India to launch state-backed 'digital rupee'

The government is also introducing a 30% tax on income from digital assets

India is set to launch a central bank digital currency (CBDC) called the digital rupee in a bid to boost the digital economy.

Nirmala Sitharaman, minister for finance and corporate affairs, announced that the Reserve Bank of India would introduce the digital rupee starting from 2022 or 2023.

While presenting the 2022-2023 budget in parliament, the finance minister said the CBDC will give a big boost to the digital economy. She added that digital currency will lead to a more efficient and cheaper currency management system, and that it will use blockchain and other technologies.

India’s central bank has previously raised concerns around private cryptocurrencies around the fact they may cause financial instability.

Sitharaman also announced that the government is imposing a 30% tax, the highest tax band available, on income coming out of digital assets. Losses from sales cannot be offset against other income either, she added.

It has been claimed that CBDCs would help further the adoption of crypto, but it’s just not as simple as that, said Kristjan Kangro founder and CEO of Change, a cryptocurrency investment platform. He added that CBDCs could help speed up transactions and add credibility to crypto, but it comes at a huge cost which is centralisation.

“It’s worth noting though that CBDCs come in a lot of flavours,” said Kangro. “Central banks across the world are experimenting in different types of digital currency with different levels of anonymity, scope and underlying technology. These experiments have had mixed results.

Get the ITPro daily newsletter

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

RELATED RESOURCE

“However, what’s certain, is that without a global approach backed up by consistent, international regulations, it’s difficult to see how CBDCs could replace cryptocurrencies in the short-term.”

India isn’t the only country in the region introducing this new technology, as last September the reserve banks of Australia, Singapore, Malaysia, and South Africa agreed to test the use of CBDCs for international settlements. The banks hoped it would reduce the time and costs for these types of transactions. The project is also set to explore different governance and operating designs to allow central banks to share CBDC infrastructures.

Zach Marzouk is a former ITPro, CloudPro, and ChannelPro staff writer, covering topics like security, privacy, worker rights, and startups, primarily in the Asia Pacific and the US regions. Zach joined ITPro in 2017 where he was introduced to the world of B2B technology as a junior staff writer, before he returned to Argentina in 2018, working in communications and as a copywriter. In 2021, he made his way back to ITPro as a staff writer during the pandemic, before joining the world of freelance in 2022.

-

Bigger salaries, more burnout: Is the CISO role in crisis?

Bigger salaries, more burnout: Is the CISO role in crisis?In-depth CISOs are more stressed than ever before – but why is this and what can be done?

By Kate O'Flaherty Published

-

Cheap cyber crime kits can be bought on the dark web for less than $25

Cheap cyber crime kits can be bought on the dark web for less than $25News Research from NordVPN shows phishing kits are now widely available on the dark web and via messaging apps like Telegram, and are often selling for less than $25.

By Emma Woollacott Published

-

Accenture bolsters industrial AI services with Flutura acquisition

Accenture bolsters industrial AI services with Flutura acquisitionNews Bangalore-based AI specialist will help “power industrial AI-led transformation” for Accenture’s global clients

By Daniel Todd Published

-

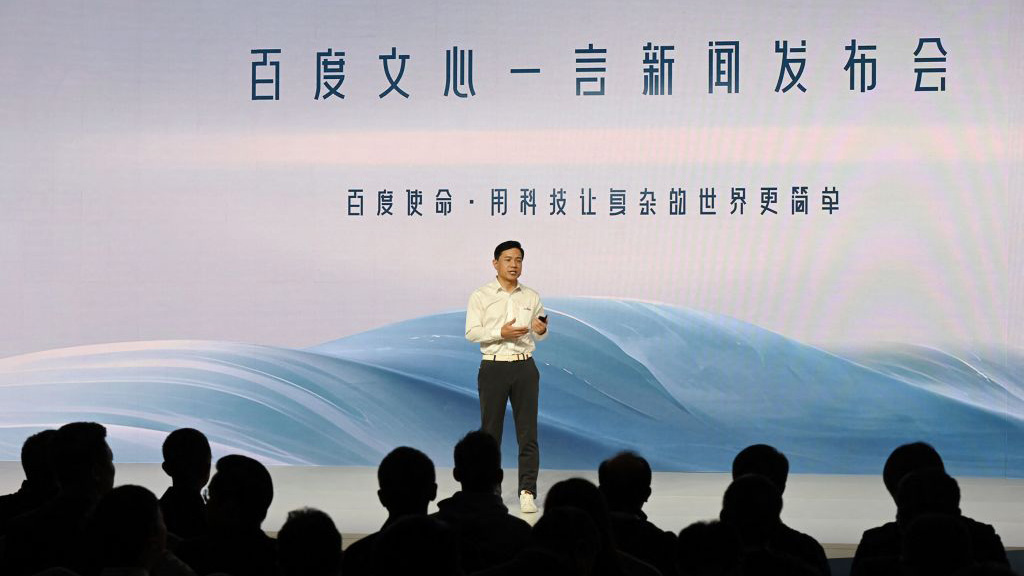

Baidu unveils 'Ernie' AI, but can it compete with Western AI rivals?

Baidu unveils 'Ernie' AI, but can it compete with Western AI rivals?News Technical shortcomings failed to persuade investors, but the company's local dominance could carry it through the AI race

By Rory Bathgate Published

-

HPE Cray supercomputer to boost Singapore’s met office weather forecasting

HPE Cray supercomputer to boost Singapore’s met office weather forecastingNews The new system provides twice the speed of its predecessor and has a peak performance of 401.4 teraflops

By Zach Marzouk Published

-

National banks build blockchain CBDC platform for faster international payments

National banks build blockchain CBDC platform for faster international paymentsNews The banks ran a pilot test where 164 payment and foreign exchange transactions were completed, totalling over $22 million over the six weeks

By Zach Marzouk Published

-

Fujitsu and Keio University partner on automated internet 'trust layer'

Fujitsu and Keio University partner on automated internet 'trust layer'News The pair want to create an interface that draws information from different sources, like experts or physical tools like sensors, to verify the authenticity of data posted on the internet

By Zach Marzouk Published

-

Mapping an entire country: Meet Singapore’s digital twin

Mapping an entire country: Meet Singapore’s digital twinIn-depth Digital twins are the future of urban planning – disclosing insights we could have once only dreamed of

By Nicole Kobie Published

-

Toshiba smashes AI engineer recruitment targets

Toshiba smashes AI engineer recruitment targetsNews The company has also outlined seven principles to help train human resources to research, develop, and use AI

By Zach Marzouk Published

-

Fujitsu taps India’s AI talent with new research centre in Bengaluru

Fujitsu taps India’s AI talent with new research centre in BengaluruNews The company aims to boost the number of its researchers in the country to 50 by 2024

By Zach Marzouk Published