicky perks. What business, then, does the UK government have in launching one of its own?

Get the ITPro daily newsletter

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

Sunak’s big day in the sun

We barely know anything about Sunak’s NFT, although we can speculate it’ll likely be sold as a digital asset through a version of the Royal Mint’s online shop, much like its other coins and collectables. How the NFT will actually look, or work in practice, though, remains shrouded in mystery. We also know nothing about what rights those who buy into the scheme should expect to have. While it could be nothing short of another gimmick from a chancellor whose entire life, at this point, comes across as an elaborate photo-op, what’s absolutely certain is that cryptoassets of this kind are highly lucrative.

Put this together with the fact the announcement came out of nowhere. Indeed, there were no mentions of NFTs in the government’s 40-page consultation document on regulating cryptoassets launched in July 2021, nor in the government’s 46-page response released this week. Cynics among us may, therefore, suggest Sunak might be reaching for ways to plug the widening hole in the UK public finances, or even fund the £4.3bn in fraudulent COVID-19 loans the Treasury wrote off in February. The likelier explanation is that, when it comes to publicity stunts, the chancellor just can’t help himself.

While there might be a lot of intriguing notes in the wider package, including a commitment to launch a stablecoin in the UK, this NFT line has overshadowed the lot. Sure, many of the measures are vague and might not lead to anything, but setting up forums and advisory groups, at least, will give the government a chance to get a grip on what’s fast becoming a runaway train. The CryptoSprint and Cryptoasset Engagement Group, in particular, are key to this process, given the UK currently has no regulatory regime in place and likely won’t for a number of years. This makes Sunak’s decision to drop a fully-fledged, government-backed NFT in just a matter of weeks all the more bizarre.

Far from this ‘cherry on the icing’ serving as an emblem of the UK’s “forward-looking approach”, it’s more akin to lobbing a grenade into a fireworks factory. For all the important work the Treasury might accomplish on setting the direction of travel on cryptoasset regulation, Sunak has shredded it all with what his imminent NFT might come to represent.

Move fast and break things

There are arguments to make that NFTs aren’t entirely ridiculous. As mindblowing as some of the most famous NFT sales have been – such as Jack Dorsey selling the first-ever tweet for almost $3 million – proponents argue these are no crazier than transactions normally seen in the art world. The worth of high valued physical assets, too, like expensive watches, are often largely derived from certificates of authenticity.

NFTs, in effect, grant us a means by which to cement such documents in the digital realm in a way they can’t be tampered with. The underlying Ethereum-powered blockchain technology, too, has potentially valuable business use cases. But at least with art, or other high-value items, you can feel; touch; smell; do whatever you want with them. Your ownership, too, is guaranteed by way of these items being in your possession, reinforced with the law.

As far as NFTs go, the regulatory landscape is non-existent, and we’re far from devising common standards for trade, particularly across borders. Terms and conditions, too, as well as rights, can vary wildly between marketplaces. Users, for example, might purchase the Royal Mint NFT from the designated marketplace, be awarded some rights, and resell it on a second marketplace with deeply limited terms of ownership. That buyer might then resell the NFT through a third, entirely separate marketplace with its own terms and conditions. They may end up not even having the rights over the NFT the marketplace claims they do.

Fundamentally, though, we absolutely cannot wash our hands of the rampant exploitation, industrial-scale money laundering, and unfathomable quantities of energy being wasted to sustain the whole operation. Nor can Sunak. While the Royal Mint NFT might be entirely legitimate – and nothing more than just a bit of fun – its launch is a tacit endorsement of the entire ecosystem in its current shape – including the refuge it provides for schemers, scammers and snake oil salespeople.

The government must be as far removed from NFTs as possible, especially if it’s serious about answering the big questions on ethics, greedy business practices, and regulations. The chancellor, after all, should be instrumental in foiling Ponzi schemes, not be seen to be throwing his weight behind them.

Keumars Afifi-Sabet is a writer and editor that specialises in public sector, cyber security, and cloud computing. He first joined ITPro as a staff writer in April 2018 and eventually became its Features Editor. Although a regular contributor to other tech sites in the past, these days you will find Keumars on LiveScience, where he runs its Technology section.

-

Third time lucky? Microsoft finally begins roll-out of controversial Recall feature

Third time lucky? Microsoft finally begins roll-out of controversial Recall featureNews The Windows Recall feature has been plagued by setbacks and backlash from security professionals

By Emma Woollacott Published

-

The UK government wants quantum technology out of the lab and in the hands of enterprises

The UK government wants quantum technology out of the lab and in the hands of enterprisesNews The UK government has unveiled plans to invest £121 million in quantum computing projects in an effort to drive real-world applications and adoption rates.

By Emma Woollacott Published